Serving Downers Grove Homeowners Since 2004

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

All Reverse Mortgage, Inc. is a HUD-approved reverse mortgage lender with more than 20 years of experience focused exclusively on reverse mortgages. We publish research-based guides like this one to help homeowners better understand the structure, eligibility rules, and market considerations surrounding reverse mortgages.

This content is designed to inform, not to sell, and to help you evaluate whether learning more about reverse mortgages makes sense for your situation.

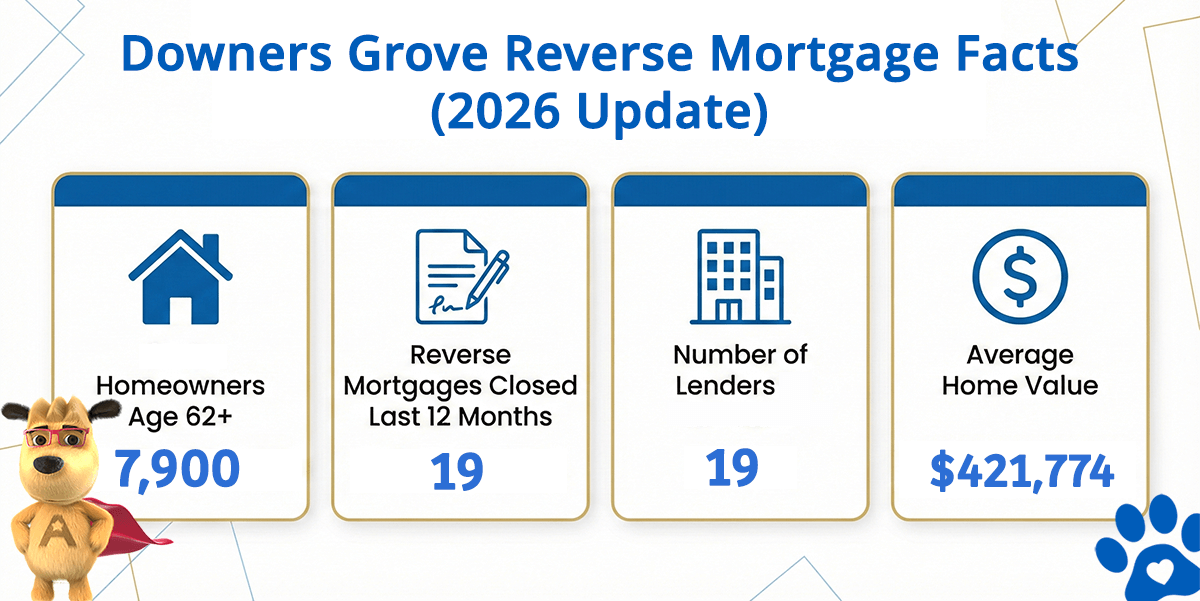

Downers Grove Reverse Mortgage Facts (2026 Update)

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Downers Grove (est) | Avg. Home Value |

|---|---|---|---|---|

| Downers Grove | 7,900 | 19 | 7 | $421,774 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

Understanding the HUD HECM Reverse Mortgage

The most widely used reverse mortgage in the United States is the Home Equity Conversion Mortgage (HECM). It is insured by the Federal Housing Administration and regulated by the U.S. Department of Housing and Urban Development.

Key features include:

-

Available to homeowners age 62 and older

-

No required monthly mortgage payments

-

Borrowers retain ownership of the home

-

The loan is repaid when the home is sold, vacated, or the last borrower passes away

-

FHA insurance provides standardized consumer protections

Reverse mortgages are increasingly used as part of broader retirement planning, rather than as a last-resort option.

Downers Grove Housing Market Context

Downers Grove is a village in DuPage County located roughly 30 miles west of downtown Chicago. It has an estimated population of 49,600 residents, with approximately 20 percent of homeowners age 62 or older.

As of early 2024, the median home value in Downers Grove was approximately $413,200. This places most owner-occupied homes well below the federal HECM lending limit of $1,249,125, meaning many properties may fall within standard HUD reverse mortgage guidelines.

Homes with values above the federal limit may require proprietary or jumbo reverse mortgage programs, which are privately insured and follow different qualification rules.

How Reverse Mortgages Are Commonly Used

Homeowners in communities like Downers Grove often explore reverse mortgages to:

-

Pay off an existing mortgage and eliminate monthly payments

-

Improve monthly cash flow during retirement

-

Establish a standby line of credit for long-term planning

-

Fund home improvements or aging-in-place modifications

Reverse mortgages are not appropriate for every homeowner. Understanding long-term costs, responsibilities, and alternatives is essential before moving forward.

Important Licensing Disclosure

This page is for informational purposes only.

All Reverse Mortgage, Inc. does not currently originate reverse mortgages in Illinois. Nothing on this page should be interpreted as an offer to lend or a solicitation in any state where licensing is not held.

Learn More About Reverse Mortgages

If you would like to explore how reverse mortgages work nationally, including estimated loan amounts based on age and home value, you can use our online reverse mortgage calculator. It provides instant estimates without requiring personal information.

For state-specific guidance, HUD also maintains a public directory of approved housing counselors and licensed lenders at 800-CALL-FHA.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald