Washington's #1 Rated Reverse Mortgage Lender*

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

Experience Excellence with Washington’s Top Reverse Mortgage Lender

For over 20 years, All Reverse Mortgage, Inc. (ARLO™) has helped Washington homeowners access their home equity through HUD-approved HECM and jumbo reverse mortgages. As Washington’s #1 Rated Reverse Mortgage Lender, we hold an A+ BBB rating with perfect 5-star reviews and zero complaints — a record that earned us recognition as a BBB Torch Award for Ethics Finalist three years running.

As a HUD-approved direct lender and proud member of the National Reverse Mortgage Lenders Association (NRMLA), we specialize exclusively in reverse mortgages — it’s all we’ve done since 2004. That singular focus is especially valuable in Washington, where the average home value of $611,300 is among the highest in the country and properties in the Seattle metro — including Bellevue, Mercer Island, Kirkland, and the Eastside communities — regularly exceed the $1,249,125 HECM lending limit.

Beyond the Puget Sound corridor, waterfront homes on the San Juan Islands, retirement communities around Sequim and the Olympic Peninsula, and growing markets in Tacoma, Olympia, and the Tri-Cities all contribute to a state where understanding both HECM and jumbo reverse mortgage programs is essential. Our team introduced the first fixed-rate jumbo reverse mortgage in 2008, giving us deep expertise in helping Washington homeowners with higher-value properties evaluate their options.

Whether your goal is to eliminate monthly mortgage payments, create a financial safety net with a growing line of credit, or access equity for retirement planning, we’re here to help you choose the right program with competitive rates and lower costs. Let us show you the difference two decades of dedicated experience can make.

Washington Reverse Mortgage Eligibility & Key Facts

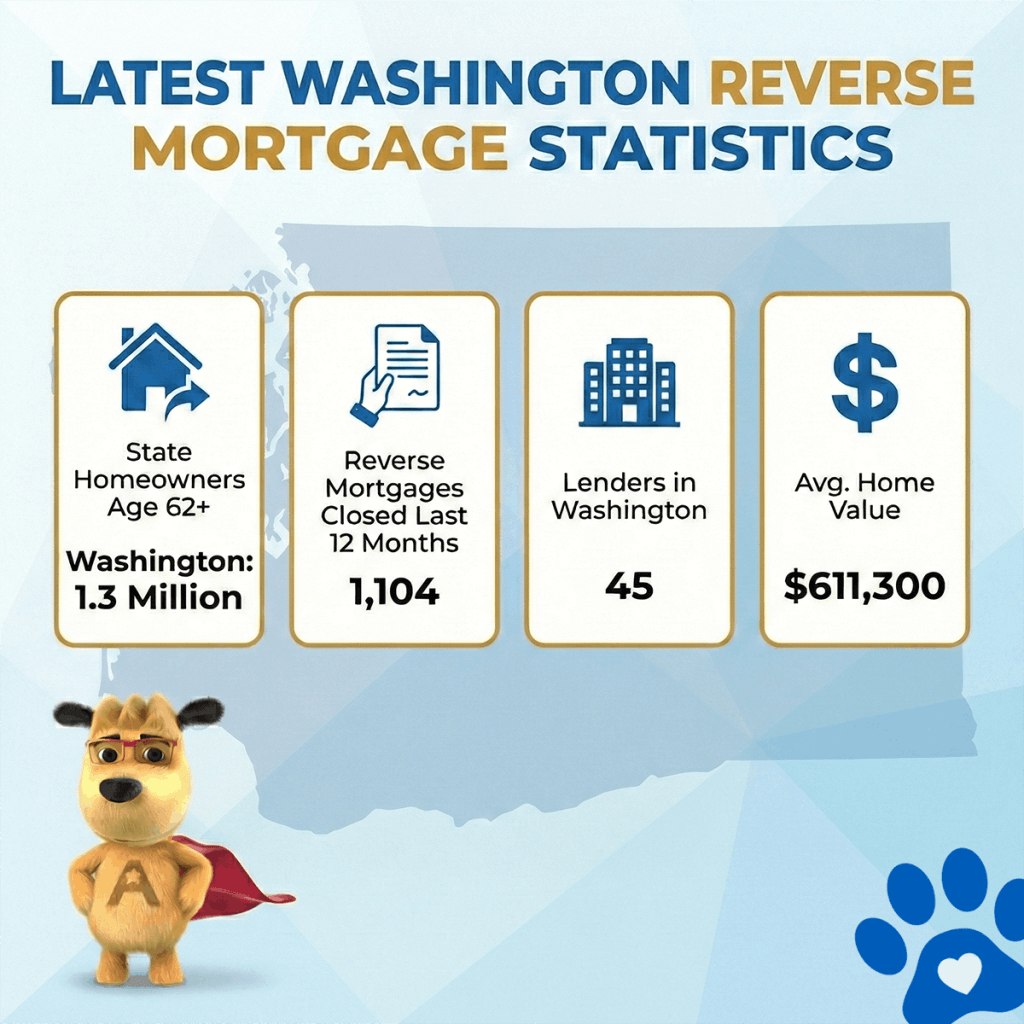

Latest Washington Reverse Mortgage Statistics

| State | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Washington | Avg. Home Value |

|---|---|---|---|---|

| Washington | 1.3 Million | 1,104 | 45 | $611,300 |

Top 10 Reverse Mortgage Cities in Washington

| Rank | City | Population | Homeowners Age 62+ | Median Home Value |

|---|---|---|---|---|

| 1 | Seattle | 749,256 | 66,000 | $832,857 |

| 2 | Spokane | 229,071 | 21,000 | $383,289 |

| 3 | Bainbridge Island | 25,903 | 4,200 | $1,128,718 |

| 4 | Port Orchard | 16,714 | 5,300 | $541,521 |

| 5 | Monroe | 20,876 | 3,400 | $711,279 |

| 6 | Kent | 136,588 | 6,800 | $635,423 |

| 7 | Kennewick | 86,276 | 7,100 | $422,057 |

| 8 | Tacoma | 222,906 | 24,500 | $478,988 |

| 9 | Olympia | 55,605 | 7,600 | $528,694 |

| 10 | Marysville | 73,246 | 6,900 | $615,183 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

Top Reverse Mortgage Lenders in Washington

| Lender | BBB Rating | Accredited | Years in Business | Customer Rating (0–5) | % Positive Reviews | Complaints | Source |

|---|---|---|---|---|---|---|---|

| All Reverse Mortgage, Inc. (ARLO) | A+ | YES | 21 | 4.94/5 | 99.0% | 0 | Source |

| American Pacific Mortgage | F | NO | 28 | 1.75/5 | 35.0% | 6 | Source |

| CrossCountry Mortgage, LLC. | F | YES | 22 | 1.43/5 | 29.0% | 303 | Source |

| Fairway Independent Mortgage | A+ | YES | 29 | 4.51/5 | 90.0% | 26 | Source |

| Finance of America Reverse LLC (FAR) | A+ | YES | 22 | 3.71/5 | 74.0% | 36 | Source |

| Goodlife Home Loans | A+ | YES | 13 | N/A (Not enough reviews) | N/A (Not enough reviews) | 1 | Source |

| Guaranteed Rate | A+ | YES | 26 | 2.25/5 | 450% | 45 | Source |

| Guild Mortgage Company LLC | A+ | NO | 65 | 1.55/5 | 31.0% | 73 | Source |

| HighTechLending Inc | A+ | YES | 19 | 4.94/5 | 99.0% | 1 | Source |

| Liberty Home Equity Solutions Inc. | A+ | NO | 22 | 1.00/5 | 20.0% | 1 | Source |

| Longbridge Financial LLC | A+ | YES | 13 | 3.77/5 | 75.0% | 34 | Source |

| Luminate Bank | NR | NO | 84 | NA | NA | NA | Source |

| MCM Holdings | A+ | YES | 27 | NA | NA | NA | Source |

| The Money House | NR | NO | 28 | NA | NA | 0 | Source |

| Movement Mortgage, LLC | A+ | NO | 18 | 4.43/5 | 89.0% | 92 | Source |

| Mutual of Omaha Mortgage | A+ | YES | 12 | 3.31/5 | 66.0% | 65 | Source |

| New American Funding | A+ | YES | 26 | 4.65/5 | 93.0% | 147 | Source |

| Plaza Home Mortgage Inc | A+ | YES | 24 | 2.67/5 | 53.0% | 6 | Source |

| Smartfi Home Loans | A+ | YES | 6 | N/A (Not enough reviews) | N/A (Not enough reviews) | 0 | Source |

| South River Mortgage, LLC | A+ | NO | 6 | 3.79/5 | 76.0% | 14 | Source |

Washington Reverse Mortgage Lending Limits

Washington, known as “The Evergreen State,” is home to over 7.8 million people, with over 1.3 million homeowners aged 62 and older. This means that nearly half a million Washingtonians may qualify for a reverse mortgage, which allows them to access their home’s equity.

As of January 2026, the median home value in Washington is around $611,300, well within the HECM reverse mortgage lending limit of $1,249,125.

Washington’s combination of no state income tax, a temperate Pacific Northwest climate, and access to both mountains and coastline has made it a popular destination for retirees — particularly those relocating from neighboring Oregon and California. The state’s economy is anchored by a thriving tech sector in the Puget Sound region, a strong agricultural industry in Eastern Washington, and renowned wine production in the Walla Walla and Columbia valleys. Many long-time Washington homeowners have seen significant equity growth, particularly in the Seattle metro area, making a reverse mortgage a strategic way to access that equity without leaving the home they love.

If you’re a homeowner aged 62 or older in Washington, All Reverse Mortgage, Inc. (ARLO™) is here to help. We’re ready to answer your questions and guide you through the process.

Essential Protections and Requirements for Washington Reverse Mortgages

In Washington State, reverse mortgages are subject to federal guidelines and additional state-specific requirements that enhance consumer protection. For those considering a reverse mortgage, it’s important to understand these key protections:

- Mandatory HUD-Approved Counseling — Washington requires all reverse mortgage applicants to complete a HUD-approved counseling session and provide a signed certificate to their lender. This step ensures that borrowers fully understand the loan’s structure, benefits, and potential alternatives.

- Protection Against Tied Financial Products — Lenders in Washington are prohibited from requiring borrowers to purchase additional financial products, such as annuities, as a condition of obtaining a reverse mortgage. This ensures a fair and transparent loan process.

- Clear Tax and Insurance Responsibilities — Borrowers remain responsible for paying property taxes, homeowners insurance, and home maintenance costs. Lenders are required to notify borrowers of these ongoing obligations to prevent foreclosure.

- Cooling-Off Period — Washington law includes a mandatory waiting period before finalizing a reverse mortgage. This ensures borrowers have time to carefully review their decision and consult with family or advisors if needed.

- Licensed Loan Originators — All reverse mortgage lenders in Washington must be properly licensed and meet the state’s standards for professionalism and transparency. This helps ensure that borrowers work with trustworthy and experienced professionals.

- Consumer Protections for Foreclosure Prevention — Washington has strong foreclosure prevention laws that require lenders to provide clear communication and offer resources for borrowers facing financial difficulties. These protections help borrowers navigate challenges and avoid unnecessary foreclosure.

Washington State Reverse Mortgage FAQs

Will a reverse mortgage affect my Senior Citizen Property Tax Exemption or Deferral Program benefits?

Does Washington charge income tax on reverse mortgage proceeds?

How does a reverse mortgage affect Apple Health (Medicaid) eligibility in Washington?

Does my spouse need to sign the reverse mortgage documents in Washington?

Can I place my reverse mortgage in my living trust in Washington?

Are there different age requirements for reverse mortgages in Washington?

What counseling is required in Washington?

What consumer protections does Washington provide for reverse mortgage borrowers?

If I have a reverse mortgage and move to assisted living, what happens?

Can I make voluntary payments on my reverse mortgage in Washington?

Can I rent out a room in my home if I have a reverse mortgage?

How does a reverse mortgage compare to a Home Equity Line of Credit (HELOC) in Washington?

Key differences:

| Feature | Reverse Mortgage | HELOC |

|---|---|---|

| Monthly payments | None required | Required (interest + principal) |

| Age requirement | 62+ | Any age (18+) |

| Income verification | Yes (financial assessment) | Yes (strict debt-to-income) |

| Upfront costs | High ($20K–$30K) | Low ($0–$500) |

| Best for | Eliminating payments, long-term cash flow | Short-term needs, renovations |

Can I use reverse mortgage proceeds to pay off debt?

HUD-Approved Reverse Mortgage Counseling Agencies in Washington

| Name | Agency ID | Address | Phone | Web Site |

|---|---|---|---|---|

| AMERICAN FINANCIAL SOLUTIONS | 84617 | 500 Pacific Avenue, BREMERTON, Washington, 98337-1944 | (888) 864-8699 | myfinancialgoals.org |

| CREDIT.ORG - SEATTLE BRANCH | 90590 | 450 Alaskan Way S, Seattle, Washington, 98104-3387 | (509) 581-4927 | credit.org |

| KOREAN COMMUNITY SERVICE CENTER OF GREATER WASHINGTON | 80370 | 7700 Little River Tpke Ste 406, Annandale, Washington, 22003-2406 | (703) 354-6345 | kcscgw.org |

| URBAN LEAGUE OF METROPOLITAN SEATTLE | 80415 | 105 14th Ave Ste 200, Seattle, Washington, 98122-7308 | (206) 461-3792 | urbanleague.org |

Did you know? Washington does not mandate in-person counseling. Visit our counseling page for a list of phone-based counseling agencies and conduct your required counseling from the comfort of your home.

Ready to Unlock Your Home’s Equity?

As Washington’s #1 Rated Reverse Mortgage Lender, All Reverse Mortgage, Inc. (ARLO™) is here to provide trusted guidance, real-time rates, and expert support to help you make informed decisions.

✔ No obligations. Just real-time rates and expert advice.

✔ Instant quote. No personal info required.

✔ Licensed experts. Get clear, honest answers.

All Reverse Mortgage, Inc. is fully licensed by the Washington State Department of Financial Institutions (License #CL-13999), ensuring that you receive expert guidance every step of the way.

Get Your Reverse Mortgage Quote from Washington’s #1 Rated Reverse Mortgage Lender* or call (800) 565-1722 to speak with a licensed expert.

Other Areas of Interest in Washington

Bainbridge Island Bellevue Bellingham Camano Island Edmonds Everett Federal Way Kennewick Kent Kirkland Marysville Monroe Olympia Port Orchard Renton Seattle Snohomish Sequim Spokane Tacoma Vancouver

Additional Resources:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald