Serving Monroe Homeowners Since 2004

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

Monroe Reverse Mortgage Lenders

At All Reverse Mortgage, Inc. (ARLO™), we are proud to be Washington’s #1 Rated Reverse Mortgage Lender, as recognized by the Better Business Bureau. We have a perfect 5-star rating and an A+ exemplary score. We’ve been serving Monroe homeowners since 2004 and are dedicated to providing reverse mortgages that help you enjoy your retirement years with peace of mind.

We understand that you deserve the best possible rate with the lowest costs. That’s why we focus solely on reverse mortgages, ensuring you receive expert guidance every step of the way. As a HUD-approved direct lender, we offer both national HECM programs and specialized jumbo Reverse Mortgages for homeowners with higher-value properties in Washington State.

We invite you to compare our customer reviews, lower rates, and closing costs with those of any other lender. We’re confident you’ll see the difference, and we look forward to helping you achieve your financial goals.

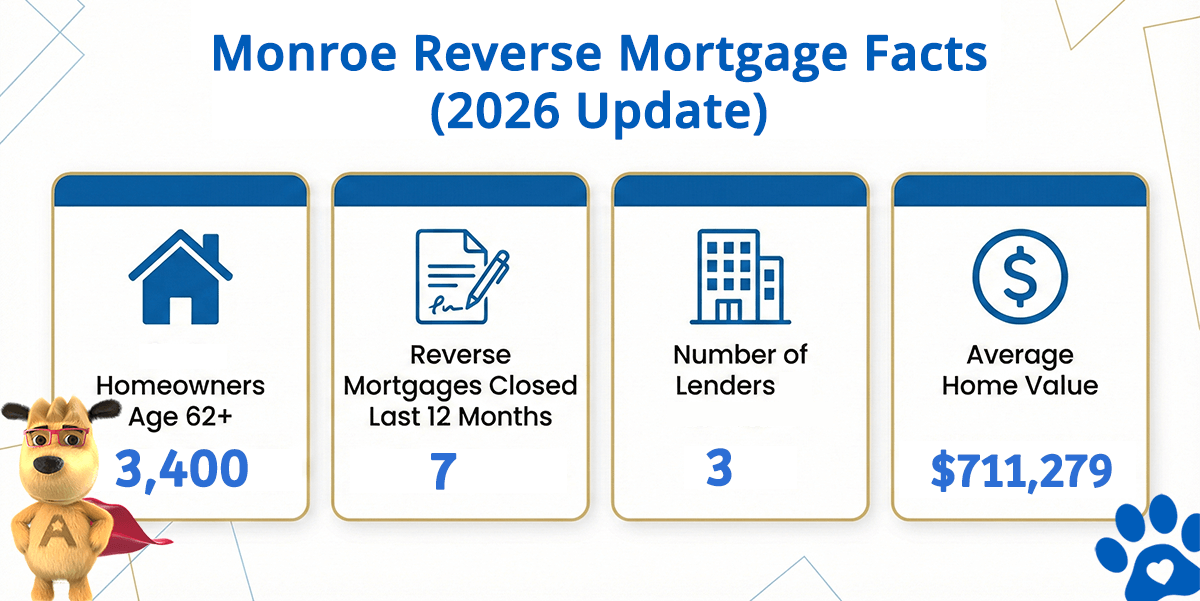

Monroe Reverse Mortgage Facts (2026 Update)

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Monroe (est) | Avg. Home Value |

|---|---|---|---|---|

| Monroe | 3,400 | 7 | 3 | $711,279 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

HUD Approved Direct Lender

All Reverse Mortgage, Inc. (ARLO™) is approved by the Department of Housing and Urban Development (HUD) to originate, underwrite, and close HUD’s Home Equity Conversion Mortgage (HECM, or “Heck-um”). The HECM is HUD’s reverse mortgage loan program.

All Reverse Mortgage of Monroe originates and closes refinance loans for homeowners who are looking to either pay off their existing loan and eliminate monthly mortgage payments, use their equity for other purposes if they have no existing loan, or a combination of both.

About All Reverse Mortgage of Monroe

The team at All Reverse Mortgage, Inc. has extensive experience, including being part of the group that introduced the first fixed-rate jumbo reverse mortgage in 2008. With this background, we are constantly exploring new products for homeowners in high-value markets where the HUD HECM may not be the best fit. Although jumbo or proprietary programs often offer lower Principal Limits relative to property values, they can be the right solution for certain borrowers.

An experienced originator can guide you through the pros and cons of each program, helping you make an informed decision. In various markets, there may be a mix of HUD HECM and niche jumbo opportunities, allowing homeowners aged 62 and above to leverage reverse mortgages as a versatile financial tool. This can be particularly valuable for those seeking to eliminate mortgage payments or establish a growing line of credit, enhancing their retirement plans.

Monroe Details

Located about 30 miles northeast of Seattle, Monroe sits at the confluence of the Skykomish, Snohomish, and Snoqualmie rivers in the Cascade foothills. Originally founded in 1864 as the town of Park Place, it served as a trading post for the indigenous Skykomish people and other settlements in the Tualco Valley. In 1890, the town was renamed to honor President James Monroe and relocated closer to the Great Northern Railway.

Monroe was incorporated in 1902 with a population of over 900 residents and quickly developed into a thriving community. The Pacific Coast Condensed Milk Company opened a milk condensery in Monroe in 1908, becoming the largest producer of Carnation brand condensed milk and significantly boosting the city’s growth. Although the plant burned down in 1928, Monroe successfully transitioned from timber to agriculture, which remains a primary source of revenue, particularly through dairy, vegetable, and berry farming.

Today, Monroe has an estimated workforce population of 7,644 residents and an unemployment rate of 7.2 percent as of 2015. Most residents commute to nearby cities for work, with the largest employer in Monroe being the Washington State Department of Corrections, which operates the Monroe Correctional Complex. Other significant employers include Monroe School District, the Cadman quarry, the Evergreen State Fair, EvergreenHealth Monroe, and the Fryelands industrial park.

Monroe offers 14 parks totaling 207 acres, with 62.6 acres designated as usable space. The city also has 14 miles of multi-use pedestrian and bicycle trails that connect neighborhoods and parks. Monroe hosts the annual Evergreen State Fair, the second-largest fair in Washington state, and is home to attractions like the Evergreen Speedway and The Reptile Zoo.

Monroe’s climate is similar to the rest of the Puget Sound lowlands, characterized by dry summers and mild, rainy winters, moderated by the marine influence from the Pacific Ocean. With 177 days of sun per year, Monroe experiences 48 inches of precipitation and 8 inches of snow annually. The average high temperature is 76.4 degrees, and the average low is 44.9 degrees.

Monroe Lending Limits (2024)

Monroe, Washington, is home to a senior population where 7.8% of residents are 65 and older, with 61% being homeowners. Many of these households could benefit from a reverse mortgage to support their retirement. The median home price in Monroe is $718,465 as of January 2024, marking a 7.1% increase over the past year. Most homes in Monroe are below the federal reverse mortgage lending limit of $1,249,125, but jumbo reverse mortgage options are available for higher-valued properties.

Ready to Unlock Your Home’s Equity?

As Monroe’s #1 Rated Reverse Mortgage Lender, All Reverse Mortgage, Inc. (ARLO™) is here to provide trusted guidance, real-time rates, and expert support to help you make informed decisions.

✔ No obligations. Just real-time rates and expert advice.

✔ Instant quote. No personal info required.

✔ Licensed experts. Get clear, honest answers.

As a fully licensed lender by the Washington State Department of Financial Institutions (License #CL-13999), we’re committed to helping you secure the retirement you deserve.

Get Your Free Quote from Monroen’s #1 Rated Reverse Mortgage Lender! Use our reverse mortgage calculator, or call (360) 558-3550 to speak with a friendly expert today.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald