|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

This page provides an educational overview of reverse mortgage activity in Cleveland, Ohio, including estimated homeowner demographics, recent FHA-insured HECM usage, and local home value context as of 2026.

All Reverse Mortgage, Inc. is a HUD-approved reverse mortgage lender headquartered in California. While we are not licensed to originate reverse mortgages in Ohio, we publish informational guides like this to help homeowners better understand how reverse mortgages work nationally, how FHA-insured HECM loans are used, and how housing values can affect eligibility and loan outcomes.

Nothing on this page is an offer to lend or a solicitation for business in Ohio. Reverse mortgage programs, availability, and terms vary by state and lender. Cleveland homeowners should consult a properly licensed Ohio reverse mortgage professional for advice or loan-specific guidance.

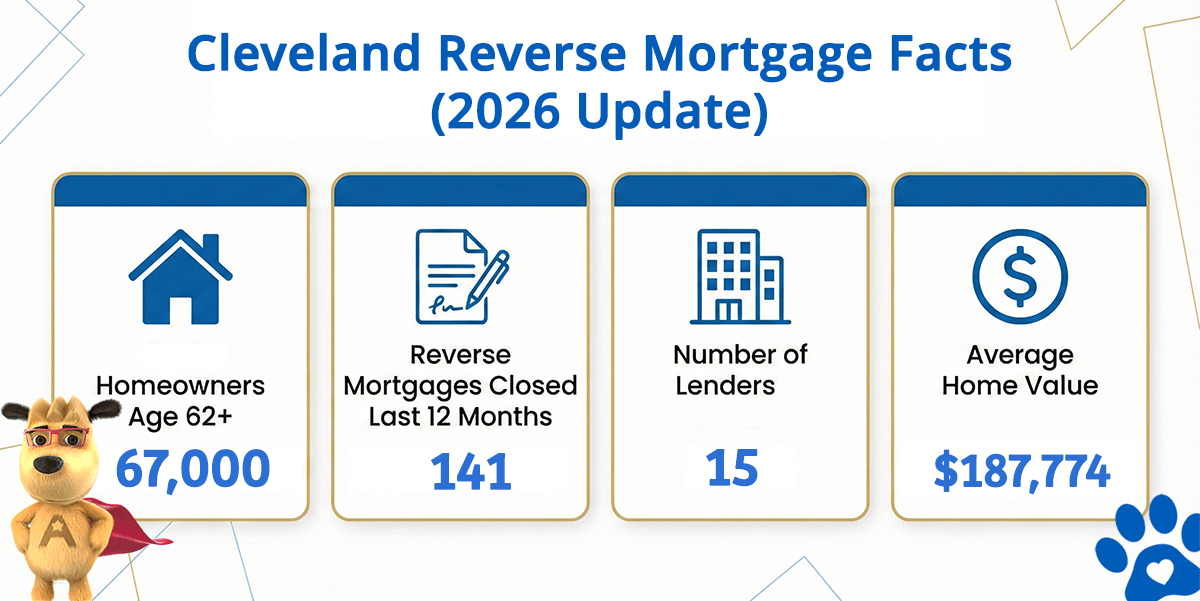

Cleveland Reverse Mortgage Facts (2026 Update)

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Cleveland (est) | Avg. Home Value |

|---|---|---|---|---|

| Cleveland | 67,000 | 141 | 15 | $187,774 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

Understanding Reverse Mortgages in Cleveland

The most common reverse mortgage in the U.S. is the Home Equity Conversion Mortgage (HECM), which is insured by the Federal Housing Administration (FHA). A HECM allows eligible homeowners age 62 and older to convert a portion of their home equity into loan proceeds without required monthly mortgage payments, provided they continue to meet loan obligations such as property taxes, insurance, and home maintenance.

Reverse mortgages are increasingly used as part of broader retirement planning strategies rather than as a last resort. Common uses include eliminating existing mortgage payments, creating a standby line of credit, supplementing retirement income, or improving monthly cash flow.

Cleveland, Ohio Reverse Mortgage Lending Context

Cleveland is the second-largest city in Ohio, with an estimated population of approximately 385,500 residents. About 16.4 percent of the population consists of homeowners age 62 and older, representing a substantial base of residents who may qualify for a reverse mortgage under federal guidelines.

Founded in 1796 and incorporated in 1836, Cleveland serves as the economic and cultural center of Northeast Ohio. The city anchors a metropolitan area of more than 3.4 million people and is known for institutions such as the Cleveland Clinic, the Rock and Roll Hall of Fame, and a strong professional sports presence.

Healthcare, bioscience, and technology play a central role in Cleveland’s economy, contributing to long-term housing stability in many neighborhoods.

Housing Market and Reverse Mortgage Eligibility

As of 2026, the average home value in Cleveland is approximately $187,774, placing many owner-occupied homes well below the national FHA HECM lending limit of $1,249,125.

This pricing structure generally means that Cleveland remains a traditional HECM-focused market, where FHA-insured reverse mortgages are often sufficient for eligible homeowners. In cases where higher-value properties exist, proprietary or jumbo reverse mortgage programs may also be available through lenders licensed to operate in Ohio.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald