FREE REVERSE MORTGAGE CALCULATOR

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

Many homeowners begin exploring a reverse mortgage with the same question:

How much can I get from a reverse mortgage?

The challenge is that most online calculators won’t give you an answer unless you provide your phone number or email address. That creates hesitation for many people who want to learn without being contacted.

This guide reviews three calculators that let you see your estimated loan amount without providing any personal information. These tools are straightforward, private, and useful for anyone who wants to understand their options before talking with a lender.

What is a reverse mortgage calculator?

A reverse mortgage calculator is a free tool that estimates how much of your home equity you may be able to access through a reverse mortgage. It uses your age, home value, zip code, and current interest rates to project loan amounts for available programs, including the HUD-insured HECM and, when eligible, proprietary or jumbo options. The calculator shows estimated cash available, credit line growth, and how your loan balance and remaining equity may change over time through amortization, giving you a clear starting point as you evaluate whether a reverse mortgage may fit your needs.f

How does a reverse mortgage calculator work?

It applies the HUD formulas that determine Principal Limits, using your home’s value, the age of the youngest borrower, and current interest rate assumptions.

Do these calculators require personal information?

Not the ones reviewed here. These tools let you see estimates without providing a phone number or email address.

What types of results can you expect?

You’ll generally see estimated loan amounts and available program options, including whether a HECM or jumbo program may apply.

Understanding Reverse Mortgage Calculators

A reverse mortgage calculator gives you an early look at whether a reverse mortgage might meet your needs. Once you enter your home value, age, and location, the tool applies the same core factors used in the industry to estimate what you might qualify for.

Most calculators focus on the Home Equity Conversion Mortgage (HECM), but some also include proprietary or jumbo options for higher-value homes. Depending on the program, you may see estimates for lump-sum funds, monthly payments, or a line of credit.

These tools won’t replace a full financial review, but they let you learn privately at your own pace and decide whether a reverse mortgage is worth exploring.

Caution with Online Calculators

Not all calculators are created with the borrower in mind. Many require personal information before showing results, and some are operated by third-party lead companies that share your information with multiple lenders. This can lead to persistent phone calls or unwanted email follow-up.

Others provide only broad estimates that don’t reflect current rates or closing costs.

For a useful and private experience, look for calculators that:

- Don’t require a phone number or email

- Use current interest rates

- Provide accurate HUD formulas and lending limits

- Provide enough detail to understand the options available

The three calculators reviewed below meet those criteria.

Review of Top 3 Reverse Mortgage Calculators

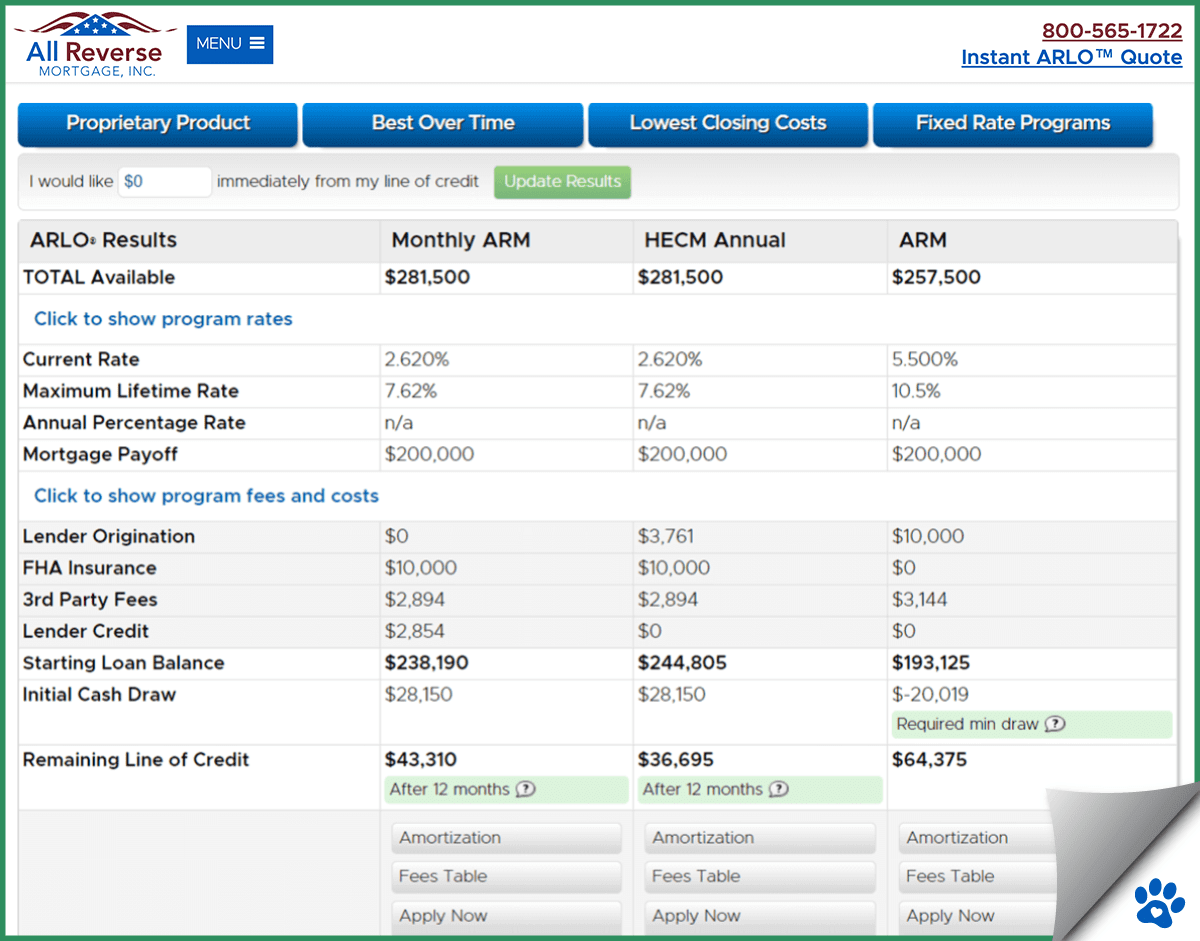

1. All Reverse’s Free Reverse Mortgage Calculator (No Info Required)

The All Reverse Free Reverse Mortgage Calculator is designed with privacy and convenience in mind. This tool allows you to quickly explore your eligibility and loan options without sharing personal contact information, ensuring a stress-free experience.

To use this calculator, enter:

- Your zip code

- Your existing mortgage balance (if any)

- Your home value

- Your date of birth

The calculator offers valuable insights into Home Equity Conversion Mortgages (HECMs) and jumbo/proprietary programs, making it particularly useful for homeowners with higher-value properties. It also offers detailed information about:

- Origination costs based on loan type and rate

- Amortization schedules for up to 20 years

This level of detail empowers you to compare loan options and select the one that aligns with your long-term financial goals.

With no requirement for personal contact information, you can use the All Reverse calculator confidently, knowing you won’t be subject to unwanted sales calls. All Reverse prioritizes a respectful, pressure-free experience, helping you make informed decisions at your own pace.

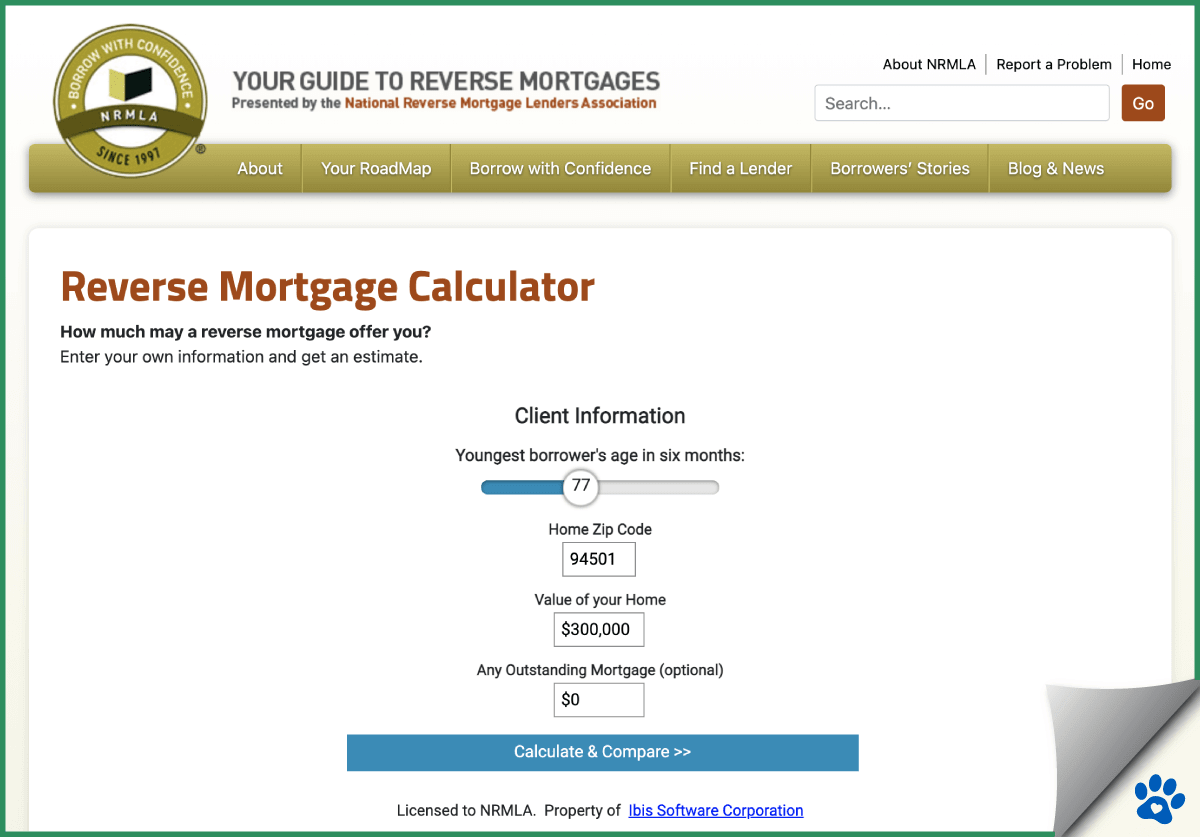

2. NRMLA Reverse Mortgage Calculator

The NRMLA Reverse Mortgage Calculator is a user-friendly tool provided by the National Reverse Mortgage Lenders Association, a respected ethics advocacy group for lenders. This calculator serves as a reliable starting point for exploring your reverse mortgage options.

To use this calculator:

- Enter your zip code.

- Adjust the slider to the age of the youngest borrower.

- Input your home’s estimated value.

The calculator will then display an approximate amount you might receive through various loan types, including:

- Annual Adjustable Loan

- Monthly Adjustable Loan

- Fixed-Rate Loan

While the NRMLA Calculator is excellent for initial estimates, it’s important to note that it does not include specific lender rates and fees, which can vary widely. As a result, the amounts shown may differ from what you might qualify for. For a detailed and accurate financial assessment, we recommend speaking directly with a lender.

3. Retirement Researcher’s Independent Calculator

The Retirement Researcher’s Independent Calculator is an advanced tool designed for users who already have a strong understanding of reverse mortgages and wish to delve deeper into the details.

To use this calculator, you’ll need to input:

- Loan terms

- Your age

- Property details

The calculator focuses on HUD factors determining the potential loan amounts available under the Home Equity Conversion Mortgage (HECM) program. It provides valuable insights into how these factors work, but does not include costs, interest rates, or lender-specific details.

This tool also allows you to add parameters, such as:

- Funds reserved for repairs

- Reserves required for income or credit conditions

However, it doesn’t indicate whether these reserves are necessary or estimate their amounts. This calculator is most helpful for understanding the HUD framework and how reverse mortgage loan amounts are calculated.

While it offers a comprehensive view of loan potential, it’s less practical for direct comparisons or cost analysis. For those exploring loan options, it’s best paired with a more user-friendly calculator that includes specific costs and interest rates.

All three tools offer value, but the All Reverse calculator provides the most complete and accurate estimate for borrowers who want detailed numbers without giving out personal information.

Here’s how they compare:

Comparing the Best Reverse Mortgage Calculators

| Calculator | Strengths | Limitations |

|---|---|---|

| All Reverse Mortgage (ARLO™) | Real-time rates, closing costs, amortization, HECM + Jumbo options | Requires address to estimate property value |

| NRMLA Calculator | Simple interface, backed by industry ethics group | No lender rates or closing cost details |

| Retirement Researcher | In-depth look at HUD calculation mechanics | No cost or rate information |

While all the calculators reviewed offer valuable insights, All Reverse Mortgage’s calculator, ARLO (All Reverse Loan Optimizer), stands out as the top choice for those exploring reverse mortgage options.

Here’s why ARLO excels:

Real-Time Accuracy

All Reverse Mortgage’s calculator provides real-time calculations with accurate costs tailored to your location anywhere in the U.S. You can adjust the details to ensure the proposal aligns with your specific needs, including current rates and fees from All Reverse Mortgage, Inc.

Privacy and Respect

Unlike many calculators, ARLO doesn’t require your social security number to generate results. If you prefer not to be contacted after using the tool, let us know, and we will respect your privacy. You’ll never face unwanted follow-ups just for using our site—but we’re always available if you need assistance.

Comprehensive Loan Options

All Reverse Mortgage’s calculator covers both government-insured HUD Home Equity Conversion Mortgages (HECM) and jumbo/private programs for higher-value homes. This versatility ensures you’ll have a complete picture of your reverse mortgage options.

Transparent Proposals

ARLO provides a written proposal with a detailed cost breakdown, including often-overlooked costs such as HUD and title fees. Unlike some competitors, we provide full transparency, empowering you to make well-informed comparisons between lenders.

Encouraging Comparison

We encourage you to shop around and compare lenders. ARLO’s transparency and accuracy set it apart, highlighting differences that other calculators might obscure. When it comes to reverse mortgage planning, an informed decision is a confident decision.

Frequently Asked Questions

How does a free reverse mortgage calculator work?

A free reverse mortgage calculator helps determine how much you might receive from a reverse mortgage. It uses information like the age of the youngest borrower or spouse, your home’s estimated value, any existing debts against your home, and your home’s zip code. The calculator then uses the current interest rates to arrive at the “Principal Limit,” which is the maximum loan amount you might qualify for based on your details. The interest rate plays a crucial role in determining this amount. A lower rate means you can potentially borrow more money. For a more detailed explanation, check out my article on Forbes.com.

Is there a reverse mortgage calculator for jumbo loans?

Why do reverse mortgage calculators ask for personal information?

How is interest calculated on a reverse mortgage?

What is the current interest rate for a reverse mortgage?

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

Have a Question About Reverse Mortgages?

Over 2000 of your questions answered by ARLO™

Ask your question now!