Reverse Mortgage Life Expectancy Set Aside (LESA) Explained

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

A key development in the overhaul of HECM guidelines was the introduction of the LESA. This requirement is a response to past challenges where borrowers, after receiving a lump-sum equity payment, struggled to meet essential obligations such as homeowners insurance, property taxes, and home maintenance to FHA standards, leading to defaults.

The LESA is designed to ensure that property charges are managed effectively, safeguarding borrowers from the risk of default.

The Security of a LESA with a Reverse Mortgage

The Life Expectancy Set Aside (LESA) is revolutionizing how borrowers approach reverse mortgages, offering a new layer of financial security and stability. Functioning similarly to an escrow account used in traditional forward mortgages for taxes and insurance, LESA is tailored based on the borrower’s age and life expectancy.

This approach ensures that funds such as homeowners insurance and property taxes are allocated for future payments, thereby mitigating the risk of borrower defaults.

For some, a LESA is a mandatory component based on their financial assessment results, but others may opt to incorporate it voluntarily into their reverse mortgage strategy. This flexibility allows borrowers to align LESA with their specific financial needs and circumstances.

Incorporating a LESA into a reverse mortgage plan can be a game-changer, especially for new borrowers who might have reservations about reverse mortgages. It addresses common concerns by ensuring that essential expenses are covered, thus offering peace of mind.

Strategizing: The Advantages of a LESA in Reverse Mortgages

The concept of a Life Expectancy Set Aside (LESA) in reverse mortgages might seem like it reduces your initial proceeds, but it’s a strategic move for long-term financial peace.

This approach is particularly advantageous for borrowers cautious about meeting ongoing loan obligations, such as taxes and insurance payments.

Family members of reverse mortgage borrowers often advocate for a Tax and Insurance LESA. Their primary goal is to ensure their elderly parents can enjoy their retirement without the stress of these financial responsibilities.

Empowering Financial Independence: Betty’s Example with LESA

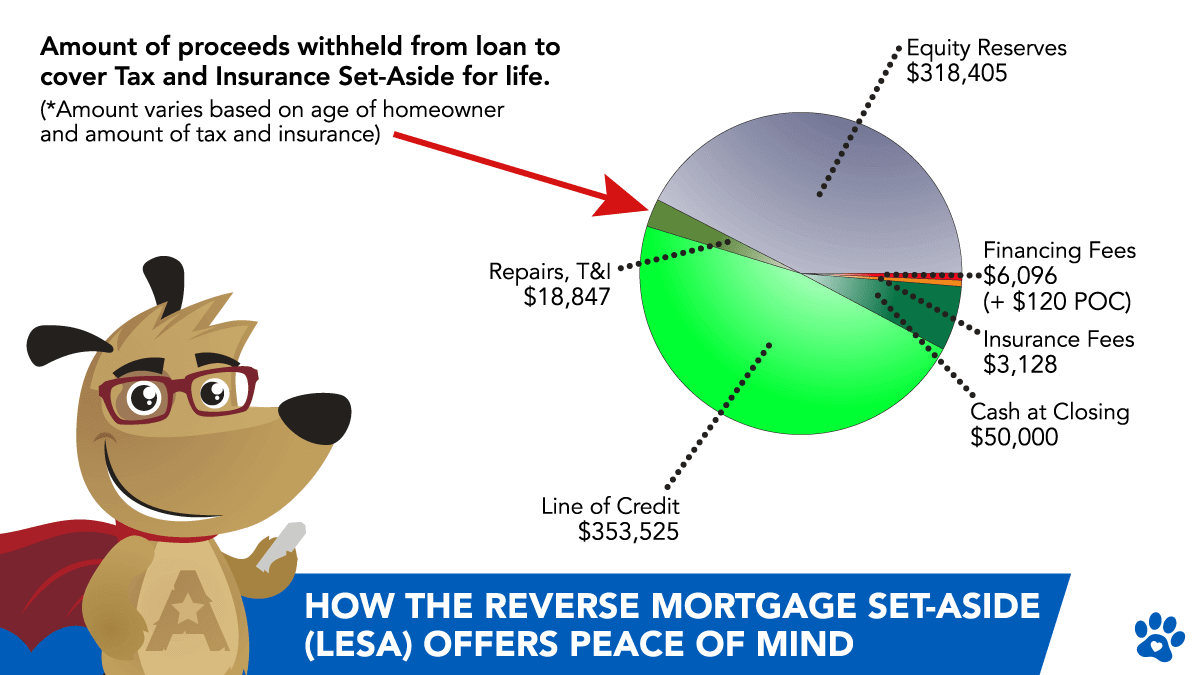

Consider the story of Betty, a homeowner born in 1932, who enjoys the comfort of her $750,000 home, which she owns outright, free from any mortgages.

Betty faces the common concern of managing ongoing property taxes and insurance, which amount to $218.71 monthly. As she contemplates making some enhancements to her home, Betty decides to tap into her home’s equity through a reverse mortgage, aiming to withdraw $50,000 upfront for the renovations.

Betty values her independence but is not immune to the stress of keeping up with regular tax and insurance obligations. Recognizing this, her son proposes a solution to alleviate her worries: incorporating a Life Expectancy Set Aside (LESA) into her reverse mortgage plan.

By allocating $18,847 to a LESA, Betty finds a way to safeguard her future. This strategic decision not only grants her the financial flexibility to make the desired home modifications but also removes the fear of failing to make mandated tax and insurance payments.

Opting for a LESA allows Betty to maintain her financial independence and focus on the joy of improving her home, secure in the knowledge that her ongoing property charges are covered.

Your LESA Guide: Easy Breakdown

| What You Want to Know | How It Helps You |

|---|---|

| What’s a LESA? | Money set aside to pay your taxes and insurance—no worries! |

| Do I Need It? | Maybe—if your credit or income needs it, or you choose it for peace. |

| How Much Gets Set Aside? | Depends on your age and bills—like $18,847 for Betty’s $218/month. |

| Does It Grow? | Yes—unused funds grow, so you set aside less now for later costs. |

| Can I Change My Mind? | No—once it’s set, it stays, so decide carefully upfront. |

LESA: Life Expectancy Set Aside—part of your loan to cover taxes and insurance.

Peace: No stress over bills—your servicer pays them for you.

Betty’s Example: $750,000 home, $50,000 upfront, $18,847 LESA for $218/month costs.

Set-Aside FAQs

What is a reverse mortgage LESA set aside?

How does a LESA benefit me?

How does the LESA growth rate work?

Can I opt-in voluntarily for a LESA set aside?

What is a reverse mortgage repair set aside?

If you have a reverse mortgage and fall behind on the taxes, can you get a modification putting the taxes and insurance on LESA?

ARLO recommends these helpful resources:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

August 23rd, 2024

August 23rd, 2024

July 29th, 2024

July 29th, 2024

August 21st, 2024

August 23rd, 2024

October 31st, 2024

November 4th, 2024

November 4th, 2022

November 4th, 2022

October 28th, 2022

November 4th, 2022

September 1st, 2022

September 1st, 2022

January 20th, 2022

January 20th, 2022

May 10th, 2021

May 10th, 2021

January 20th, 2021

December 28th, 2020

December 28th, 2020

December 8th, 2020

December 8th, 2020

November 11th, 2020

November 11th, 2020

October 7th, 2020

October 7th, 2020

October 11th, 2020

May 4th, 2020

May 4th, 2020

March 27th, 2021

November 27th, 2019

November 27th, 2019

October 15th, 2019

October 15th, 2019

October 3rd, 2018

October 3rd, 2018

May 16th, 2017

May 16th, 2017

February 15th, 2017

February 15th, 2017

February 7th, 2017

February 8th, 2017

November 18th, 2016

November 18th, 2016

July 12th, 2016

July 12th, 2016

September 20th, 2016

September 20th, 2016

September 20th, 2016

September 20th, 2016

November 10th, 2020

November 11th, 2020

October 25th, 2022

November 2nd, 2022