How to Understand Your Reverse Mortgage Statement

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

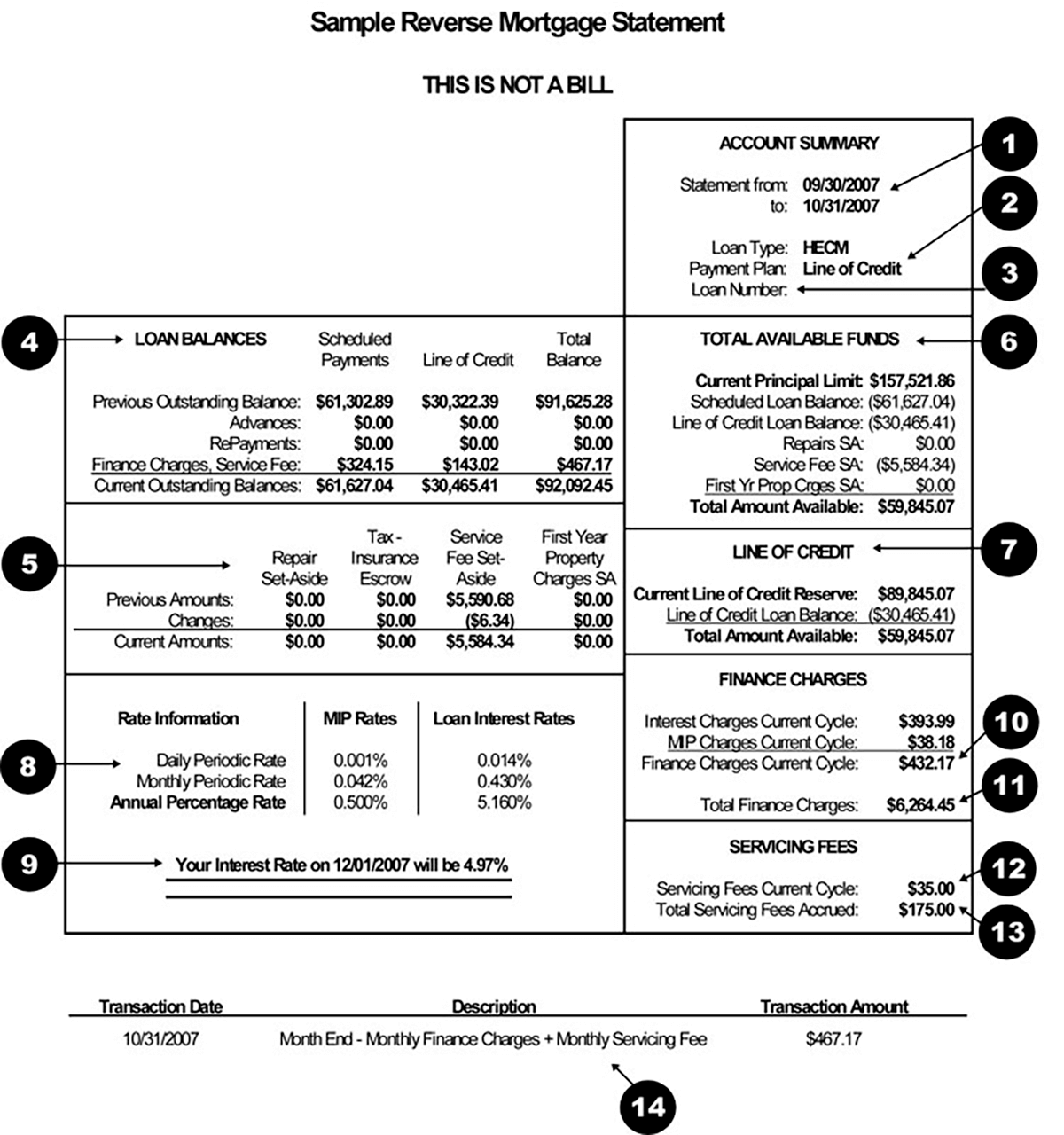

Reverse Mortgage Statement – Explanation of Terms:

1. Statement Date: The period that the statement represents. The sample statement displays all of the loan activity that occurred during October.

2. Payment Plan: This is the current payment plan type that has been selected. The borrower selected a “Line of Credit” payment plan option in the sample statement.

3. Loan Number: This is your reverse mortgage loan number. You’ll want to refer to this loan number when you call our Reverse Mortgage Servicing Department for any questions on your loan.

4. Loan Balances: This box details the breakdown of your reverse mortgage loan balance. It also will display any advances or repayments on your reverse mortgage and any finance charges or servicing fees for the past month. If you would like to know your loan balance as of the last day of the statement, look at the figure in the bottom right side of the box.

In the sample statement, the borrower’s total loan balance was $92,092.45.

5. Set Asides: This box represents the balances and any activity that may have taken place with the set-asides on your reverse mortgage. Several types of set asides (Repair set-asides, Tax/Insurance Set Asides, etc.). These set-asides designate some of your reverse mortgage funds for required purposes. For example, if you have funds set aside to complete needed repairs to your home, you will see a figure in the “Repair Set-Aside” column. Not all loan types must have set-asides, so you may not see any activity in this section.

6. Total Available Funds: This box calculates any remaining funds you have available to borrow on your reverse mortgage. In the sample statement, the borrower has a total of $59,845.07 remaining that they can borrow.

7. Line of Credit: This box displays any remaining money available to borrow on the line of credit if you selected a line of credit as part of your payment plan option. In the sample statement, the borrower has $59,845.07 remaining that they can borrow on their line of credit. If you do not like a line of credit as part of your payment plan option, this box will be blank.

8. Interest Rate: This is the breakdown of the interest rate on your reverse mortgage during the statement period. In the sample statement, the interest for October was calculated using 5.16%, and the mortgage insurance premium was calculated using 0.50%.

9. Interest Rate Change Notice: This is a notice to you of any changes upcoming in your reverse mortgage interest rate. The borrower’s interest rate in the sample statement will decrease to 4.97% on December 1st.

10. Finance Charges Current Cycle: This is the total interest and mortgage insurance premium accrued on your reverse mortgage during the statement period.

11. Total Finance Charges: This is the total interest and mortgage insurance premiums accrued since receiving your reverse mortgage. This figure includes the up-front mortgage insurance premium – if applicable – (which was collected at the time of closing) and all of the monthly interest and mortgage insurance premiums accrued on your loan.

12. Servicing Fees Current Cycle: This is the dollar amount of the monthly servicing fee added to the loan balance. This monthly servicing fee is determined at the time of closing.

13. Total Servicing Fees Accrued: This is the total amount of the monthly servicing fees that have accrued since you received your reverse mortgage.

14. Transaction Detail: If you had any transactions (line of credit advances, repayments, accrued interest, monthly scheduled payments, etc.) on your reverse mortgage during the statement period, they are listed here. The sample statement had no activity other than the $467.17 in accrued interest, mortgage insurance premiums, and monthly servicing fee.

Post Closing FAQs

How can I request funds from my Line of Credit?

What should I do if I have required repairs to be completed?

How do I arrange for my payments to be deposited directly into my bank or credit union account?

When will I receive my scheduled monthly payment?

Who is responsible for paying the property taxes and insurance on my home?

Will I receive an activity statement on my reverse mortgage?

I was told that my loan might “grow.” What does that mean?

Who owns my home?

Annual Occupancy Certification

What happens to my reverse mortgage if I pass away or move from the home permanently?

Who should I contact for any questions about my reverse mortgage?

If you’d like to learn the reverse mortgage statement reads, contact the toll-free number on your statement or try our Reverse Mortgage Calculator. PS – We also welcome and respond to the comments below…

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

April 3rd, 2024

April 5th, 2024

October 26th, 2023

October 26th, 2023

October 5th, 2023

October 5th, 2023

June 27th, 2023

July 17th, 2023

March 25th, 2023

March 29th, 2023

September 14th, 2022

September 18th, 2022

May 25th, 2022

June 10th, 2022

February 14th, 2022

February 16th, 2022

June 2nd, 2020

June 2nd, 2020

May 15th, 2020

May 15th, 2020

July 23rd, 2013

July 23rd, 2013

July 15th, 2013

August 14th, 2013

May 13th, 2013

May 20th, 2013

May 21st, 2013

March 13th, 2012

January 23rd, 2012

January 24th, 2012