America’s #1 Rated Reverse Lender*

One Reverse Mortgage Problem No One is Talking About

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

..one originator’s observations about the undiscussed reasons for problems with the MMI fund.

We heard from Brian Montgomery at the annual NRMLA meeting that he envisions further changes coming down the road for the HUD HECM program. Jessica Guerin at The Housing Wire (Housing Wire on Brian Montgomery) tells us that Montgomery outlined the “fixes” attempted by HUD and that they amounted to, in his words, short term fixes that have not worked to stop the losses the reverse mortgage program is suffering.

FHA Commissioner Montgomery Hints That More Changes Are Coming…

During his keynote address on Tuesday at the 2018 Annual Meeting and Expo in San Diego, Federal Housing Commissioner Brian Montgomery restated his support for the Home Equity Conversion Mortgage program as a critical resource for seniors to age in place, but he hinted that more changes are needed to ensure its long-term sustainability.

Without elaborating, Commissioner Montgomery said,

“We are studying long-term changes to both origination and servicing that will put us on a sustainable path for seniors and for our industry.”

Immediately upon arriving at FHA in May 2018, Commissioner Montgomery formed two cross-disciplinary working groups to review FHA’s single-family programs, one focused on the forward mortgage portfolio and the other on HECM. “The working groups have been meeting on a weekly basis to triage pressing issues and develop solutions,” he said.

FHA soon discovered that appraisal bias – inflated appraisals on HECM properties – was more common than initially thought. This was a big concern, commented Commissioner Montgomery, because inflated appraisals can result in increased claims submissions and losses to the FHA insurance fund.

FHA implemented its appraisal inflation mitigation policy, announced in Mortgagee Letter 2018-06, on September 28.

“We understand these policies will be challenging for you in the short-term,” said Montgomery, “and we appreciate your patience on that front. We know the immediate process is not ideal, but we hope to fully automate it by December 1.”

He continued, “The reality was that the HECM appraisal submission changes are the least impactful of all the policy options that were on the table, which included (further) increases to the annual and monthly premiums and further reductions to the PLF (principal limit factors).”

Commissioner Montgomery also thanked his staff at the Santa Ana and Denver Homeownership Centers and Tulsa Servicing Center for their close collaboration developing policies that were published more recently in Mortgagee Letter 2018-08 to streamline the process for submitting HECM assignment requests.

“There are now only a handful of HECM assignment requests still in the backlog,” he said, adding, “I believe these actions demonstrate our commitment to making it (HECM) work.”

More Changes Coming…

Even with all the cuts the program has received over recent years, Montgomery said they did not go far enough to solve the problems.

Montgomery said they looked at risk factors that affect the program and took steps to address those issues. The most recent step was the second appraisal rule on select loans instituted in October of 2018. We don’t blame HUD for wanting to be sure that they are getting honest appraisals, but we question if this is really the next best place to change.

We could go over the cuts and changes to the HECM program over the past several years to discuss each one and its effectiveness, but the recent changes only affect those loans originated since the change took effect and most have not even had a chance to show an impact on the MIP fund yet. HUD is concerned with appraisals and values again now, but HUD implemented the appraisal independence rules over 7 years ago to fight appraisal issues.

Most lenders are now completely out of the appraisal process and if HUD is still seeing appraisers who are not supplying them with honest values, after all this time, why has HUD not taken the steps to remove approvals from appraisers who cannot provide honest values?

Are there some AMC’s guilty of value issues more so than others? If so, then HUD ought to take aggressive action against those offenders and their owners as well. HUD certainly has the data to see if there are areas where there is more risk than others and appraisers, AMC’s and lenders who push the appraisal envelope should be made aware that it will not be tolerated and then action taken against them.

What’s Never Talked About

And then there is the 900-pound gorilla in the room that we never hear about but at our company it is the source of blog comment after blog comment from people writing in – non-occupancy by the reverse mortgage borrower(s) but somehow those loans are just staying active month after month and sometimes year after year.

We receive multiple blog comments daily from heirs, neighbors of reverse mortgage holders and others regarding reverse mortgage properties for which the borrowers have either long-passed or have long-since moved and the property is still being rented or lived in by a family member or others.

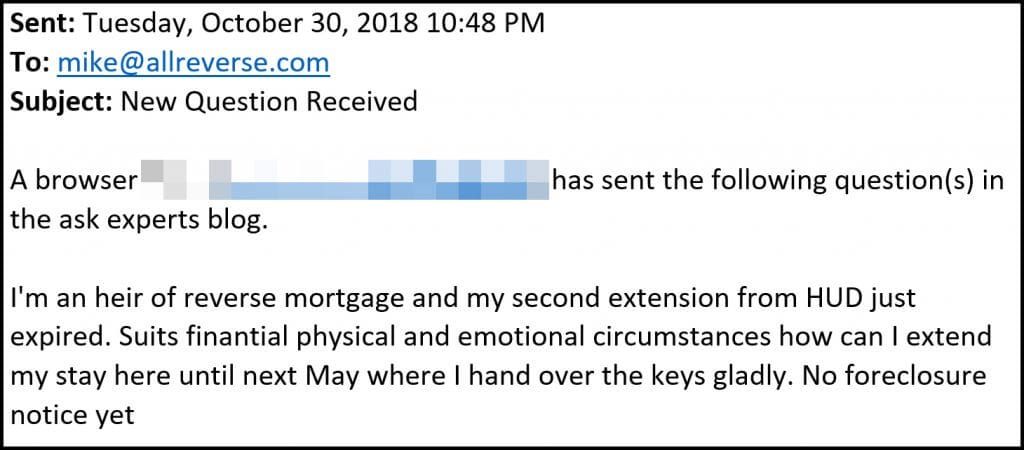

Example of one comment received just yesterday:

Often it is the family member or the renter writing to us to ask how long they can stay and they will tell us that they have been there years in some cases and want to know how to get around paying the taxes, insurance or other assessments!

Imagine that, they have already accrued thousands of dollars in interest that they will never repay and now want to know how to avoid paying the taxes and insurance as well!

We have received hundreds of questions about how to avoid leaving the home even though the borrowers no longer occupy the premises (which we politely remind folks that the loan is meant for the senior borrower to remain in the home for life and to contact their servicer).

What can be done?

- Possibly a much more aggressive servicing regimen for reverse mortgages?

- More property inspections?

- More aggressive foreclosure activity when the borrower no longer occupies the home?

Is it possible to prosecute people for fraudulently signing and sending occupancy affidavits back to lenders (believe it or not some people admit anonymously in blog posts they do this)? Maybe the non-recourse nature of the loan changes if the borrower or the borrower’s heirs commit fraud? We don’t know, we aren’t saying we have all the answers here, but this must be costing the program in the most severe way possible.

After all, if the property still has equity, the owners would sell it to keep that equity while if it has no equity, it seems a lot of borrowers have the school of thought of why not just let a family member stay until they get kicked out if there are no consequences to that action?

While we don’t get to see a breakdown of the loans on which HUD loses money, it doesn’t take a genius to figure out that the losses are coming from loans that were probably originated prior to 2014 when the cuts to program benefits and borrower’s receipt of funds option changes first started taking place. That being the case, all the cuts HUD has made only affect loans typically less than 4 years old and not likely to produce losses to the MMI fund yet anyway.

Expecting those cuts to have an impact on the losses of the older book of business is not reasonable. With the exception of the increased MMI premiums on newer loans which will help to raise the income and offset the loss, those changes will likely have no impact on the loans that were losing money at all for several more years so it’s still too early to even know if the changes were inadequate or if there will actually be a surplus in the future on the new book of business. No one knows.

We think that HUD is right to be doing what they need to do to keep the program viable long term, but to ignore the abuses on the back end for older existing loans and to just keep cutting on the front for new, lower LTV loans is far too short-sighted. As long as the program relies on actuarial tables that are being totally skewed with the older loans outstanding that already had higher LTV’s, the results will only get worse on the older book unless HUD does something to eliminate the excessive losses there as well.

Those losses will keep mounting until the new book has time to offset the issues of the older product parameters and that will take a very long time – and that time will lengthen if the new volume decreases or is shut down and new loans are not originated at the higher MMI rates at lower LTV’s to offset the risks.

HUD Should Investigate Loan Maturity

We would like to see HUD push for more aggressive measures to protect the integrity of the borrower base so that the loans are only outstanding to actual borrowers and once they do become due and payable, servicers move swiftly to determine the motives of the heirs and if they are not actively seeking repayment measures, then better to foreclose sooner rather than later as more costs accrue.

We are not suggesting that when bona fide heirs are seeking to sell a home or pay off the loan with other financing that the lenders are not given the latitude to work with them, but when this is clearly not the case, when borrowers or heirs have deliberately sought to deceive or when the borrowers have left the home, we believe HUD should work with servicers to implement much greater enforcement procedures.

We aren’t attorneys and don’t even know if it’s possible, but we would encourage HUD to investigate altering the language in the documents so that borrowers and their estate lose all or a portion of the non-recourse nature of the loan in the event of fraud – particularly occupancy fraud.

Perhaps there could also be a notification requirement by borrowers or heirs included in the documents for the non-recourse to be effective? But again, any changes to the loan documents would not affect loans already outstanding so the push needs to come in the servicing area and it needs to start now.

The loan should be available to all who need it and there are far too many who are endangering the program for everyone else who really needs it in the name of a free place to live or free income. There’s the trick that doesn’t leave anyone with a treat but the heir or others who continue to live in the home free of charge beyond the program’s intent, endangering the program for all to come.

There’s the trick that doesn’t leave anyone with a treat but the heir or others who continue to live in the home free of charge beyond the program’s intent, endangering the program for all to come.

Have a Question About Reverse Mortgages?

Over 2000 of your questions answered by ARLO™

Ask your question now!

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

December 26th, 2018

December 26th, 2018