|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

Get Started in 3 Simple Steps

- Enter Your ZIP Code

We use this to estimate regional closing costs and FHA lending limits. - Confirm Your Home’s Value

ARLO™ uses real estate data to estimate your value—adjust it if needed. - Enter Your Mortgage Balance & Age

Your quote will show how much you can borrow after any existing loans are paid off.

➡️ Once complete, you’ll see your personalized loan options in real time.

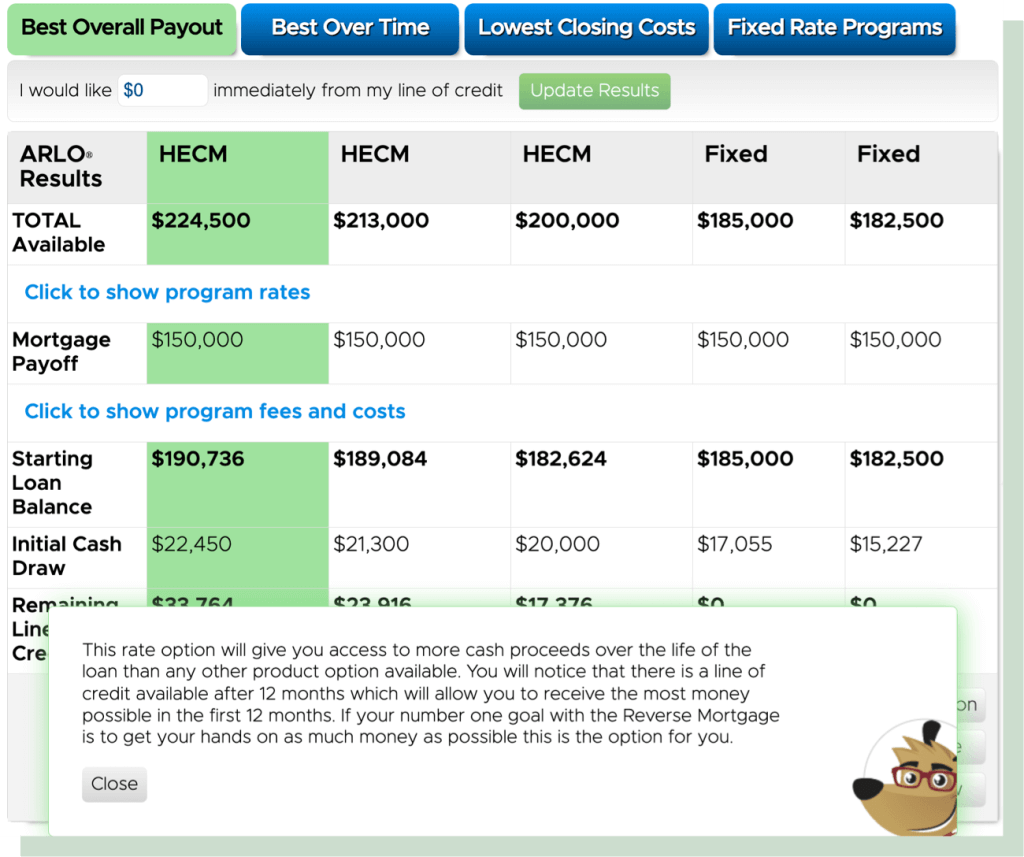

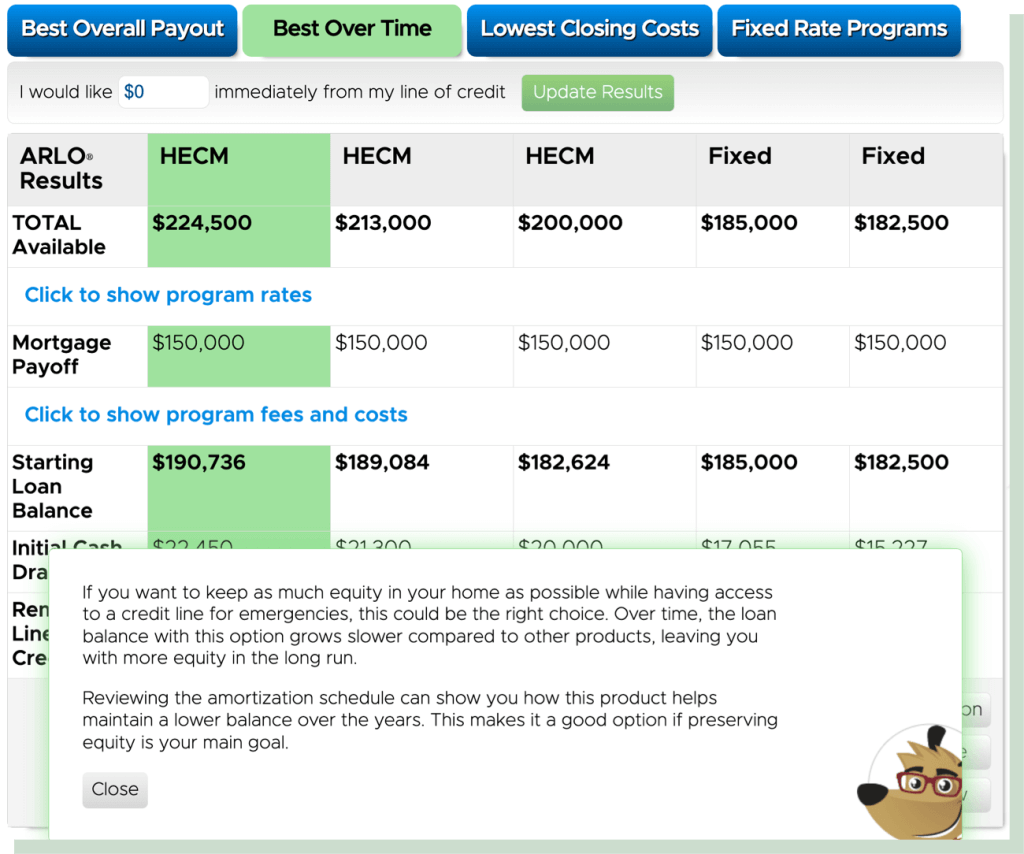

Best Over Time: “If you want to keep as much equity in your home as possible while having access to a credit line for emergencies, this could be the right choice. Over time, the loan balance with this option grows slower than other products, leaving you with more equity in the long run. Reviewing the amortization schedule can show how this product helps maintain a lower balance over the years. This makes it a good option if preserving equity is your main goal.”

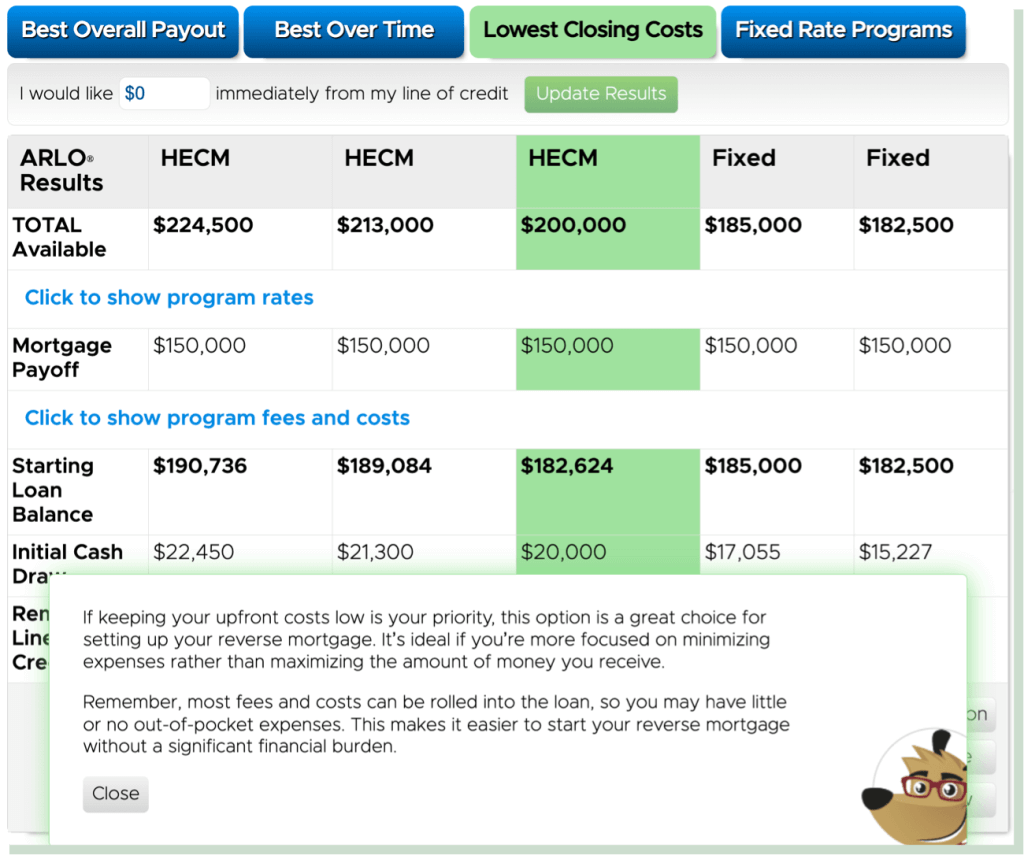

Lowest Closing Costs: “If keeping your upfront costs low is your priority, this option is great for setting up your reverse mortgage. It’s ideal if you’re more focused on minimizing expenses than maximizing the money you receive. Remember, most fees and costs can be rolled into the loan so that you may have little or no out-of-pocket expenses. This makes it easier to start your reverse mortgage without a significant financial burden.”

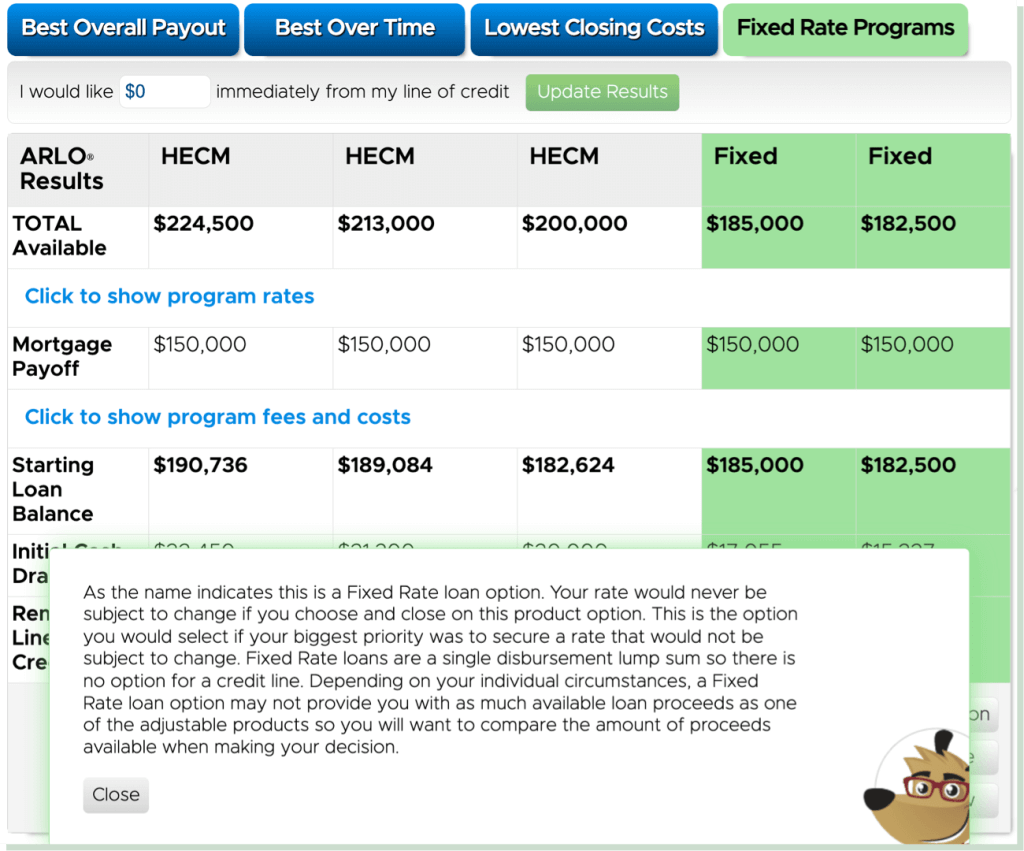

Fixed Rate Loan Options: “As the name indicates, this is a fixed-rate loan option. Your rate would never be subject to change if you choose and close on this product option. If your biggest priority were to secure a rate that would not be subject to change, you would select this option. Fixed-rate loans are a single disbursement lump sum, so there is no option for a credit line. Depending on your circumstances, a Fixed Rate loan option may not provide you with as much available loan proceeds as one of the adjustable products, so you will want to compare the amount of proceeds available when making your decision.

What Borrowers Say

Searching for the best reverse mortgage calculator to understand the numbers, I discovered All Reverse Mortgage and noticed their rates were lower than the major lenders. Their prompt response and quick follow-up demonstrated their commitment to excellent customer service. -Peter H. (BBB)

Pros and Cons of a Reverse Mortgage

✅ Benefits

- No monthly mortgage payments required

- Access tax-free cash for any purpose

- FHA-insured loans mean you’ll never owe more than your home’s value

- Multiple options: lump sum, line of credit, or monthly advances

⚠️ Considerations

- Interest adds up over time, reducing equity

- You’re still responsible for taxes, insurance, and maintenance

- Closing costs may be higher than traditional loans

➡️ See full breakdown of reverse mortgage pros and cons

Reverse Mortgage vs. Other Equity Options

| Feature | Reverse Mortgage | HELOC |

|---|---|---|

| Monthly Payments | ✅ None required | ❌ Required |

| Credit Requirements | ✅ Flexible | ❌ Stricter |

| Income Verification | ✅ Flexible | ❌ Stricter |

| Term | ✅ Lifetime | ❌ 10 Years |

ARLO™ vs. Other Reverse Mortgage Calculators: What Makes Ours Better in 2025

| Feature | All Reverse Mortgage (ARLO™) | Other Calculators |

|---|---|---|

| Daily Rate & APR Updates | ✅ Yes | ❌ No |

| Closing Cost Estimates | ✅ Includes all local appraisal and title fees | ❌ Rarely itemized or location-specific |

| Amortization Schedules | ✅ Full loan balance projections | ❌ Usually not included |

| AI-Powered Loan Insights | ✅ Custom to You | ❌ Generic |

| HECM & Jumbo Program Results | ✅ Shows all qualifying loan types | ❌ May only show HECM or limited options |

Frequently Asked Questions

How much can I get from a reverse mortgage?

Your loan amount depends on your age, your home’s appraised value, current interest rates, and any existing mortgage balance. Our calculator uses HUD’s official formulas to instantly show how much you may qualify for.

Is there a reverse mortgage calculator that doesn’t ask for personal info?

Yes. Our light version calculator requires no personal information—no email, no phone number. Just enter your ZIP code, home value, and age to receive a fully customized quote.

Why do interest rates affect reverse mortgage proceeds?

Lower interest rates allow you to access more equity, while higher rates reduce your borrowing potential. That’s why our calculator updates daily—to ensure the most accurate estimate based on today’s market.

How does the HECM line of credit grow?

The unused portion of your line of credit grows at your loan’s interest rate plus 0.5%. This unique feature can increase your available funds over time, especially if you delay accessing the credit.

How accurate are reverse mortgage calculators?

Accuracy depends on whether the tool uses real-time data. Our calculator updates daily using 2025’s latest HECM lending limits, current interest rates, and regional closing costs to provide the most accurate reverse mortgage estimate online.

What makes All Reverse Mortgage’s calculator different?

It’s powered by ARLO™, our proprietary loan optimizer. Unlike generic tools, ARLO™ compares HECM, jumbo, and proprietary programs, factoring in local fees and borrower age to provide side-by-side results in seconds.

Want to know how much you qualify for? Use the reverse mortgage calculator now or call us at (800) 565-1722. We’re America’s #1 rated reverse mortgage lender with over 20 years of experience and a 4.99/5-star customer satisfaction rating.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald