America’s #1 Rated Reverse Lender*

Reverse Mortgage Costs to Rise with Dodd-Frank Financial Reform

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

Everyone affiliated with the Mortgage industry should be aware of the upcoming changes regarding Loan Officer Compensation that are set to take effect on April 1, 2011 and the negative impact they will have on the consumer.

Simply, the law restricts Loan Originators from earning an Origination Fee and YSP (Yield Spread Premium) on a transaction simultaneously. What this does is force the Originator to make a choice between YSP and charging an Origination fee on their loans.

For those who are unaware of the difference, YSP is paid by the Bank or Lender to an Originator directly for a certain product or rate and an Origination fee is paid by the Borrower directly through their loan.

Many people out there will ask; “Why is this an issue?” This is a major issue for the consumer because as of April 1st, the cost of borrowing money will be going up, especially on Reverse Mortgage loans. The last time members of Congress wrote a new law implementing changes to the Mortgage Industry we received the Appraiser Independence rules.

Ask anyone still working in the Mortgage Industry how that has affected consumers. Costs on appraisals went up significantly and the overall quality of the work decreased. I will outline in this article exactly why this is bad for the consumer as well as provide a specific example of how this could lead to an originator steering a client to a riskier product for the Lender and HUD while showing how the cost of borrowing money will be increasing.

Reverse Mortgages are already known as “Expensive” loans because you have to factor in a 2% financed charge for Mortgage Insurance that each Reverse Mortgage Borrower must pay in addition to standard closing costs (ex. Title, Appraisal, Origination etc). This is one of the reasons why the Introduction of the HECM Saver was such an exciting thing.

This product would significantly lower the amount of financed costs that a Reverse Mortgage borrower would have to pay because the Mortgage Insurance Premium was only 0.01% while simultaneously lowering the risk factor to HUD by also lowering their exposure on the loan.

With Reverse Mortgages, the amount that a consumer can borrower is determined by 3 separate factors. Two of these factors are the value of their home and the age of the youngest applicant. However, the third factor is the interest rate being offered on the product.

The higher the interest rate, the lower the available proceeds to a consumer (Principal Limit Factor). Now, factor in a new Originator compensation rule that restricts how an originator can earn a living that is offering Reverse Mortgages and forces them to choose between charging an Origination Fee and receiving YSP.

For example, if a loan currently being done today had a $2,000 YSP from the Lender to the Originator, the originator can lower the origination fee that they would charge that borrower under the new rule by $2,000. By being able to charge an Origination Fee and receive YSP, an Originator can keep a borrower’s closing costs lower.

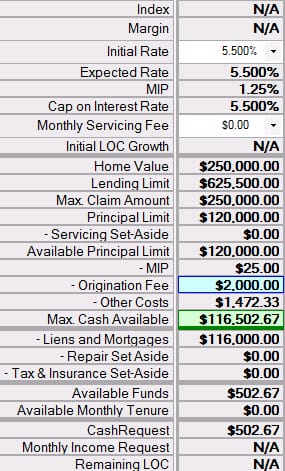

This brings us to the example I alluded to earlier. Jane Doe has a $250,000 home with an existing lien on the property of $116,000. This particular consumer is not interested in receiving additional cash proceeds at the closing of the loan, but solely interested in eliminating her current mortgage and monthly payment, obtaining a Fixed Rate loan and preserving as much equity in her home as possible.

As it stands today, this borrower is a perfect candidate for the HECM Saver Fixed Rate product that we have available to us. The originator could charge her a $2,000 origination fee (at this property value the maximum permitted is $4,500.00) and get a YSP from the Lender for the product offered which in this case is $2,000.

This would allow the originator to earn a “reasonable” living on this loan to cover expenses and marketing costs, etc and simultaneously lower Ms. Doe’s financed closing costs by $2,500.

This homeowner would have a total of only $3,497.33 in total financed closing costs to obtain this loan and would get her mortgage paid off and keep her new mortgage balance as low as possible because the available proceeds on the HECM Saver for her is exactly $120,000.

Under the new Loan Officer Compensation model, the Originator would not have the option of receiving the $2,000 YSP from the Lender, so they would not be able to quote the loan as previously described.

Before Dodd-Frank Compensation Rules

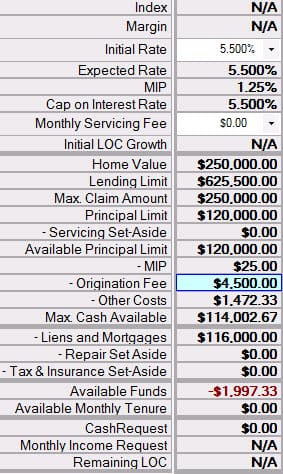

Since an Originator/Company cannot earn a living and cover expenses making only $2,000 on a per loan basis, they would have to look at restructuring their quote to Ms. Doe. Now, the originator would have to look at charging a maximum origination fee to Ms. Doe because they could not receive the YSP from the Lender in addition to the Origination fee (Cost of borrowing for Ms. Doe just went up as I previously stated they would).

In addition to the costs going up, Ms. Doe no longer qualifies for the Saver product unless she wanted to bring in $2,000 cash at closing because now her financed fees would be $5,497.33 in addition to her $116,000 payoff exceeding the maximum provided by the Saver product of $120,000.

With this being the case, the originator would then be forced to offer her the HECM Standard Product which will further increase her financed closing costs as well has increase HUD’s exposure on Ms. Doe’s property.

Since the Mortgage Insurance Premium would now be $5,000 Ms. Doe would be looking at over $6,400 in financed costs before factoring in whether or not the originator would have to charge an origination fee in order to earn a living.

After Dodd-Frank (Same client short to close & Higher Costs)

With Reverse Mortgages, the secondary market and the procedure for locking loans also makes it incredibly difficult. Reverse Mortgage loans on average for a company like ours take approximately 30 days to get through the entire process.

Meanwhile, our Lender’s for the most part, do not allow a Reverse Mortgage loan to be locked in until it is ready to close because the available lock-in periods on a Reverse Mortgage loan are significantly shorter (on average between 2 to 15 days maximum) than a traditional or “Forward” mortgage. This prohibits an originator to lock in a loan in the beginning of the process in order to secure the quote they are providing their customer.

With the volatility in the secondary market for mortgage backed securities, and the locking procedures on these loans, it will be very unlikely for Reverse Mortgage Originators to choose YSP as their form of compensation.

Again, this will increase the cost to the consumer looking to obtain a Reverse Mortgage. With “Forward” mortgages, the new Compensation rule is not as big of a hindrance because of longer lock-in periods that are offered (up to 60 day locks) and less existing restrictions on maximum Origination fees.

The example that I provided in this article is from a real life scenario that an originator in my office is looking into for this homeowner right now and trying to get her the best possible scenario while still earning a living for our company.

However, the new Compensation rule doesn’t just affect this particular borrower I referenced, but every consumer out there that will be looking into obtaining a Reverse Mortgage. By having the option to earn YSP from the Lender and Charge origination fees simultaneously, it allows an Originator more flexibility to get a Homeowner the best possible loan. Ms. Doe is just one example of that.

The proposed legislation has garnered the attention of many including two industry organizations. Both NAIHP (National Association of Independent Housing Professionals) and NAMB (National Association of Mortgage Brokers) have filed legal suit against the Federal Reserve regarding Loan Officer Compensation to halt this law from going into effect on April 1, 2011.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

Have a Question About Reverse Mortgages?

Over 2000 of your questions answered by ARLO™

Ask your question now!