|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

Reverse Mortgages in Oklahoma: A Comprehensive Guide

If you’re an Oklahoma homeowner aged 62 or older, a reverse mortgage could be a valuable tool to help you unlock the equity in your home and improve your financial security during retirement. In this guide, we’ll cover everything you need to know about reverse mortgages in Oklahoma, including key facts, the latest statistics, top lenders, and essential protections.

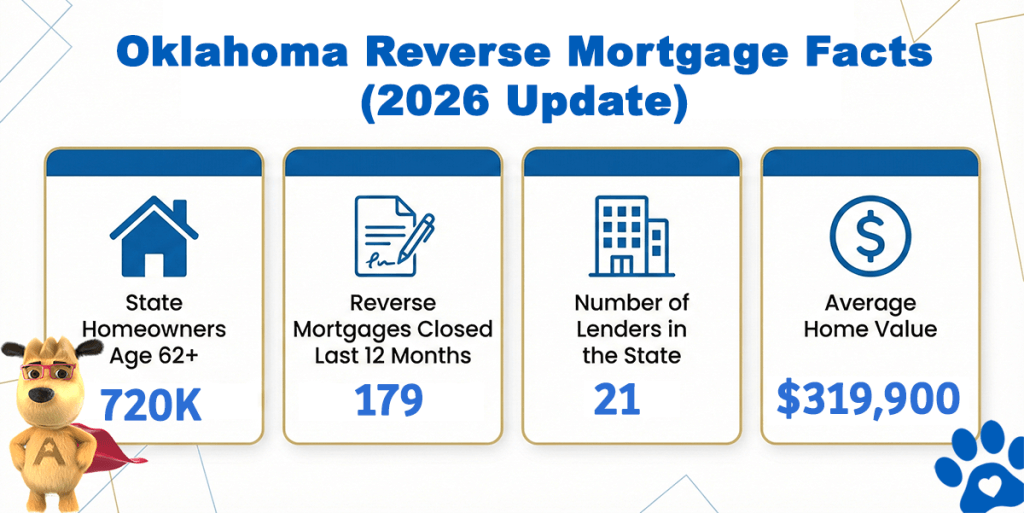

Oklahoma Reverse Mortgage Statistics (2026 Update)

| State | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Oklahoma | Avg. Home Value |

|---|---|---|---|---|

| Oklahoma | 720,000 | 179 | 21 | $254,100 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

Top Reverse Mortgage Lenders in Oklahoma

| Lender | BBB Rating | Accredited | Years in Business | Customer Rating (0–5) | % Positive Reviews | Complaints | Source |

|---|---|---|---|---|---|---|---|

| American Pacific Mortgage | F | NO | 28 | 1.75/5 | 35.0% | 6 | Source |

| CrossCountry Mortgage, LLC. | F | YES | 22 | 1.43/5 | 29.0% | 303 | Source |

| Fairway Independent Mortgage | A+ | YES | 29 | 4.51/5 | 90.0% | 26 | Source |

| Finance of America Reverse LLC (FAR) | A+ | YES | 22 | 3.71/5 | 74.0% | 36 | Source |

| Goodlife Home Loans | A+ | YES | 13 | N/A (Not enough reviews) | N/A (Not enough reviews) | 1 | Source |

| Guaranteed Rate | A+ | YES | 26 | 2.25/5 | 450% | 45 | Source |

| Guild Mortgage Company LLC | A+ | NO | 65 | 1.55/5 | 31.0% | 73 | Source |

| HighTechLending Inc | A+ | YES | 19 | 4.94/5 | 99.0% | 1 | Source |

| Liberty Home Equity Solutions Inc. | A+ | NO | 22 | 1.00/5 | 20.0% | 1 | Source |

| Longbridge Financial LLC | A+ | YES | 13 | 3.77/5 | 75.0% | 34 | Source |

| Luminate Bank | NR | NO | 84 | NA | NA | NA | Source |

| MCM Holdings | A+ | YES | 27 | NA | NA | NA | Source |

| The Money House | NR | NO | 28 | NA | NA | 0 | Source |

| Movement Mortgage, LLC | A+ | NO | 18 | 4.43/5 | 89.0% | 92 | Source |

| Mutual of Omaha Mortgage | A+ | YES | 12 | 3.31/5 | 66.0% | 65 | Source |

| New American Funding | A+ | YES | 26 | 4.65/5 | 93.0% | 147 | Source |

| Plaza Home Mortgage Inc | A+ | YES | 24 | 2.67/5 | 53.0% | 6 | Source |

| Smartfi Home Loans | A+ | YES | 6 | N/A (Not enough reviews) | N/A (Not enough reviews) | 0 | Source |

| South River Mortgage, LLC | A+ | NO | 6 | 3.79/5 | 76.0% | 14 | Source |

Oklahoma Reverse Mortgage Lending Limits (2026)

Oklahoma is the 28th most populous state in the U.S., with an estimated population of about 4.0 million people in 2026. Most residents live in the Oklahoma City and Tulsa metropolitan areas. The state has a significant older homeowner population, with roughly 1.0 to 1.1 million residents age 62 and older, and an estimated 720,000 of them owning their homes. Strong homeownership among older residents creates a sizable base of homeowners who may benefit from reverse mortgage options.

Home Ownership and Reverse Mortgage Potential

With homeownership rates above the national average, many Oklahoma homeowners have built substantial equity over years of ownership. This equity can be accessed through reverse mortgages, which allow eligible homeowners to supplement retirement income or eliminate monthly mortgage payments while remaining in their homes.

Reverse Mortgage Options and Home Values

As of 2026, the average home value in Oklahoma is approximately $319,900, well below the federal Home Equity Conversion Mortgage (HECM) lending limit of $1,249,125. This means most Oklahoma homeowners can qualify for the full benefits of a federally insured HECM reverse mortgage without needing proprietary (jumbo) options. For homes with values above the standard HECM limit, jumbo reverse mortgage programs are available to provide higher borrowing capacity.

Economy and Long-Term Stability

Oklahoma’s economy is diverse, with key sectors such as energy, aerospace and defense, agriculture, and biosciences supporting long-term housing demand and stable homeownership. Major employers such as Express Employment Professionals, Hobby Lobby, and Avis Budget Group contribute to regional economic resilience.

HUD-Approved Reverse Mortgage Counseling Agencies in Oklahoma

| Name | Agency ID | Address | Phone | Web Site |

|---|---|---|---|---|

| QUICKCERT, INC. | 84311 | 7122 S Sheridan Rd Ste 2-533, Tulsa, Oklahoma, 74133-2774 | (888) 383-8885 | quickcert.org |

Did you know? Oklahoma State does not mandate in-person counseling. Visit our counseling page for a list of phone-based counseling agencies and conduct your required counseling from the comfort of your home.

Top Lender Resources in OK:

Reversemortgage.org NRMLA Members in Oklahoma

HUD.GOV Approved Lenders Search

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald