|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

Reverse Mortgages in Hawaii: A Comprehensive Guide

If you’re a Hawaii homeowner aged 62 or older, a reverse mortgage could be a valuable tool to help you unlock the equity in your home and improve your financial security during retirement. In this guide, we’ll cover everything you need to know about reverse mortgages in Hawaii, including key facts, the latest statistics, top lenders, and essential protections

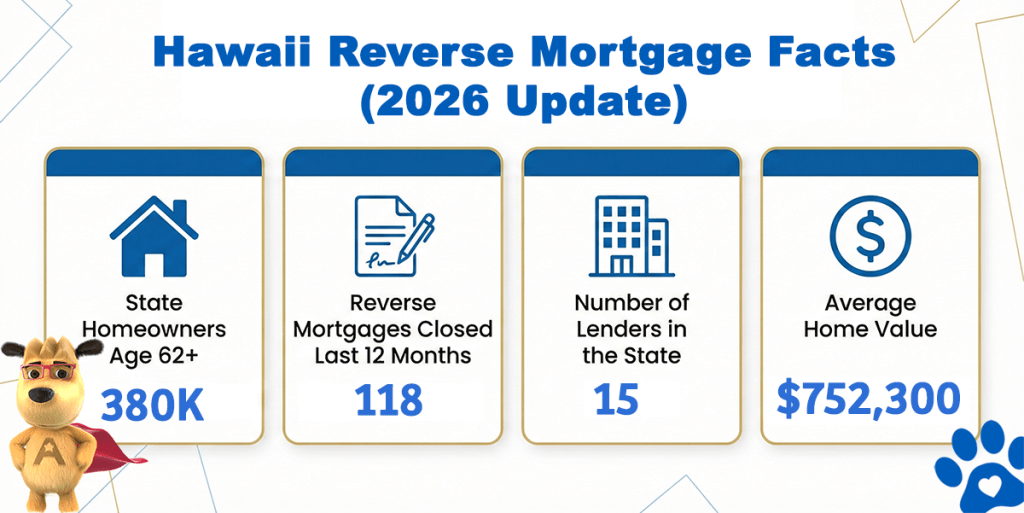

Hawaii Reverse Mortgage Statistics (2026 Update)

| State | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Hawaii | Avg. Home Value |

|---|---|---|---|---|

| Hawaii | 380,000 | 118 | 15 | $752,300 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

Hawaii Reverse Mortgage Lending Limits (2026)

Hawaii is home to approximately 1.45 million residents as of 2026, with population density concentrated on Oʻahu, particularly in Honolulu. An estimated 380,000 Hawaii homeowners are age 62 or older, ranking the state among the highest concentrations of reverse-mortgage-eligible homeowners per capita.

Homeownership remains strong across the islands, and with 15 active reverse mortgage lenders statewide and 118 reverse mortgages closed in the last 12 months, Hawaii continues to see steady demand for reverse mortgage solutions.

Hawaii Housing Market and Reverse Mortgage Opportunities

Hawaii’s housing market remains one of the most expensive in the country. As of 2026, the average home value in Hawaii is $752,300, well above the national average.

Because many Hawaii homes approach or exceed the federal HECM lending limit, homeowners often benefit from:

- Full utilization of FHA-insured HECM reverse mortgages when values fall within the limit

- Jumbo reverse mortgage options for higher-value properties, allowing access to additional equity beyond FHA limits

This combination of high home values and a large population of older homeowners makes Hawaii a strong market for reverse mortgages as a retirement planning tool.

Why Reverse Mortgages Matter in Hawaii

With a high cost of living, limited housing supply, and significant home equity tied up in primary residences, reverse mortgages can help Hawaii homeowners:

- Eliminate monthly mortgage payments

- Access tax-free loan proceeds

- Age in place without selling their home

- Supplement retirement income in a high-expense state

For many long-time Hawaii homeowners, a reverse mortgage provides a way to stay in their home while converting equity into usable cash flow.

Hawaii Reverse Mortgage Lenders

| Lender | BBB Rating | Accredited | Years in Business | Customer Rating (0–5) | % Positive Reviews | Complaints | Source |

|---|---|---|---|---|---|---|---|

| All Reverse Mortgage, Inc. (ARLO) | A+ | YES | 21 | 4.94/5 | 99.0% | 0 | Source |

| American Pacific Mortgage | F | NO | 28 | 1.75/5 | 35.0% | 6 | Source |

| CrossCountry Mortgage, LLC. | F | YES | 22 | 1.43/5 | 29.0% | 303 | Source |

| Fairway Independent Mortgage | A+ | YES | 29 | 4.51/5 | 90.0% | 26 | Source |

| Finance of America Reverse LLC (FAR) | A+ | YES | 22 | 3.71/5 | 74.0% | 36 | Source |

| Goodlife Home Loans | A+ | YES | 13 | N/A (Not enough reviews) | N/A (Not enough reviews) | 1 | Source |

| Guaranteed Rate | A+ | YES | 26 | 2.25/5 | 450% | 45 | Source |

| Guild Mortgage Company LLC | A+ | NO | 65 | 1.55/5 | 31.0% | 73 | Source |

| HighTechLending Inc | A+ | YES | 19 | 4.94/5 | 99.0% | 1 | Source |

| Liberty Home Equity Solutions Inc. | A+ | NO | 22 | 1.00/5 | 20.0% | 1 | Source |

| Longbridge Financial LLC | A+ | YES | 13 | 3.77/5 | 75.0% | 34 | Source |

| Luminate Bank | NR | NO | 84 | NA | NA | NA | Source |

| MCM Holdings | A+ | YES | 27 | NA | NA | NA | Source |

| The Money House | NR | NO | 28 | NA | NA | 0 | Source |

| Movement Mortgage, LLC | A+ | NO | 18 | 4.43/5 | 89.0% | 92 | Source |

| Mutual of Omaha Mortgage | A+ | YES | 12 | 3.31/5 | 66.0% | 65 | Source |

| New American Funding | A+ | YES | 26 | 4.65/5 | 93.0% | 147 | Source |

| Plaza Home Mortgage Inc | A+ | YES | 24 | 2.67/5 | 53.0% | 6 | Source |

| Smartfi Home Loans | A+ | YES | 6 | N/A (Not enough reviews) | N/A (Not enough reviews) | 0 | Source |

| South River Mortgage, LLC | A+ | NO | 6 | 3.79/5 | 76.0% | 14 | Source |

HUD-Approved Reverse Mortgage Counseling Agencies in Hawaii

| Name | Agency ID | Address | Phone | Web Site |

|---|---|---|---|---|

| LEGAL AID SOCIETY OF HAWAII | 80972 | 924 Bethel Street, HONOLULU, Hawaii, 96813-4304 | (808) 536-4302 | legalaidhawaii.org |

| LEGAL AID SOCIETY OF HAWAII - HILO BRANCH | 80975 | 101 Aupuni Street, HILO, Hawaii, 96720-4246 | (808) 961-2851 | legalaidhawaii.org |

Did you know? Hawaii does not mandate in-person counseling. Visit our counseling page for a list of phone-based counseling agencies, and you can conduct your required counseling from the comfort of your home.

Other Areas of Interest in Hawaii

Additional Resources:

Reversemortgage.org NRMLA Members in Hawaii: https://www.reversemortgage.org/Find-a-Lender/state/HI

HUD.GOV Approved Lenders Search: https://www.hud.gov/program_offices/housing/sfh/lender/lenderlist

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald