HELOC Resets Create ‘Perfect Storm’ For Reverse Mortgages

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

Senior homeowners may be looking at a combination of events that could equate to the perfect storm brewing that doesn’t even appear on most of their horizons.

There is a combination of events, those that have already happened, those that are going to happen, and those likely to happen, that could leave many senior homeowners in a real bind.

So much so that if they don’t plan for it now, they could find that they are unprepared for the consequences that could come later.

I’m talking about the combination of the regulations on credit since the collapse of the credit market after the 2008 crash, the fact that roughly 40% of the $373 Billion in Home Equity Credit Lines are reaching the end of their draw period in the next 3 years and the fact that the economy is finally showing signs of improvement (which sounds great but it means that interest rates will be going up).

These three things could spell disaster for anyone not ready for the events if they are in the affected group, and let me explain why.

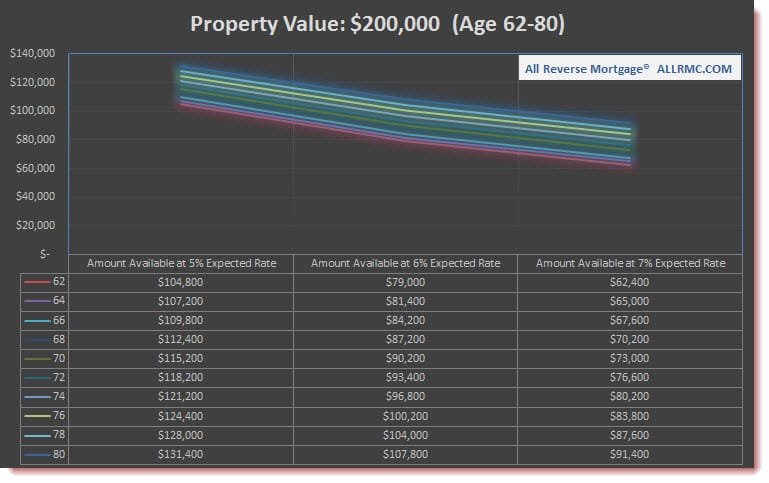

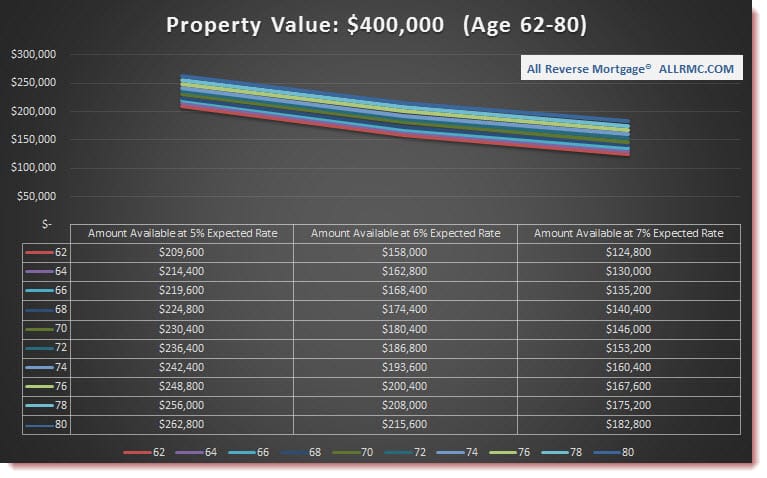

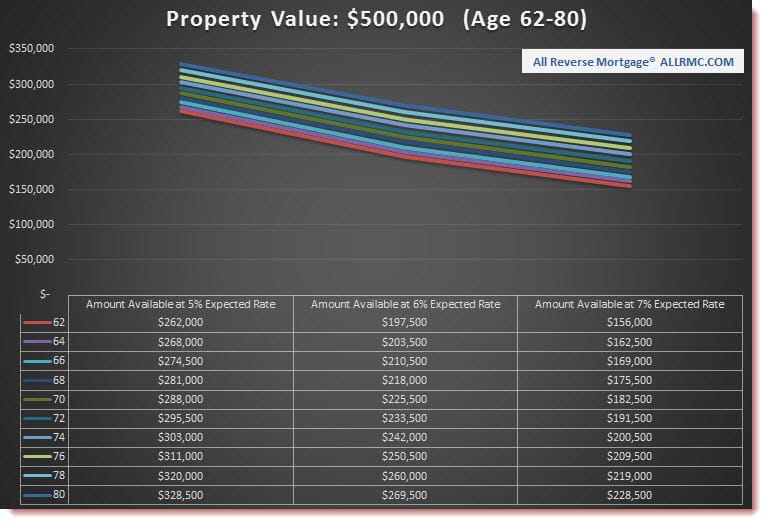

Let’s start with rising interest rates. I have heard many people say that they are not concerned with rates rising one or two percent, and normally, that’s not a huge issue, but when long-term rates rise, it really can affect the amount of money reverse mortgage borrowers receive under the program.

Here’s why. HUD uses rates in their equations as one factor determining how much money a borrower will receive under the Home Equity Conversion Mortgage (HECM or “Heck-um”) reverse mortgage.

The rates have been so low that many have forgotten that a relatively small rise in the long-term rates can make a big difference in how much money borrowers receive under the program.

The following chart illustrates the difference in the amount of proceeds for borrowers of various ages when interest rates rise. HUD’s “floor” is 5%. That means that as long as the expected rate (the note rate for the fixed program and the 10-year index plus the margin for the adjustable loans) stays at roughly 5% or below, the borrower receives the maximum amount available under the program.

The expected rate has been below this point for several years now. As you can see, there is a significant decrease in the proceeds to the borrower as the rates go above the HUD floor of 5%.

Those waiting to get their reverse mortgage for one reason or another may be in for a big surprise if the rates rise later this year, as economists for the MBA, Fannie Mae, and Freddie Mac predict (economists predict rates increase).

Based on the charts above, borrowers waiting for their homes to increase in value or for that next birthday before obtaining their reverse mortgage may find that the gains they expected by waiting are more than erased by the amount they lose from higher rates.

Then you have the billions of dollars of Home equity Lines of Credit that will soon enter the repayment period.

What this means to many senior homeowners is that the line of credit that you have taken for granted for so long will soon be frozen, and you will have no more access to those funds if you are one of the ones who has reached the end of the draw period.

In addition, your payments will go from interest only to full principal and interest repayments and could double or triple (or who knows with rising rates).

A borrower with a Home Equity Line of Credit of $100,000 with a $50,000 balance paying interest-only now of about 4% pays only $166.67 per month and has a line of $50,000 for life’s unexpected emergencies.

If you are one of the ones who have their line reset at a rise in rates to just 6%, then your payment could go to a 10-year principal and interest payment of $555.10 per month with no access to any future funds! That’s an over 300% increase in payments, leading us to the final factor mentioned above for the perfect storm – the credit crunch.

Before the credit crunch, a Home Equity Line of Credit loan was almost a rubber stamp of approval for a homeowner with good equity. However, according to an article on Bankrate, since the crash, “…not everyone meets the requirements to borrow from home equity.

Consumers must have enough equity, a high credit score, and a healthy relationship between their debt and income to take money out of their house…”

The Bankrate article continues to outline the fall of the popularity of the HELOC and that those loans that lenders still do are being scrutinized much more heavily.

This means that borrowers who may need a way to roll their existing HELOCs that enter the repayment period in the next 3 years may not be able to find a loan for which they can qualify and now are faced with the higher payments as their current HELOC is reset.

They would have no alternative but to enter into the loan’s repayment period.

The three events combined, higher rates giving borrowers lower benefits on any reverse mortgage that they may seek, an existing HELOC that enters a reset and repayment period (also at a probable higher than the current rate), and the fact that replacement HELOCs are more challenging to obtain with current underwriting standards could wreak havoc on unprepared borrowers’ finances.

But there is something you can do now.

There is no time like now to take another look at the HUD HECM reverse mortgage. Consider this if you have been waiting for your property value to go up or for your next birthday.

If you are a 68-year-old homeowner with a $300,000 home, if you planned on waiting until after the summer so that you could get a little more appreciation or so that you would be within 6 months of your next birthday so you would get higher benefits, look at how these changes would affect you.

At 68, your Principal Limit (the benefit amount you would receive before any payoffs) is currently $168,600 at the existing low rates. At 69, this rises to $170,700, an increase of just $2,100 at current rates.

However, even with the increased age but a three-quarter percent rate rise to just 5.75%, the $2,100 gain becomes $28,200 LESS. Along the same lines, it would take an increase in value of about $61,000 to get the same benefit after the increase in rate for the 68-year-old borrower.

The charts above illustrate drops of over $100,000 in proceeds in some cases (property value of $500,000 or more and a 2% rise in rates).

Finally, if you were to obtain your HUD HECM now and haven’t used it for a few years, consider these 5 factors:

1. Your maximum interest rate cap would be calculated based on today’s low rates.

2. Your Principal Limit would increase with the line of credit growth so that you would have more money available later anyway.

3. Your line of credit can never be frozen (assuming you meet the conditions outlined in the loan agreement), and you will not have to worry about payments possibly tripling in the near future on existing HELOC loans.

4. While there is never a payment due on a reverse mortgage, there is no prepayment penalty, and you can make a full or partial payment at any time without penalty if your goal is to continue to pay your line down.

5. You can lock in your benefit amount at today’s low rates instead of waiting until that amount is drastically reduced due to higher interest rates.

Also See:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

July 20th, 2023

June 10th, 2019

June 10th, 2019