Reverse Mortgage Property Requirements – New for 2025/2026

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

I would like to know the exact reverse mortgage property requirements, such as central heating, water wells, septic systems, etc. To hear these reverse mortgages advertised, one might get the impression that getting one is very simple. However, after some preliminary inquiries, it’s beginning to look like everything else involving the government can become incredibly complicated.

Updated September 2025 with the latest HUD 4000.1 rules on ADUs, manufactured homes, and PACE liens

Understanding HUD’s Property Standards

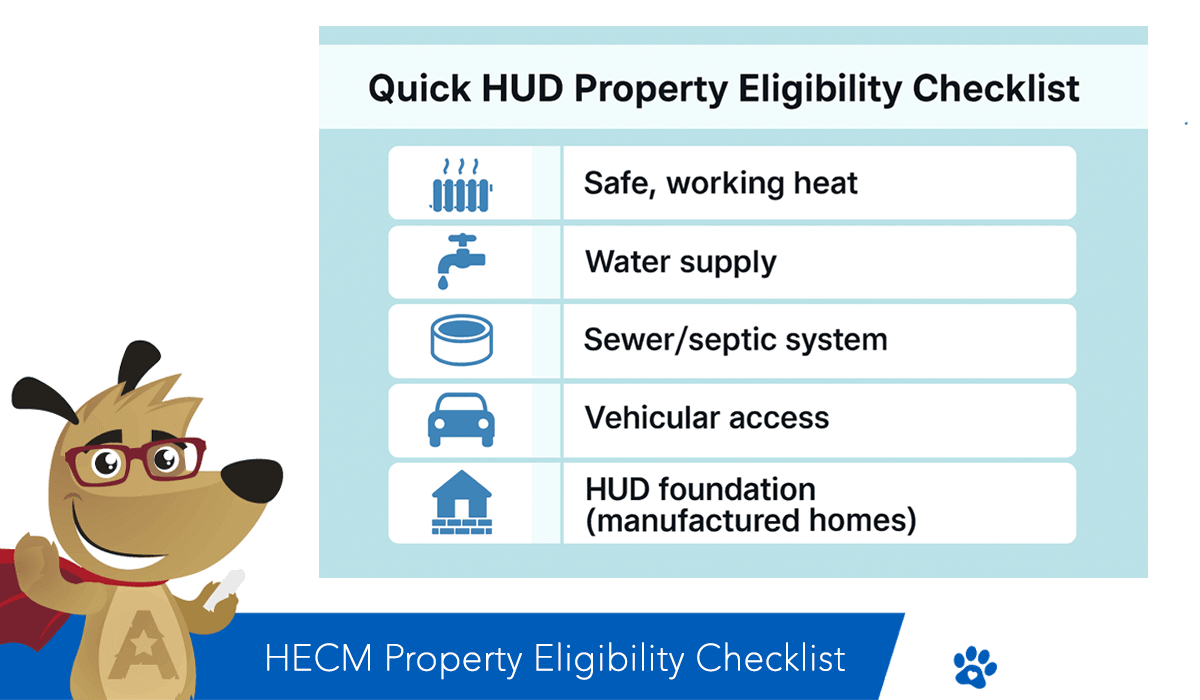

When applying for a reverse mortgage, your home must meet specific property standards set by HUD. These requirements ensure the property is safe, sound, and secure, but they can vary depending on your specific situation.

For instance, a home does not need central heating, but it must have a permanent, working heat source that HUD considers acceptable. Acceptable heat sources vary by region. For example, a simple wall heater might be suitable in Hawaii, but not in Maine or Massachusetts, where a complete heating system is required. Portable plug-in space heaters aren’t acceptable.

For water, city or approved private wells are acceptable, but may require additional tests or agreements with others (as is the case with shared private wells) when the source is from a private or shared well. Cisterns or untreated river water typically won’t qualify. This is where we get into all the differences we can’t possibly discuss here, so if your water source is anything other than city water, you should bring it up to your loan officer right away for discussion.

Because the rules can be detailed and sometimes confusing, it’s not practical to list or explain every possibility here. Fortunately, HUD makes its complete manuals available to the public, allowing homeowners to review the official guidelines as needed. This will give every homeowner a good idea if their home meets HUD’s requirements and what might be needed if they have alternative water sources.

Property Types That Work for Reverse Mortgages

| Loan Type | Eligible Homes | Key Things to Know |

|---|---|---|

| HECM (FHA-Insured) | Single-family homes; FHA-approved condos; Manufactured homes (built after June 15, 1976 with HUD certification tags); 1–4 unit properties (borrower must live in one unit) | Must meet FHA property standards; Home must be your primary residence (not a vacation home or rental) |

| Proprietary (Jumbo) | Single-family homes; Some condos (even if not FHA-approved); Certain 2–4 unit properties (borrower must live in one unit) | Not government-insured; More flexible than FHA rules; Designed for higher-value homes; Must be primary residence |

HUD Property Requirement Manual

If you would like to review the official property standards yourself, HUD now publishes all information in one place, the Single Family Housing Policy Handbook (HUD Handbook 4000.1, last revised August 13, 2025). This handbook combines and supersedes many older manuals, including 4155.2 and 4150.2, and serves as the current rulebook lenders follow for FHA-insured reverse mortgages.

The handbook outlines minimum property standards for safety, soundness, and security, as well as appraisal rules and specific requirements for features such as manufactured homes, accessory dwelling units (ADUs), and septic systems. HUD sometimes issues Mortgagee Letters to add or clarify details, so checking the latest version is important.

FHA’s Property Requirements for Septic and Sewer Systems

FHA requires that homes be connected to a public sewer system whenever feasible. If that’s not possible, the property may instead rely on an individual septic system or a community sewage system, provided they meet HUD/FHA standards.

Community Sewer Systems

HUD no longer maintains a list of approved systems. Instead:

- The appraiser must record the name of the community system on the appraisal report.

- The lender is responsible for confirming that the system is properly licensed and capable of servicing the property.

Individual Sewage Systems

If a property cannot connect to public sewer and instead uses an individual system that is acceptable to the local health authority, HUD/FHA will accept it.

- This may include septic tanks, cesspools, pit privies, and mound systems.

- Inspections aren’t automatic unless there’s a local rule, signs of failure, or the Direct Endorsement underwriter decides it’s needed. For example, if the home’s been vacant for more than 30 days.

When inspections are required, they must be completed by:

- The local health authority

- A licensed sanitation professional, or

- Another qualified party, as determined by the Direct Endorsement (DE) Underwriter.

If the home has been vacant for more than 30 days, the underwriter must determine if an inspection is necessary, even if there are no signs of failure.

Did You Know? – FHA allows septic and community systems when public sewer isn’t available, but lenders and appraisers have the final say on inspections and approvals. Always confirm with your lender if additional requirements (overlays) apply to your property.

What’s New for Reverse Mortgage Property Requirements in 2025/2026

HUD made several important updates to its Single Family Housing Policy Handbook (4000.1 — August 13, 2025) that can affect whether a home qualifies for a reverse mortgage. Here’s what homeowners should know:

Accessory Dwelling Units (ADUs) More Clearly Defined

HUD now spells out how homes with one Accessory Dwelling Unit are handled.

A single-family house with one ADU can still qualify for a HECM if:

- The ADU is subordinate to the main home, meets local zoning and safety codes, and the borrower must live in the main unit.

- The appraiser reports the ADU separately, including its size, features, and whether it’s legally rentable.

- HUD allows lenders to request market rent information from appraisers for an ADU, but it’s optional. Don’t assume the income will count.

Stricter Manufactured Home Standards

Manufactured homes remain eligible, but HUD reinforced key requirements:

- Must be at least 400 square feet and built on or after June 15, 1976, with the original HUD certification label intact.

- If there’s any doubt about where the home came from, your lender may require transport and installation paperwork to prove it wasn’t previously set up elsewhere.

- Must sit on a permanent foundation that meets HUD’s PFGMH standards and be titled and taxed as real property.

These updates are based on the latest HECM property standards from HUD. They help keep borrowers safer and give clearer expectations for unusual home types or features.

Did You Know? – HUD sets the baseline property standards, but many lenders add their own “overlays.” For example, some require septic inspections even when HUD doesn’t, or may not allow certain private road or easement setups. Always ask early about lender overlays so you’re not surprised later.

Other Important HUD Updates

While not strictly property standards, HUD also made changes that affect how your property is appraised and whether certain liens need to be cleared:

PACE and Clean Energy Liens Must Be Cleared

Properties with unpaid Property Assessed Clean Energy (PACE) or similar “green energy” liens no longer qualify until those obligations are paid off. Borrowers can often use proceeds from the reverse mortgage itself to pay off the PACE balance at closing.

Appraisals: Better Review and Flexibility

- HUD has added a formal Request for Review of Value (ROV) process, allowing you to request that the lender correct clear errors before the value is finalized.

- Limited remote observation technology may be used in special cases, such as disaster follow-up or certain final inspections, but not to skip a full on-site appraisal.

- HUD allows homes with unusual construction (log, dome, earth-sheltered, etc.), but the appraiser must prove there’s a market for the property by finding recent sales of similar homes to support both value and marketability. If there are no comparable sales, the property is unlikely to qualify.

Curious If Your Property Qualifies? Find out with a custom reverse mortgage quote from All Reverse Mortgage—America’s #1 with a 4.99/5-star rating! Call (800) 565-1722 or click here for your free quote —simple, trusted, 100% secure!

Property FAQs

What types of properties are eligible for a reverse mortgage?

Can a reverse mortgage be done on an investment property?

Does HUD need to approve my home for a reverse mortgage?

How does the appraiser value my property?

The appraiser determines the value of your home based on the sales comparison method. This means the appraiser must first inspect your home, taking note of its size, condition, upgrades, amenities, etc., and then find recent sales as close to your property as possible that are as similar to your home as possible at that time, and then make market-based adjustments for the differences between your property and each comparable.

Can you get a reverse mortgage if your home needs repairs?

You can obtain a reverse mortgage if the repairs are not considered to be health and safety concerns, functional inadequacies, or those affecting the home’s livability. Some repairs may be completed after the loan closes, with funds set aside for repair completion.

ARLO recommends these helpful resources:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

February 22nd, 2026

February 22nd, 2026

January 12th, 2026

January 12th, 2026

October 29th, 2025

October 29th, 2025

April 26th, 2025

April 26th, 2025

March 20th, 2025

March 20th, 2025

January 12th, 2025

January 12th, 2025

December 29th, 2024

December 29th, 2024

December 13th, 2024

December 13th, 2024

August 23rd, 2024

August 23rd, 2024

January 5th, 2024

January 5th, 2024

December 8th, 2023

December 8th, 2023

October 26th, 2023

October 26th, 2023

October 5th, 2023

October 5th, 2023

September 28th, 2023

September 29th, 2023

September 24th, 2023

September 24th, 2023

August 22nd, 2023

August 22nd, 2023

July 25th, 2023

July 25th, 2023

July 8th, 2023

July 8th, 2023

May 16th, 2023

May 23rd, 2023

May 11th, 2023

May 11th, 2023

April 21st, 2023

April 21st, 2023

April 4th, 2023

April 4th, 2023

February 14th, 2023

February 14th, 2023

January 12th, 2023

January 12th, 2023

December 31st, 2022

December 31st, 2022

September 18th, 2022

September 18th, 2022

September 10th, 2022

September 10th, 2022

September 6th, 2022

September 6th, 2022

August 17th, 2022

August 17th, 2022

August 26th, 2022

August 30th, 2022

July 12th, 2022

July 12th, 2022

June 28th, 2022

June 28th, 2022

May 2nd, 2022

May 2nd, 2022

October 18th, 2022

October 30th, 2022

April 2nd, 2022

April 2nd, 2022

March 8th, 2022

March 8th, 2022

September 9th, 2021

September 9th, 2021

August 9th, 2021

August 9th, 2021

May 10th, 2021

May 10th, 2021

May 4th, 2021

May 4th, 2021

October 8th, 2020

October 8th, 2020

September 1st, 2020

September 1st, 2020

August 26th, 2020

August 26th, 2020

August 16th, 2020

August 16th, 2020

June 29th, 2020

June 29th, 2020

June 15th, 2020

June 15th, 2020

May 17th, 2020

May 17th, 2020

March 16th, 2020

March 16th, 2020

February 13th, 2020

February 13th, 2020

February 13th, 2020

February 13th, 2020

January 28th, 2020

January 29th, 2020

January 16th, 2020

January 16th, 2020

November 11th, 2019

November 11th, 2019

October 29th, 2019

October 29th, 2019

October 27th, 2019

October 27th, 2019

October 15th, 2019

October 15th, 2019

October 12th, 2019

October 12th, 2019

September 23rd, 2019

September 23rd, 2019

August 15th, 2019

August 15th, 2019

August 12th, 2019

August 12th, 2019

June 25th, 2019

June 25th, 2019

May 1st, 2019

May 1st, 2019

March 30th, 2019

March 30th, 2019

March 28th, 2019

March 28th, 2019

March 20th, 2019

March 20th, 2019

March 27th, 2018

March 27th, 2018

March 7th, 2018

March 7th, 2018