Serving Spokane Homeowners Since 2004

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

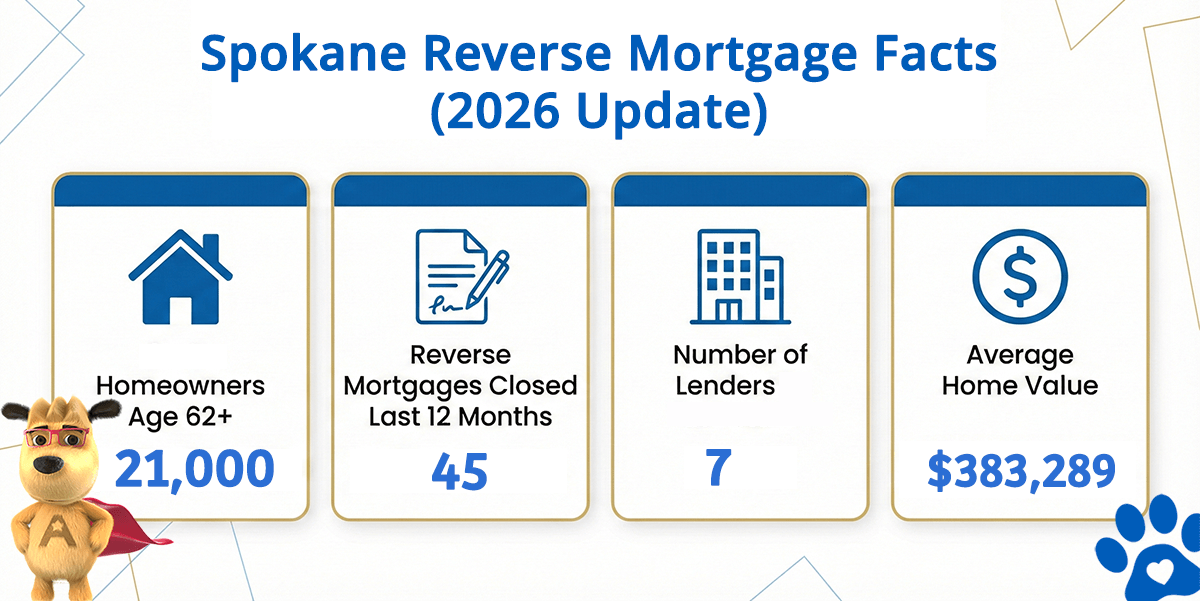

Spokane Reverse Mortgage Market at a Glance

Spokane Reverse Mortgage Facts (2026 Update)

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Spokane (est) | Avg. Home Value |

|---|---|---|---|---|

| Spokane | 21,000 | 45 | 7 | $383,289 |

What the Numbers Tell Us About Reverse Mortgages in Spokane

Spokane is Eastern Washington’s largest city and the state’s second-largest metro area, with an estimated 21,000 homeowners aged 62 and older. With an average home value of $383,289, most Spokane properties fall well within the federal HECM lending limit of $1,249,125, meaning the majority of qualified homeowners can access the standard FHA-insured HECM program without needing a proprietary product.

Spokane’s affordability relative to western Washington, combined with its growing downtown, proximity to outdoor recreation, and strong healthcare infrastructure, has attracted steady migration from higher-cost markets. Many senior homeowners here have lived in established neighborhoods like South Hill, Manito, and Indian Trail for decades, building equity through one of the state’s most stable housing markets.

While most Spokane properties are well within the HECM limit, homes in premium neighborhoods and along the Spokane River can approach higher values. In those cases, jumbo reverse mortgage programs may provide access to additional equity — though jumbo programs typically offer lower loan-to-value ratios than a HECM, so they may not always be the best fit for every borrower.

How a Reverse Mortgage Works for Spokane Homeowners

A reverse mortgage is a loan secured by your home that allows homeowners age 62 and older to convert a portion of their equity into tax-free funds — without making monthly mortgage payments. The most common type is the Home Equity Conversion Mortgage (HECM), which is insured by the Federal Housing Administration and regulated by HUD.

The loan becomes due when the last borrower permanently leaves the home — whether through sale, relocation, or passing. Until then, borrowers retain full title and may continue living in the property as long as they meet standard obligations including property taxes, homeowners insurance, and home maintenance.

Common Uses in Spokane

- Eliminating an existing mortgage payment to reduce monthly fixed costs — particularly valuable for retired healthcare workers, educators, and military-connected homeowners managing Spokane County property taxes on fixed incomes

- Establishing a line of credit that grows over time — a strategic reserve for healthcare expenses, home maintenance, or long-term care planning that grows regardless of home value fluctuations

- Accessing equity in higher-value properties through jumbo reverse mortgage programs — available for homeowners with South Hill estates or Spokane River properties exceeding the federal lending limit

- Supplementing retirement income to maintain quality of life in Eastern Washington’s largest city without selling a home in one of the state’s most affordable major metro areas

Spokane Reverse Mortgage Eligibility

| Requirement | Details |

|---|---|

| Age | 62 or older (both spouses if applicable) |

| Property Type | Primary residence — single-family, townhome, FHA-approved condo, or 2–4 unit (owner-occupied) |

| Equity | Sufficient equity in the home (typically 50% or more) |

| Counseling | Must complete a HUD-approved counseling session before application |

| Financial Assessment | Demonstrated ability to maintain property taxes, insurance, and home upkeep |

For a personalized estimate based on your Spokane home value, try our free reverse mortgage calculator — no personal information required.

Understanding the Costs

Reverse mortgages carry upfront and ongoing costs that borrowers should understand before proceeding. These typically include an origination fee, FHA mortgage insurance premium (MIP), third-party closing costs, and interest that accrues over the life of the loan.

Because interest compounds over time, the loan balance grows — meaning more equity is used the longer the loan remains in place. This is an important consideration for homeowners who plan to leave the property to heirs or who may need to sell in the near term. A thorough review of the pros and cons is essential to making an informed decision.

Is a Reverse Mortgage Right for You?

A reverse mortgage is not the right solution for every homeowner. It works best for those who plan to remain in their home long-term, have substantial equity, and want to improve cash flow or eliminate existing mortgage payments during retirement.

It may not be ideal if you plan to move within a few years, want to preserve maximum equity for heirs, or are uncomfortable with a rising loan balance. Understanding how a reverse mortgage works from the outset — including what happens when the last borrower leaves the home and whether refinancing makes sense down the road — helps ensure the decision aligns with your long-term goals.

HUD-approved counseling is a required step in the process, and for good reason: it provides an independent review of your financial situation and ensures you fully understand the terms before committing.

HUD-Approved Direct Lender Serving Spokane

All Reverse Mortgage, Inc. (ARLO™) is a HUD-approved direct lender specializing exclusively in reverse mortgages since 2004 and maintains an A+ rating with the Better Business Bureau. We are proud to be Washington’s #1 Rated Reverse Mortgage Lender.

We are approved to offer both FHA-insured HECM loans and jumbo reverse mortgage programs for higher-value properties. Our leadership team was involved in the introduction of the first fixed-rate jumbo reverse mortgage in 2008, giving us deep experience across both FHA-insured HECM loans and proprietary programs. This experience is relevant across Washington’s diverse markets, including Eastern Washington communities like Spokane where affordability and long-term ownership create strong equity positions.

All Reverse Mortgage, Inc. is fully licensed by the Washington Department of Financial Institutions (License #CL-13999). We invite you to compare our reviews, rates, and closing costs with those of any other lender.

See today’s rates with no obligation — view current rates or call (509) 955-2266 to speak with a licensed specialist.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald