America’s #1 Rated Reverse Lender*

|

ARLO™REVERSE MORTGAGE

ASSISTANT |

What to Expect When Your Reverse Mortgage is Assigned to HUD

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

We received a notice that our reverse mortgage loan is being assigned to HUD, along with the name of the handling company. This company has numerous complaints, especially about foreclosing before heirs can settle the home. I am the beneficiary of my mom’s house, which is in a trust and a will to avoid probate. What recourse do I have if they refuse to work with me and foreclose despite my efforts? The complaints mention lies, runarounds, no payoff amounts, and unreturned calls. This is terrifying, as there’s enough equity to sell the house and pay off the loan. I don’t want to hire an attorney if I’m following all requirements and they still refuse to cooperate. Who can I complain to, and why is this company still in business? My mother, who has the reverse mortgage, is still alive but may not have much longer. Why do they make settling the loan so difficult? -Thank you, Laura K.

Why Lenders Assign Reverse Mortgages to HUD

Let’s start with some background.

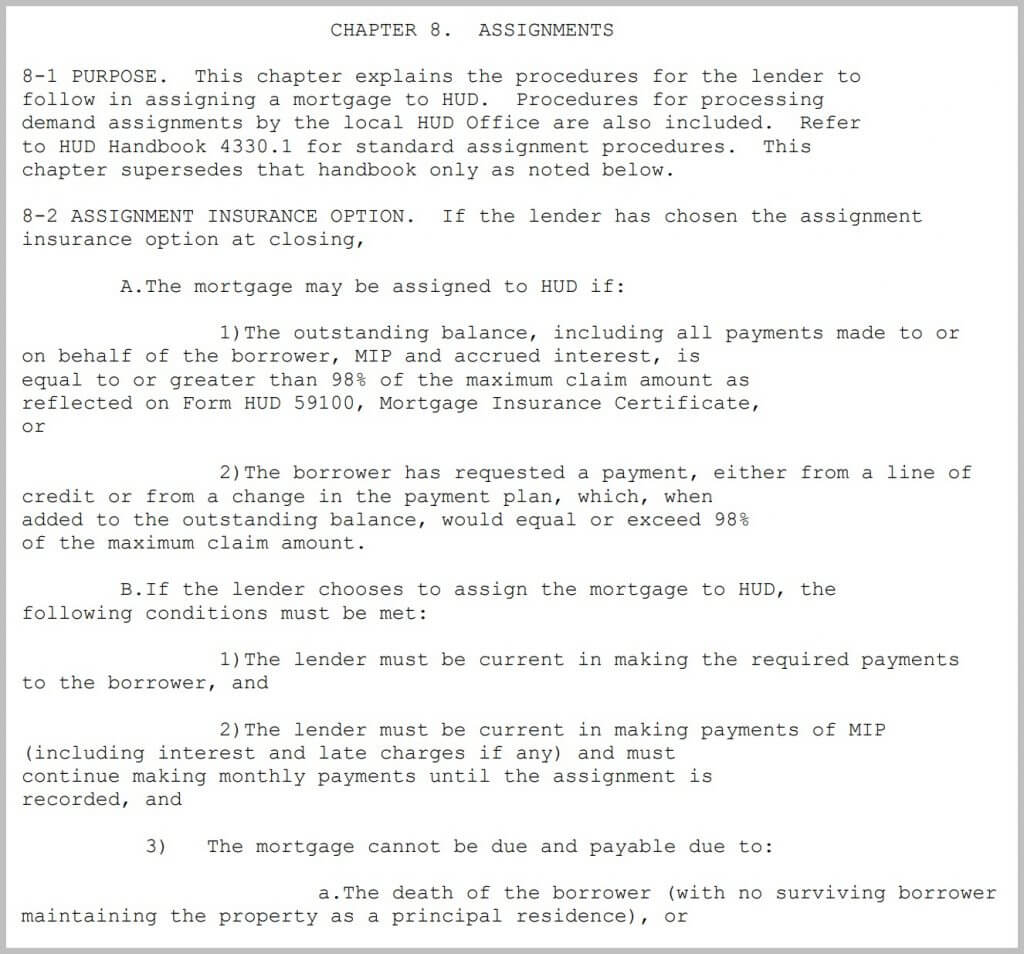

Reverse mortgages are typically assigned to HUD when the loan amount is very high compared to the original value or maximum claim amount. The HUD manual mentions other reasons for assignment, but this is the most common one.

Many homes that reach this point have little to no equity left because borrowers have used all the funds available to them, and the interest has accrued on the loan. This is the purpose of a reverse mortgage: it allows borrowers to live in the property without making payments.

If borrowers can afford to make monthly payments to keep equity in the property, they can do so with a reverse mortgage. However, most borrowers choose a reverse mortgage to live in their home without making payments.

Once the borrowers no longer live in the home, HUD’s servicer will move quickly toward foreclosure to minimize losses if it believes the heirs are not actively working to pay off the loan.

Timing of Reverse Mortgage Assignments to HUD

Most reverse mortgages are assigned to HUD when there is little equity left in the property. The longer they wait, the more losses they will incur. Ideally, HUD prefers that heirs pay off the loans, but this is not common when there is little equity.

HUD will contact an appraiser to assess the property’s value. If there is no equity and no one has transferred the title from the deceased borrowers, it is clear that no one is making an effort to repay the loan promptly.

Reverse mortgage lenders and servicers have been sued for releasing information to unauthorized individuals. They can only release information if they have written consent from the borrower, a court order, or a trust with a certified successor trustee.

If someone contacts them without proper authorization, they cannot release any information. This is not the lender or HUD being difficult; it is the law and a result of previous lawsuits.

To avoid issues, make sure everything is in order ahead of time. I have overseen a few reverse mortgage payoffs (including settling my own mother’s loan), and they went smoothly. Here’s what you need to do…

Setting Up Authority with the Servicer

Ensure you have the authority to speak with the lender on behalf of the loan. This can be done now by having your parents sign an authorization form, allowing the lender or servicer to communicate with the heirs they designate. With this authorization in place, the lender can discuss all loan-related matters with the designated heirs.

This applies to all heirs and must be done in advance. It’s too late to have Mom and Dad sign an authorization after they pass away or become incapacitated.

Ensuring the Trust is in Order

If your mom has a family trust, speak to your estate attorney now and devise a plan to complete the certification of the trust as soon as possible after your mom passes. If your mom is incapacitated, the trust may contain language allowing you to be moved from successor trustee to trustee immediately so you do not have to wait.

Either way, when your mom passes, you will already be the new trustee, with the power to sell the property or take out a new loan without delay.

Neither HUD nor the servicer wants to foreclose. However, they cannot speak to anyone who is not authorized to communicate on behalf of the borrower or show proof of being the new owner. This process typically takes time, especially if you must go through probate or if heirs fail to take immediate steps to change the title after the borrower’s passing.

Often, heirs start contacting the lender without proper authorization, leading to frustration and negative comments you may have read. If you have taken the necessary steps to change the title and have the trust certification showing you are now the trustee, the servicer can and will work with you to sell the home.

If you are not recognized as authorized to communicate and act on the borrowers’ behalf, and the title is still in the borrowers’ names (the estate) with no moves being made to change that, the foreclosure action will eventually begin in accordance with the loan terms, especially if there is no equity left in the property to minimize losses.

I recommend taking the steps outlined above: obtain a signed authorization from your mom if she is capable, or position yourself as the trustee of the trust if you are the successor trustee. This will make dealing with the reverse mortgage much easier.

Consulting with an Attorney

As always, I strongly recommend that you speak to your estate attorney who handled the will and trust and get legal advice on any tax or other estate implications before taking any action.

If you ensure that your title and authorizations are in order in advance, you will likely find the process much easier than you have been led to believe.

ARLO recommends these helpful resources:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

November 13th, 2025

November 14th, 2025

August 29th, 2025

August 29th, 2025

August 28th, 2025

August 29th, 2025

July 21st, 2025

July 21st, 2025

May 2nd, 2025

May 5th, 2025

The current loan balanceAccrued interestAny amounts advanced by the lender on your behalfFees for preparing and recording the final loan documents

Once you receive the payoff demand, the full amount must usually be sent by wire. These payoff figures are typically valid for about 14 days, after which an updated payoff amount would be required if the loan isn't yet paid.Since you plan to transfer the property to your daughter at the same time, it would be wise to involve a title company or real estate attorney to handle the transaction. They can:Request the lender's payoff statement for youEnsure proper recording of the deedProvide title insurance for your daughter (which protects her interests, especially if she plans to get a mortgage in the future)Help document the transfer as an intra-family gift to minimize or eliminate any transfer taxes, depending on your local laws

Because this involves both a legal transfer of real estate and a mortgage payoff, I recommend consulting your estate attorney and a reputable title company to make sure the process is handled correctly and tax-efficiently.Wishing you and your daughter the best with this transition.February 10th, 2025

January 24th, 2025

January 24th, 2025

January 2nd, 2025

January 8th, 2025

September 7th, 2024

September 9th, 2024

September 2nd, 2024

September 3rd, 2024

August 10th, 2024

August 14th, 2024

August 28th, 2024

August 31st, 2024

June 26th, 2024

June 29th, 2024

June 25th, 2024

June 29th, 2024

June 8th, 2024

June 8th, 2024

June 12th, 2024

June 17th, 2024

June 7th, 2024

June 9th, 2024

June 3rd, 2024

June 8th, 2024

May 27th, 2025

May 27th, 2025

May 27th, 2024

June 2nd, 2024

June 4th, 2024

May 16th, 2024

May 22nd, 2024

April 30th, 2024

May 5th, 2024

February 11th, 2024

February 11th, 2024

December 20th, 2023

December 24th, 2023

October 17th, 2023

October 17th, 2023

June 9th, 2023

June 9th, 2023

April 29th, 2023

May 5th, 2023

July 29th, 2023

July 30th, 2023

January 15th, 2023

January 22nd, 2023

December 7th, 2022

December 7th, 2022

October 29th, 2022

November 4th, 2022

July 28th, 2023

August 10th, 2023

September 27th, 2022

September 27th, 2022

September 5th, 2022

September 10th, 2022

August 16th, 2022

August 16th, 2022

August 10th, 2022

August 16th, 2022

June 13th, 2022

June 13th, 2022

May 2nd, 2022

May 10th, 2022

January 27th, 2022

February 2nd, 2022

April 1st, 2022

April 12th, 2022

January 12th, 2022

January 20th, 2022

June 2nd, 2021

June 2nd, 2021

May 15th, 2021

May 16th, 2021

May 13th, 2021

April 21st, 2021

April 21st, 2021

April 6th, 2021

April 7th, 2021

December 9th, 2020

December 10th, 2020

November 23rd, 2020

November 24th, 2020

November 10th, 2020

November 11th, 2020

October 14th, 2020

October 15th, 2020

October 6th, 2020

October 7th, 2020

September 26th, 2020

September 28th, 2020

December 13th, 2019

December 14th, 2019