|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

All Reverse Mortgage, Inc. is a HUD-approved reverse mortgage lender with more than 20 years of experience focused exclusively on reverse mortgages. We publish research-based guides like this one to help homeowners better understand how reverse mortgages work, what the federal rules allow, and how these loans are commonly used in large housing markets like Carol Stream.

Our goal is simple: clear explanations, accurate data, and no sales pressure.

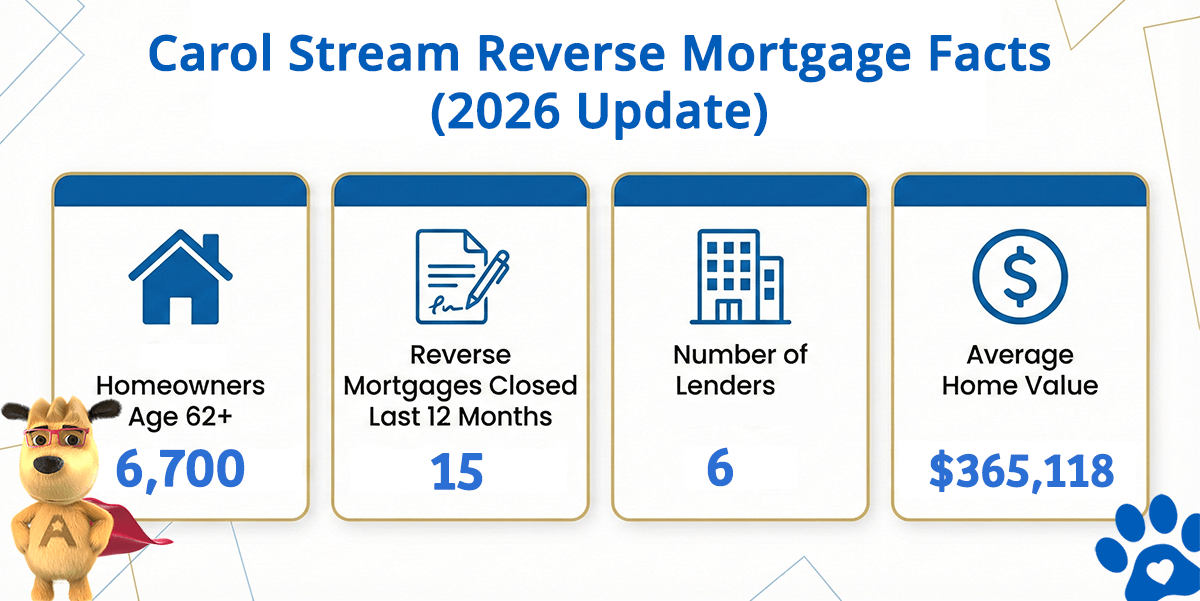

Carol Stream Reverse Mortgage Facts (2026 Update)

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Carol Stream (est) | Avg. Home Value |

|---|---|---|---|---|

| Carol Stream | 6,700 | 15 | 6 | $365,118 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

Understanding the HECM Reverse Mortgage Program

The Home Equity Conversion Mortgage (HECM) is the only reverse mortgage program insured by the federal government. It is designed for homeowners age 62 or older and allows qualified borrowers to convert a portion of their home equity into loan proceeds without required monthly mortgage payments.

While HECM loans are subject to a national lending limit, homeowners with higher-value properties may also encounter proprietary or jumbo reverse mortgage programs that operate outside FHA guidelines. Each option has different structures, protections, and tradeoffs, which is why understanding the basics is essential before speaking with any licensed provider.

Carol Stream Housing and Retirement Context

Carol Stream is a village in DuPage County with a population of roughly 40,000 residents. About 14 percent of the community consists of homeowners age 62 or older. Many residents value the area for its proximity to Chicago, established neighborhoods, and access to parks and forest preserves.

From a housing perspective, Carol Stream remains well below the national HECM lending limit in effect for 2026, though individual home values can vary widely. Understanding how equity, age, interest rates, and loan structure interact is an important step for homeowners considering long-term retirement planning strategies tied to their home.

Using This Information

This page is designed to help homeowners become better informed about reverse mortgages before making any financial decisions. Reverse mortgages are regulated financial products with long-term implications, and education should always come first.

If you would like to explore general eligibility ranges and national lending limits, you can use our reverse mortgage calculator for educational estimates. No personal information is required.

If you reside in Carol Stream, this information can help you prepare for conversations with a properly licensed reverse mortgage professional in your state.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald