|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

Reverse Mortgages in Nevada: A Comprehensive Guide

If you’re a Nevada homeowner aged 62 or older, a reverse mortgage could be a valuable tool to help you unlock the equity in your home and improve your financial security during retirement. In this guide, we’ll cover everything you need to know about reverse mortgages in Nevada, including key facts, the latest statistics, top lenders, and essential protections.

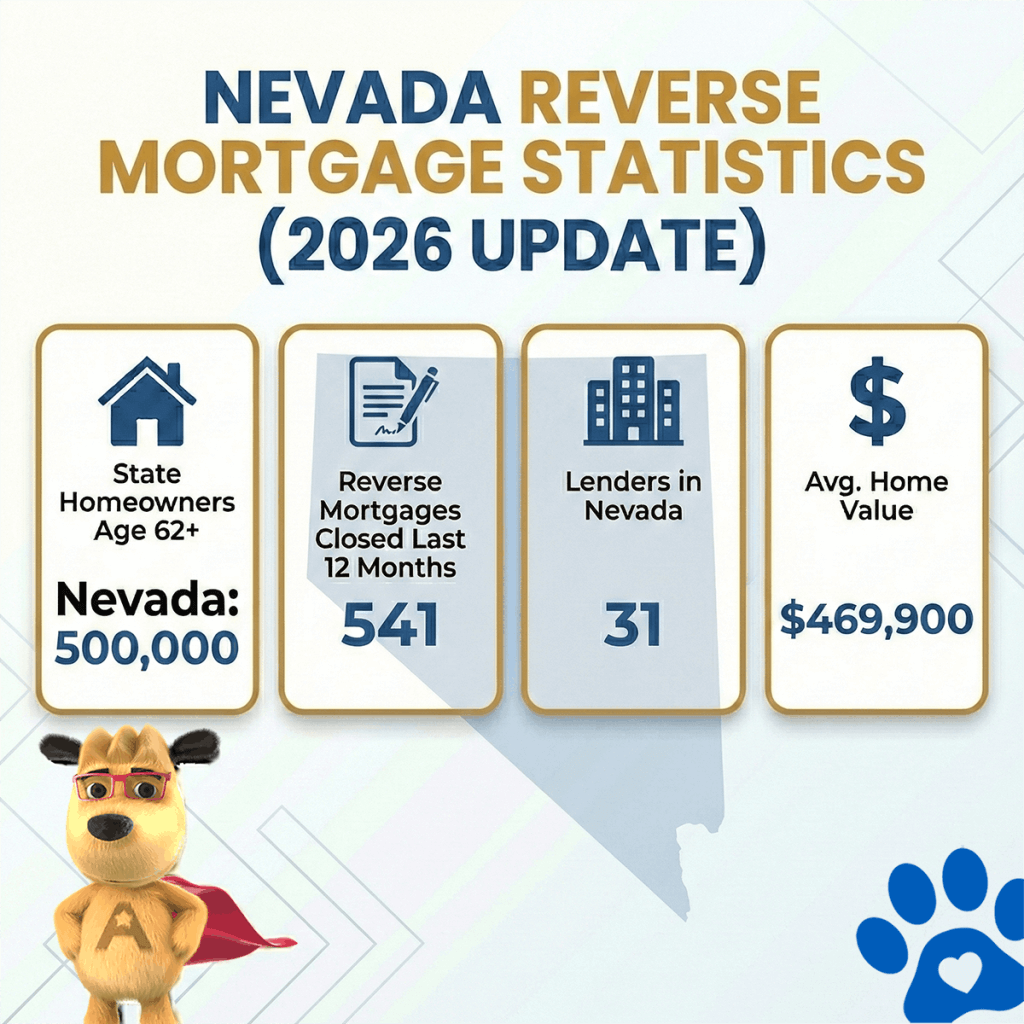

Nevada Reverse Mortgage Statistics (2026 Update)

| State | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Nevada | Avg. Home Value |

|---|---|---|---|---|

| Nevada | 500,000 | 541 | 31 | $469,900 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

Top Reverse Mortgage Lenders in Nevada

| Lender | BBB Rating | Accredited | Years in Business | Customer Rating (0–5) | % Positive Reviews | Complaints | Source |

|---|---|---|---|---|---|---|---|

| American Pacific Mortgage | F | NO | 28 | 1.75/5 | 35.0% | 6 | Source |

| CrossCountry Mortgage, LLC. | F | YES | 22 | 1.43/5 | 29.0% | 303 | Source |

| Fairway Independent Mortgage | A+ | YES | 29 | 4.51/5 | 90.0% | 26 | Source |

| Finance of America Reverse LLC (FAR) | A+ | YES | 22 | 3.71/5 | 74.0% | 36 | Source |

| Goodlife Home Loans | A+ | YES | 13 | N/A (Not enough reviews) | N/A (Not enough reviews) | 1 | Source |

| Guaranteed Rate | A+ | YES | 26 | 2.25/5 | 450% | 45 | Source |

| Guild Mortgage Company LLC | A+ | NO | 65 | 1.55/5 | 31.0% | 73 | Source |

| HighTechLending Inc | A+ | YES | 19 | 4.94/5 | 99.0% | 1 | Source |

| Liberty Home Equity Solutions Inc. | A+ | NO | 22 | 1.00/5 | 20.0% | 1 | Source |

| Longbridge Financial LLC | A+ | YES | 13 | 3.77/5 | 75.0% | 34 | Source |

| Luminate Bank | NR | NO | 84 | NA | NA | NA | Source |

| MCM Holdings | A+ | YES | 27 | NA | NA | NA | Source |

| The Money House | NR | NO | 28 | NA | NA | 0 | Source |

| Movement Mortgage, LLC | A+ | NO | 18 | 4.43/5 | 89.0% | 92 | Source |

| Mutual of Omaha Mortgage | A+ | YES | 12 | 3.31/5 | 66.0% | 65 | Source |

| New American Funding | A+ | YES | 26 | 4.65/5 | 93.0% | 147 | Source |

| Plaza Home Mortgage Inc | A+ | YES | 24 | 2.67/5 | 53.0% | 6 | Source |

| Smartfi Home Loans | A+ | YES | 6 | N/A (Not enough reviews) | N/A (Not enough reviews) | 0 | Source |

| South River Mortgage, LLC | A+ | NO | 6 | 3.79/5 | 76.0% | 14 | Source |

Nevada Reverse Mortgage Lending Limits

Nevada is the 33rd most populous state in the U.S. and the 7th largest in terms of land area. As of 2026, approximately 3.4 million people reside in the state, with a significant portion of the population concentrated around Las Vegas. Of the state’s total population, around 500,000 residents aged 62 or older are homeowners, creating a substantial pool of residents eligible for reverse mortgage opportunities.

Historical and Cultural Overview

For at least 10,000 years, Nevada was inhabited by multiple Native American tribes before the arrival of European explorers. The Spanish were the first Europeans to claim the area, incorporating it as part of New Spain. The territory later became part of Mexico and was ceded to the United States after the Mexican-American War. Nevada was admitted as the 36th state in 1864, during the Civil War.

Key Cities and Economic Overview

Las Vegas, the largest city in Nevada, has a metropolitan population exceeding 2 million. Originally a small desert town, Las Vegas transformed in the early 20th century into the entertainment capital of the U.S., known for its casinos, nightlife, and quick marriages and divorces. Today, the city draws millions of tourists each year for gambling, concerts, and conventions. Famous residents from Las Vegas include tennis legend Andre Agassi and the rock band The Killers.

Outside of Las Vegas, Nevada’s other significant city is Reno, known as “The Biggest Little City in the World.” Nevada is a top producer of gold, making it an economic powerhouse in mining. Tourism dominates Nevada’s economy, with companies like MGM Resorts International and Las Vegas Sands among the largest employers in the state. Johnson Electric is another significant employer.

Climate and Geography

Nevada is the driest state in the U.S., with much of the land classified as desert. The climate varies between the northern and southern regions, with long, hot summers and mild winters in the south, and shorter, cooler summers in the north. The average high temperature reaches 90°F in the summer, while winter lows average around 22°F. However, extreme temperatures have ranged from 120°F to -50°F.

Reverse Mortgage Opportunities in Nevada

As of January 2026, the average home value in Nevada is $469,900, which is below the federal maximum reverse mortgage lending limit of $1,249,125. This makes many homes in Nevada eligible for HECM (Home Equity Conversion Mortgage) loans. For homeowners with properties exceeding the federal limit, jumbo reverse mortgage programs are available to provide more borrowing power.

HUD-Approved Reverse Mortgage Counseling Agencies in Nevada

| Name | Agency ID | Address | Phone | Web Site |

|---|---|---|---|---|

| NEIGHBORHOOD HOUSING SERVICES OF SOUTHERN NEVADA | 84593 | 1849 CIVIC CENTER DR NORTH LAS VEGAS, NV 89030-7131 | (702) 649-0998 | http://www.nwsn.org |

Did you know? Nevada does not mandate in-person counseling. Visit our counseling page for a list of phone-based counseling agencies and conduct your required counseling from the comfort of your home.

Additional Resources:

Reversemortgage.org NRMLA Members in Nevada

HUD.GOV Approved Lenders Search

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald