|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

All Reverse Mortgage, Inc. is a HUD-approved reverse mortgage lender with more than 20 years of experience focused exclusively on reverse mortgages. We publish research-based guides like this one to help homeowners better understand how reverse mortgages work, what the federal rules allow, and how these loans are commonly used in large housing markets like Barrington.

Our goal is simple: clear explanations, accurate data, and no sales pressure.

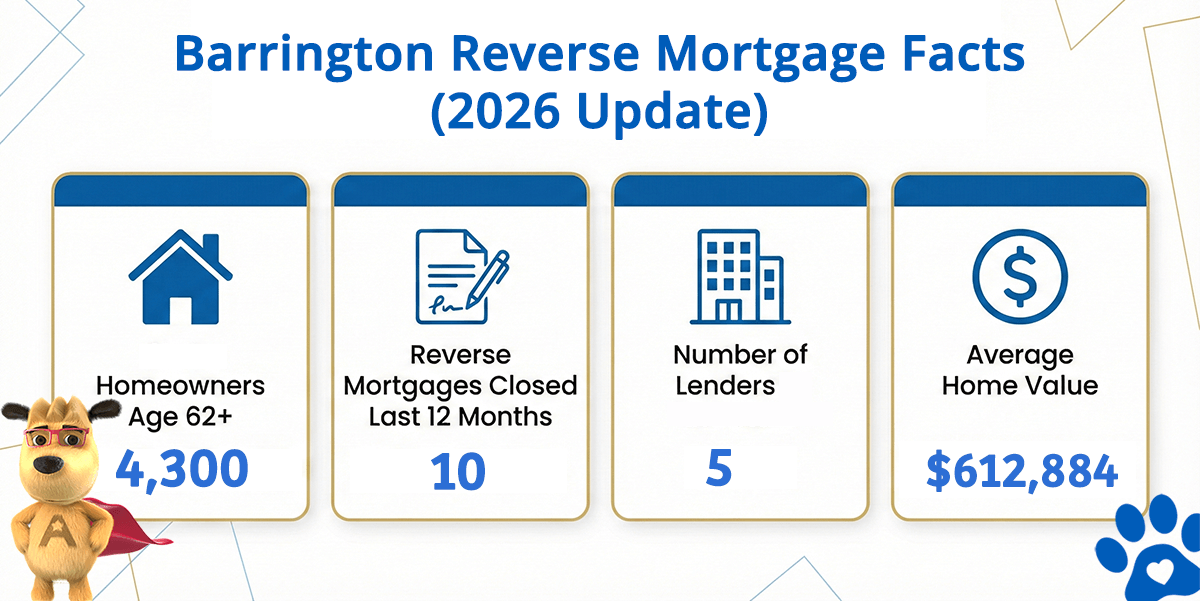

Barrington Reverse Mortgage Facts (2026 Update)

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Barrington (est) | Avg. Home Value |

|---|---|---|---|---|

| Barrington | 4,300 | 10 | 5 | $612,884 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

Understanding Reverse Mortgages

A reverse mortgage is a home loan available to homeowners age 62 and older that allows them to convert a portion of their home equity into loan proceeds. Unlike a traditional mortgage, no monthly mortgage payments are required as long as the borrower continues to live in the home, maintains the property, and keeps taxes and insurance current.

The most common reverse mortgage is the HUD-insured Home Equity Conversion Mortgage (HECM). Because it is federally insured, the HECM program follows standardized rules related to eligibility, loan limits, and borrower protections across all states where it is offered.

Key features of a reverse mortgage generally include:

-

No required monthly mortgage payment

-

The ability to remain in the home for life, as long as loan obligations are met

-

Loan proceeds that can be received as a lump sum, line of credit, monthly payments, or a combination

-

A non-recourse structure, meaning the loan balance can never exceed the home’s value at repayment

Reverse Mortgage Activity in Barrington

Barrington is a well-established community with a meaningful concentration of long-term homeowners. Based on available data:

-

Approximately 4,300 homeowners in Barrington are age 62 or older

-

Reverse mortgage usage remains relatively modest, with about 10 FHA-insured HECM loans closed over the most recent 12-month period

-

Roughly five lenders were active in the local market during that time

This suggests that while reverse mortgages are not widely used in Barrington, they are present as a retirement planning tool for a small portion of eligible homeowners.

Home Values and Federal Lending Limits

The average home value in Barrington is estimated at $612,884.

For context:

-

The 2026 federal HECM lending limit is $1,249,125

-

Most homes in Barrington fall well below this national limit

-

This generally places many properties within the value range eligible for HUD-insured reverse mortgage programs

For higher-value properties that exceed federal limits, proprietary or “jumbo” reverse mortgage programs may exist in the broader market, though availability and terms vary by state and lender.

About Barrington, Illinois

Barrington is a northwest suburban community located approximately 32 miles from downtown Chicago. With a population of around 10,600 residents, Barrington is known for its historic districts, strong school system, and high rate of homeownership.

Approximately 21 percent of Barrington’s population is age 62 or older, reflecting a stable base of long-term residents who may be exploring ways to remain in their homes during retirement.

The local economy includes professional services, healthcare, finance, and small businesses, with many residents commuting to Chicago for additional employment opportunities.

Educational Takeaway

Reverse mortgages are no longer viewed solely as a last resort. For many homeowners nationwide, they are used strategically to:

-

Eliminate an existing mortgage payment

-

Create cash flow flexibility in retirement

-

Establish a standby line of credit

-

Support long-term housing stability

Understanding how these loans work at a national level can help homeowners make more informed decisions, even if they ultimately work with a locally licensed lender.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald