Which is Best? Fixed vs. Adjustable Rate Reverse Mortgages

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

If you’re planning to stay in your home but worry about your savings lasting through retirement, a reverse mortgage could help you achieve financial peace of mind. Reverse mortgages allow you to access your home equity without making monthly payments, giving you flexibility and security in your retirement years.

What Are the Types of Reverse Mortgages?

The most common reverse mortgage is the Home Equity Conversion Mortgage (HECM), insured by the Federal Housing Administration (FHA). HECMs are available with both fixed and adjustable interest rates. For homeowners with properties valued above the 2025 HECM limit of $1,209,750, proprietary (or “jumbo”) reverse mortgages may be a better fit.

- Fixed-Rate Reverse Mortgages: Provide a one-time lump-sum payment at closing.

- Adjustable-Rate Reverse Mortgages: Offer flexible payout options, including monthly payments, a line of credit, or a combination of both.

Fixed vs. Adjustable Rate HECM Features

| Feature | HECM Fixed | HECM Adjustable |

|---|---|---|

| 2024 Lending Limit | $1,209,750 | $1,209,750 |

| Lump Sum | ✔ Yes | ✔ Yes |

| Purchase | ✔ Yes | ✔ Yes |

| Line of Credit | ✘ Not Available | ✔ Yes |

| Term Payments* | ✘ Not Available | ✔ Yes |

| Tenure Payments* | ✘ Not Available | ✔ Yes |

| Best For | Single lump sum disbursement | Flexible payment plans, line of credit, growth rate feature |

| Rates | Fixed: 7.560% (8.996% APR) | Adjustable: 6.560% (1.750 margin) |

| Notes: Term = Payments over a set period (e.g., 5 or 10 years). Tenure = Payments for the borrower’s lifetime. Rates as of 2024. |

Fixed vs. Adjustable-Rate Reverse Mortgages

Fixed-Rate Reverse Mortgages

- Lump-Sum Payment: Borrowers receive all loan proceeds upfront, paying interest on the full amount from the start.

- One-Time Draw: Funds must be fully accessed at closing, and repayments cannot be reborrowed.

- Best For: Those with immediate financial needs, such as paying off debts or funding large expenses.

Adjustable-Rate Reverse Mortgages

- Flexible Payout: Borrowers can take funds as needed, reducing interest costs on unused amounts.

- Line of Credit Growth: Unused funds grow over time, increasing your borrowing power.

- Best For: Homeowners who want ongoing access to funds or to preserve future flexibility.

Fixed Rates 60% Disbursement Limit Rule

Borrowers can access up to 60% of available funds in the first 12 months unless higher amounts are required to pay off liens or loan costs. Adjustable-rate loans allow unused funds to grow over time, while fixed-rate loans require taking all funds upfront.

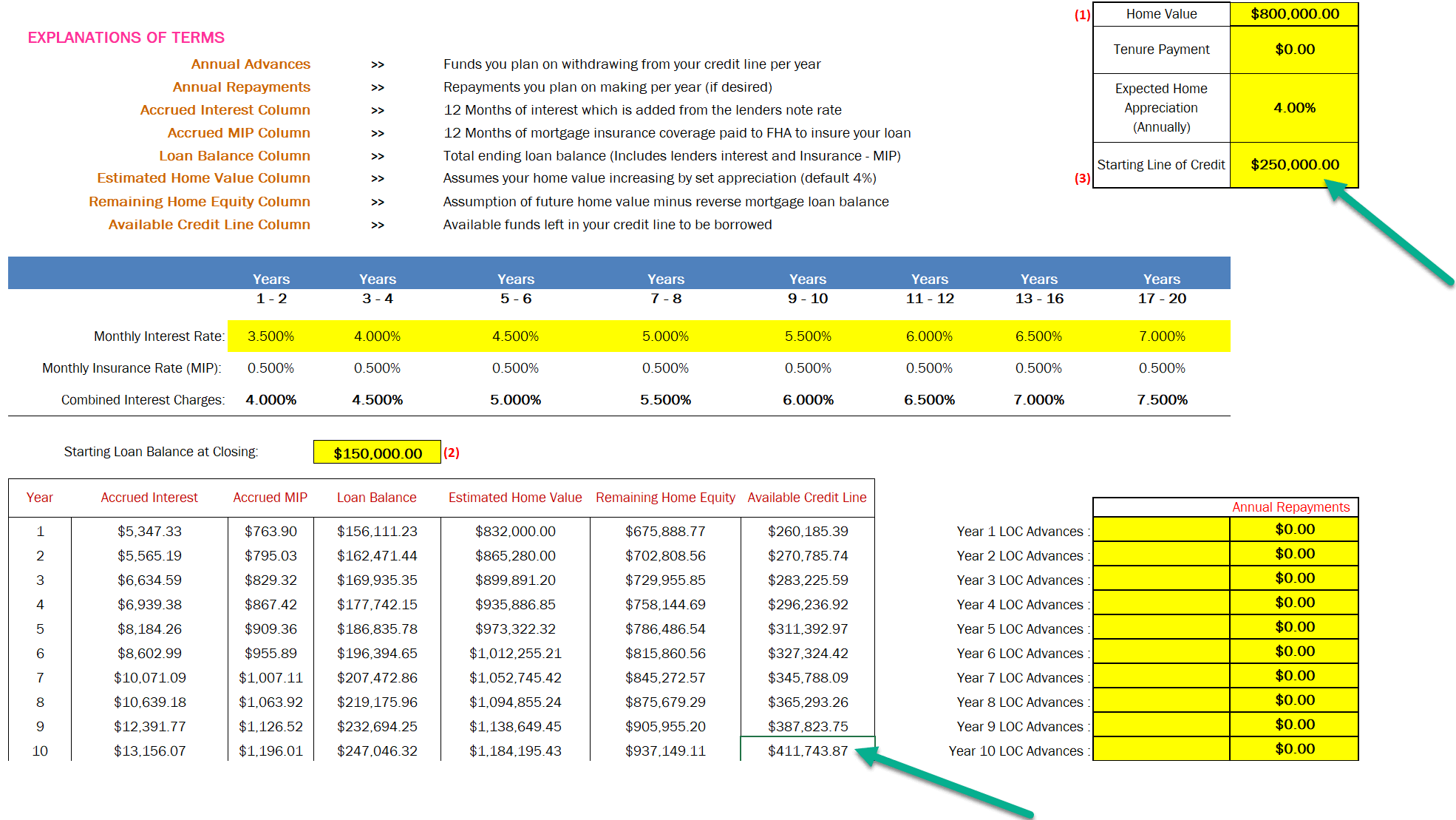

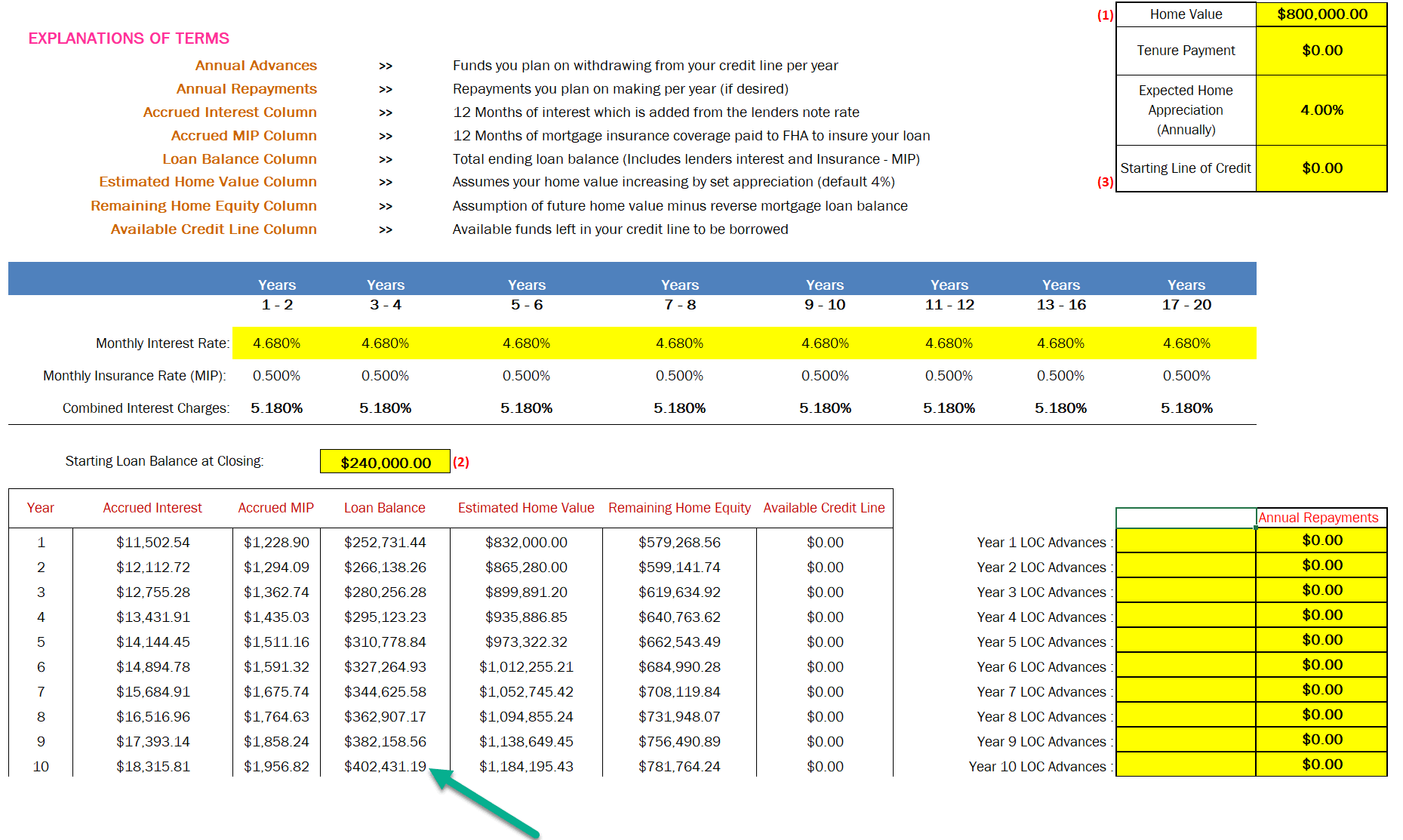

An Example: Choosing Between Fixed and Adjustable Rates

Suppose your reverse mortgage benefit is $400,000:

- If you owe $100,000 on your current mortgage and need $50,000 for home repairs, you would draw $150,000 at closing.

- With a fixed-rate loan, you must take 60% of available funds ($240,000). The unused $90,000 would accrue interest immediately, even if you don’t need it.

- With an adjustable-rate loan, you could draw $150,000 and leave the remaining $250,000 in a line of credit. The unused amount grows over time, providing more equity to borrow in the future.

Under this circumstance, you would only have interest added to the $150k balance, and after 10 years at current interest rates, your loan balance will be around $247k

HECM Reverse Mortgage Rates

| Fixed Rate | Adjustable Rate | 2025 Lending Limit |

|---|---|---|

| 7.560% (9.080% APR) | 5.375% (1.750 Margin) | $1,209,750 |

| 7.680% (9.217% APR) | 5.625% (2.000 Margin) | $1,209,750 |

| 7.810% (9.365% APR) | 5.875% (2.250 Margin) | $1,209,750 |

| 7.930% (9.502% APR) | 6.125% (2.500 Margin) | $1,209,750 |

Fixed Rate FAQs

What is the current fixed rate for a reverse mortgage?

Why isn’t a line of credit available at a fixed interest rate?

Are all fixed-rate reverse mortgages the same?

How often do reverse mortgage interest rates change?

Key Takeaways

- Fixed-Rate Loans: Offer certainty with a one-time lump sum but less flexibility for future needs.

- Adjustable-Rate Loans: Provide flexibility with options for monthly payments or a growing line of credit.

- No Prepayment Penalty: Both loan types allow for repayment without additional costs.

Choosing the right reverse mortgage depends on your financial goals and immediate needs. Speak with a trusted lender to evaluate your options.

Fixed or Adjustable—Which Fits You? Find out with a free quote from All Reverse Mortgage—America’s #1 with a 4.99/5-star rating! Call (800) 565-1722 or click here for your free quote —simple, trusted, 100% secure!

ARLO recommends these helpful resources:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

June 7th, 2023

June 7th, 2023

January 31st, 2023

January 31st, 2023

August 31st, 2022

September 6th, 2022

August 28th, 2022

August 28th, 2022

February 22nd, 2022

February 22nd, 2022

July 7th, 2020

July 7th, 2020

October 6th, 2019

October 6th, 2019

May 6th, 2019

May 6th, 2019

March 28th, 2013

May 25th, 2021

May 31st, 2021