|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

All Reverse Mortgage, Inc. is a HUD-approved reverse mortgage lender with more than 20 years of experience focused exclusively on reverse mortgages. We publish market research and consumer guides like this one to help homeowners better understand reverse mortgage programs, eligibility requirements, and long-term considerations.

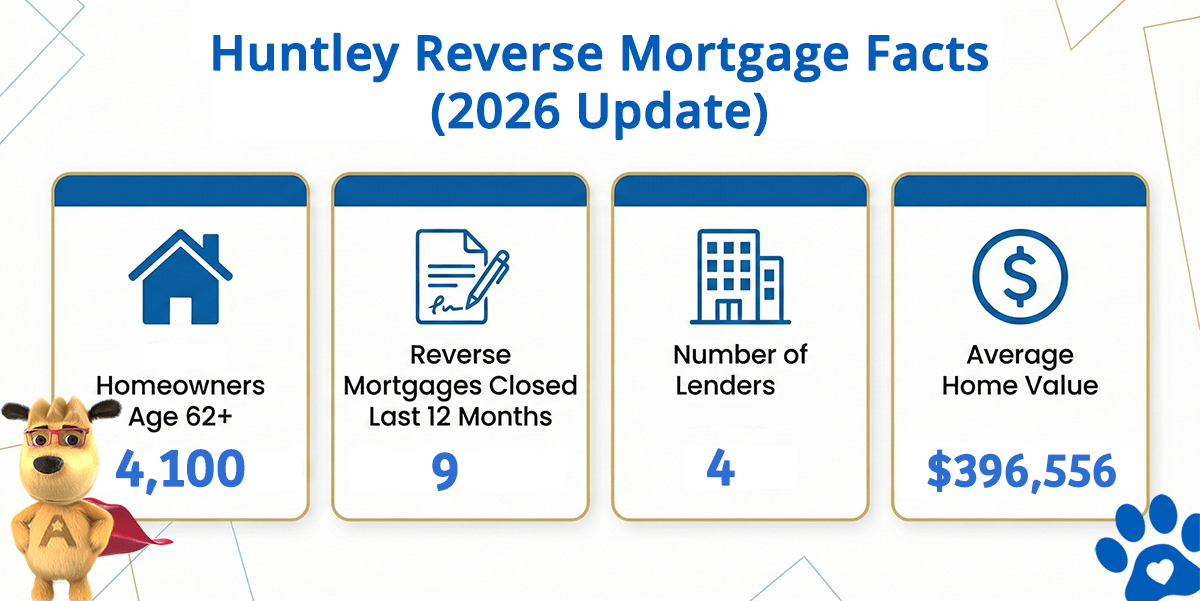

Huntley Reverse Mortgage Facts (2026 Update)

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Huntley (est) | Avg. Home Value |

|---|---|---|---|---|

| Huntley | 4,100 | 9 | 4 | $396,556 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

Understanding the HUD HECM Reverse Mortgage

The Home Equity Conversion Mortgage (HECM) is the most common reverse mortgage program in the United States. It is insured by the Federal Housing Administration and regulated by the U.S. Department of Housing and Urban Development.

Core features include:

-

Available to homeowners age 62 and older

-

No required monthly mortgage payments

-

Borrowers retain ownership of the home

-

Loan repayment occurs when the home is sold, vacated, or the last borrower passes away

-

FHA insurance provides standardized consumer protections

For many homeowners, reverse mortgages are used as part of long-term retirement planning rather than short-term cash solutions.

Huntley Housing Market Context

Huntley is a village located in McHenry and Kane counties, approximately 45 miles northwest of downtown Chicago. Incorporated in 1872, the community has grown to an estimated population of 25,000 residents.

Huntley is known for having a higher-than-average share of homeowners age 62 and older, estimated at roughly 35 percent of the population. This demographic profile makes understanding reverse mortgage rules especially relevant for local homeowners planning to age in place.

How Reverse Mortgages Are Commonly Used

Homeowners in communities like Huntley often explore reverse mortgages to:

-

Pay off an existing mortgage and eliminate monthly payments

-

Improve monthly cash flow during retirement

-

Establish a line of credit for future needs

-

Fund home improvements or long-term care planning

Reverse mortgages involve long-term obligations and are not suitable for every situation. Understanding costs, responsibilities, and alternatives is essential before making any decision.

Federal Lending Limits and Home Values

As of 2026, the federal HECM lending limit is $1,249,125. Most homes in Huntley fall below this limit, meaning they may align with standard HUD reverse mortgage guidelines.

Homes valued above the federal limit may require proprietary or jumbo reverse mortgage programs, which are privately insured and follow different underwriting standards.

Learn More About Reverse Mortgages

If you would like to explore how reverse mortgages work nationally, including estimated loan amounts based on age and home value, you may use our online reverse mortgage calculator. It provides instant estimates without requiring personal information.

For Illinois-specific assistance, HUD also maintains a public directory of licensed lenders and approved housing counselors at 800-CALL-FHA.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald