America’s #1 Rated Reverse Lender*

Reversemortgage.org Releases New Consumer Guides

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

New Consumer Guides Walk You Through the Reverse Mortgage Process

More than one million American homeowners have been served by Federal Housing Administration-backed reverse mortgages via the Home Equity Conversion Mortgage program.

Now in its 27th year, the HECM program continues to enhance its consumer protections as lenders strive to improve the customer experience for both reverse mortgage borrowers and their families.

Like the acronym suggests, HECMs allow homeowners age 62 and older to convert a portion of their home equity into loan proceeds. The borrower can access these proceeds tax-free and can use at their own discretion. Insured by the FHA, HECMs represent more than 90% of reverse mortgages available in the marketplace today.

Reverse mortgages are often described as complex products that require prospective borrowers to do their homework so they can be fully aware of the loan terms.

Luckily, there are several new consumer guides intended to help prospective borrowers become familiar with the reverse mortgage loan process, detailing what happens during loan servicing after the HECM closes, to what can be expected when the loan becomes due and payable. There’s also a checklist of key considerations consumers should ask themselves before moving forward with a loan application.

What happens after loan closing?

You’ve just closed your HECM. To get here, you’ve gone through the mandatory HECM counseling that is required of all borrowers to ensure that a reverse mortgage is a sustainable solution for your particular situation. You’ve met with your lender, crossed all the T’s and dotted all the I’s on the loan documents. You’re now one step closer to begin receiving loan proceeds.

A lot of behind-the-scenes work occurs for your HECM before you begin receiving that first loan disbursement. The loan servicing that occurs on the back-end of your reverse mortgage is a critical part of the borrower experience, and it’s important that you know what your responsibilities are under the loan terms.

This is why the National Reverse Mortgage Lenders Association (NRMLA), the trade association that sets ethical lending practices within the reverse mortgage industry, released a series of consumer guides to bring greater transparency to the borrowing process.

The guide, titled “What You Need to Know About Your HECM After Closing,” explains the important role of the reverse mortgage loan servicer and the rules, guidelines and timelines that apply to the HECM loan.

This guide can serve as a valuable resource for borrowers and their families in providing the necessary information every reverse mortgage borrower should know about staying in touch with their loan servicers, including occupancy requirements under the loan terms and what situations may trigger the reverse mortgage to become due and payable.

NRMLA encourages all borrowers to share the information within this consumer guide with their families, heirs, financial advisors, real estate agents, or anyone else that might assist with their financial affairs.

What happens why my loan is due?

To help reverse mortgage borrowers and their families navigate the end of the loan process, that is, when the reverse mortgage ultimately becomes due and payable, NRMLA created the free brochure titled, “What Do I Do When My Loan is Due?”

This easy to understand five-page guide discusses what happens when the reverse mortgage reaches its Maturity Event. Typically, this occurs when the reverse mortgage borrower sells the home, conveys title of the property to someone else, passes away, resides elsewhere for more than 12 months, fails to pay property charges or allows the home to fall into disrepair.

The guide also provides borrowers with a step-by-step walk through the end of loan process, which includes how to contact the loan servicer, as well as plans to satisfy the reverse mortgage loan balance, including the required timelines to do so, among other options for settling the loan.

Also See: Ask the Experts: Heirs & Loan Maturity

Still on the fence? Try this checklist

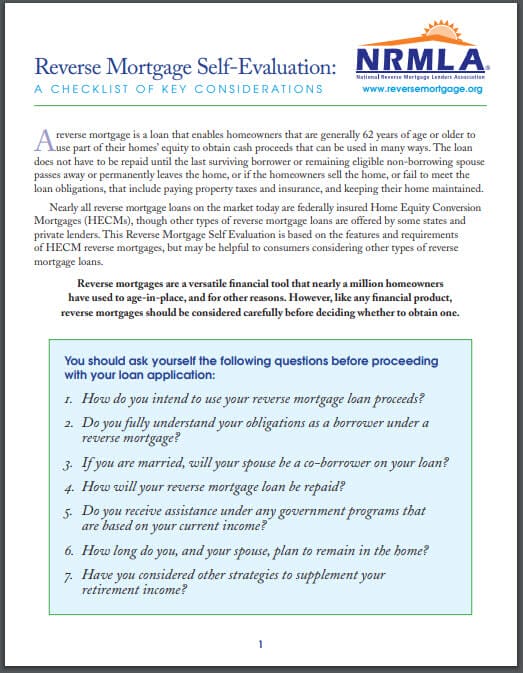

For those who are considering a reverse mortgage but may still be on the fence about moving forward, try using NRMLA’s “Reverse Mortgage Self-Evaluation: A Checklist of Considerations” to make an informed decision about your reverse mortgage experience.

Created to help prospective borrowers consider whether a reverse mortgage is right for their particular situation, this six-page checklist poses several questions and important considerations that interested consumers should first ask themselves before proceeding with a HECM loan application.

A few examples included within the questionnaire include asking yourself: How do you intend to use your reverse mortgage loan proceeds?; Do you fully understand your obligations as a reverse mortgage borrower?; How will your reverse mortgage be repaid?; and how long do you, and your spouse, plan to remain in the home?

This checklist is meant to serve as an educational resource, and is not intended to replace mandatory HECM counseling approved by the U.S. Department of Housing and Urban Development.

The same goes for all of these consumer guides in the sense that they are intended for educational purposes so that prospective reverse mortgages borrowers can make a well-informed decision about their HECM experience.

If you are interested in getting a reverse mortgage and would like to know more about the borrowing process, contact us today at (800) 565-1722 or calculate your available loan here.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

Have a Question About Reverse Mortgages?

Over 2000 of your questions answered by ARLO™

Ask your question now!