|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

Dayton Reverse Mortgage Lenders

This page provides an educational overview of reverse mortgage activity in Dayton, Ohio, including estimated homeowner demographics, recent FHA-insured HECM usage, and local home value trends as of 2026.

All Reverse Mortgage, Inc. is a HUD-approved reverse mortgage lender headquartered in California. We are not licensed to originate reverse mortgages in the state of Ohio. This page is published strictly for informational and educational purposes and should not be interpreted as an offer to lend or a solicitation for business in Ohio.

Reverse mortgage availability, program options, and loan terms vary by state and lender. Homeowners in Dayton should consult a reverse mortgage professional licensed in Ohio for guidance specific to their situation.

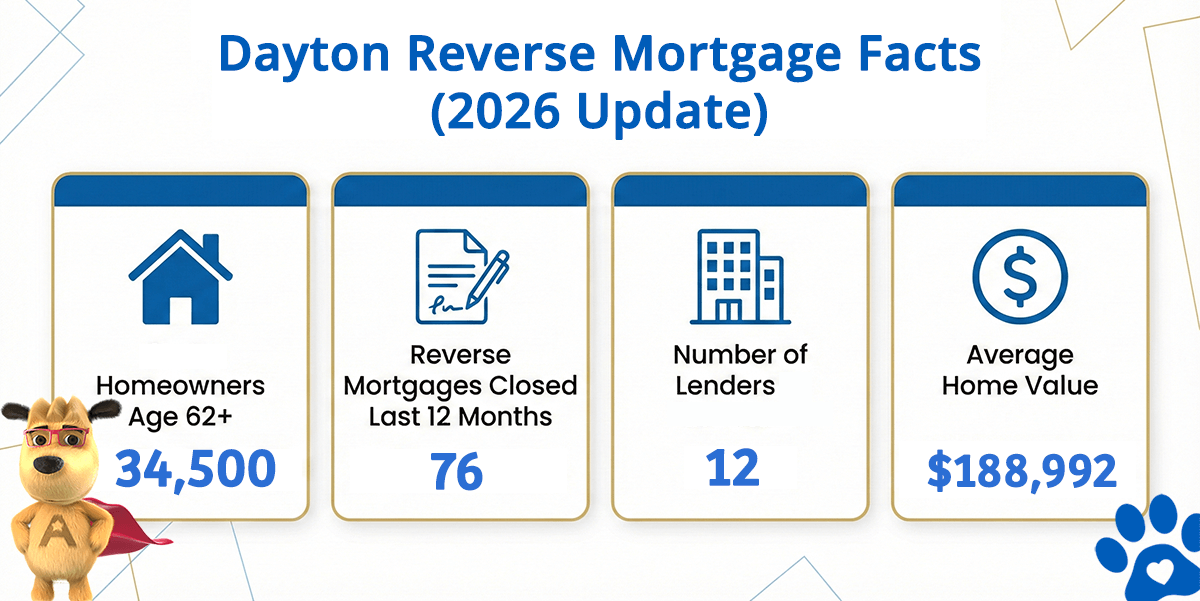

Dayton Reverse Mortgage Facts (2026 Update)

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Dayton (est) | Avg. Home Value |

|---|---|---|---|---|

| Dayton | 34,500 | 76 | 12 | $188,992 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

Understanding Reverse Mortgages in Dayton

The most common reverse mortgage program nationwide is the Home Equity Conversion Mortgage (HECM), which is insured by the Federal Housing Administration (FHA). A HECM allows eligible homeowners age 62 and older to convert a portion of their home equity into loan proceeds without required monthly mortgage payments, provided property taxes, homeowners insurance, and basic maintenance obligations are met.

In recent years, reverse mortgages have increasingly been used as a retirement planning tool rather than a last-resort option. Many homeowners use them to eliminate existing mortgage payments, create a line of credit that grows over time, or improve long-term cash-flow flexibility while remaining in their homes.

Dayton, Ohio Reverse Mortgage Lending Context

Dayton is the sixth-largest city in Ohio, with an estimated population of approximately 140,000 residents. About 15.9 percent of the population consists of homeowners age 62 and older, representing a meaningful segment of residents who may qualify for reverse mortgage programs under federal guidelines.

Founded in 1805, Dayton is the oldest of Ohio’s six largest cities and has long been associated with innovation and engineering. The city is best known as the birthplace of Orville and Wilbur Wright, whose work laid the foundation for modern aviation. Today, Dayton’s cultural and historical significance is reflected in institutions such as the National Museum of the U.S. Air Force and numerous local museums.

Housing Market and Reverse Mortgage Eligibility

As of 2026, the average home value in Dayton is approximately $188,992. Many owner-occupied homes in the area fall well below the national FHA HECM lending limit of $1,249,125, making federally insured reverse mortgages a commonly sufficient option for eligible homeowners.

For higher-valued properties, proprietary or jumbo reverse mortgage programs may also exist through lenders licensed in Ohio. These programs are not FHA-insured and vary by lender in terms of loan structure, pricing, and consumer protections.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald