|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

Reverse Mortgages in Connecticut: A Comprehensive Guide

If you’re a Connecticut homeowner aged 62 or older, a reverse mortgage could be a valuable tool to help you unlock the equity in your home and improve your financial security during retirement. In this guide, we’ll cover everything you need to know about reverse mortgages in Connecticut, including key facts, the latest statistics, top lenders, and essential protections.

Top 20 Reverse Mortgage Lenders in Connecticut

| Lender | BBB Rating | Accredited | Years in Business | Customer Rating (0–5) | % Positive Reviews | Complaints | Source |

|---|---|---|---|---|---|---|---|

| American Pacific Mortgage | F | NO | 28 | 1.75/5 | 35.0% | 6 | Source |

| CrossCountry Mortgage, LLC. | F | YES | 22 | 1.43/5 | 29.0% | 303 | Source |

| Fairway Independent Mortgage | A+ | YES | 29 | 4.51/5 | 90.0% | 26 | Source |

| Finance of America Reverse LLC (FAR) | A+ | YES | 22 | 3.71/5 | 74.0% | 36 | Source |

| Goodlife Home Loans | A+ | YES | 13 | N/A (Not enough reviews) | N/A (Not enough reviews) | 1 | Source |

| Guaranteed Rate | A+ | YES | 26 | 2.25/5 | 450% | 45 | Source |

| Guild Mortgage Company LLC | A+ | NO | 65 | 1.55/5 | 31.0% | 73 | Source |

| HighTechLending Inc | A+ | YES | 19 | 4.94/5 | 99.0% | 1 | Source |

| Liberty Home Equity Solutions Inc. | A+ | NO | 22 | 1.00/5 | 20.0% | 1 | Source |

| Longbridge Financial LLC | A+ | YES | 13 | 3.77/5 | 75.0% | 34 | Source |

| Luminate Bank | NR | NO | 84 | NA | NA | NA | Source |

| MCM Holdings | A+ | YES | 27 | NA | NA | NA | Source |

| The Money House | NR | NO | 28 | NA | NA | 0 | Source |

| Movement Mortgage, LLC | A+ | NO | 18 | 4.43/5 | 89.0% | 92 | Source |

| Mutual of Omaha Mortgage | A+ | YES | 12 | 3.31/5 | 66.0% | 65 | Source |

| New American Funding | A+ | YES | 26 | 4.65/5 | 93.0% | 147 | Source |

| Plaza Home Mortgage Inc | A+ | YES | 24 | 2.67/5 | 53.0% | 6 | Source |

| Smartfi Home Loans | A+ | YES | 6 | N/A (Not enough reviews) | N/A (Not enough reviews) | 0 | Source |

| South River Mortgage, LLC | A+ | NO | 6 | 3.79/5 | 76.0% | 14 | Source |

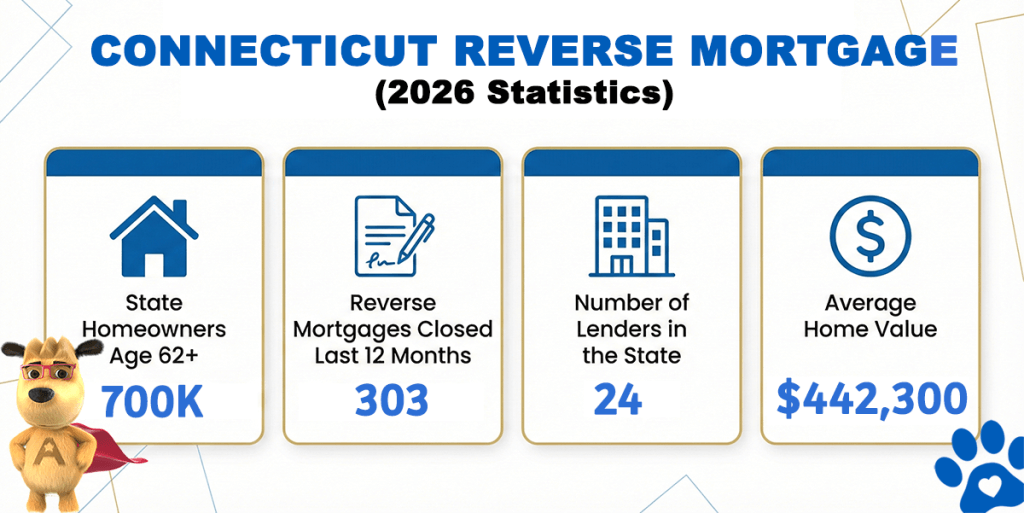

Latest Connecticut Reverse Mortgage Statistics (2026 Update)

| State | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Connecticut | Avg. Home Value |

|---|---|---|---|---|

| Connecticut | 700,000 | 303 | 24 | $442,300 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

Connecticut Overview and Demographics

Connecticut, the southernmost state in New England, ranks as the 29th most populous state in the U.S. As of 2026, the state has an estimated population of approximately 3.6 to 3.7 million residents, with the highest population density and household incomes concentrated in western Connecticut along the New York border.

Roughly 880,000 Connecticut residents are age 62 and older, and older homeowners represent a significant share of the housing market. An estimated 685,000 to 700,000 homeowners in Connecticut are age 62+, reflecting a high homeownership rate among long-tenured residents and making the state well-positioned for reverse mortgage utilization.

Connecticut’s History and Economy

The region was first explored by the Dutch in 1614, though English settlers established the earliest permanent communities in the 1630s. Connecticut was one of the original 13 colonies and became the fifth state to join the Union in 1788. The state earned the nickname “The Constitution State” due to its early framework for representative government.

Bridgeport, Connecticut’s largest city, has a population of roughly 150,000 and historically served as a major industrial center. It was also famously home to P.T. Barnum’s circus operations in the 19th century. Other major cities include New Haven, home to Yale University, Stamford, a key financial hub, and Hartford, the state capital.

Connecticut’s economy is anchored by insurance, finance, healthcare, defense, and advanced manufacturing. The state consistently ranks among the highest in per-capita income in the U.S. and remains home to numerous major corporations, including Aetna, Cigna, and Travelers, underscoring its long-standing role as a national business and insurance center.

Reverse Mortgage Opportunities in Connecticut

As of January 2026, the median home value in Connecticut is $442,3006, which represents a 6.3% increase over the previous year. Given this median value, many Connecticut homes fall under the federal reverse mortgage lending limit of $1,249,125, making them eligible for HECM (Home Equity Conversion Mortgage) loans. For homes valued above this limit, proprietary jumbo reverse mortgage programs are available for more borrowing power.

HUD-Approved Reverse Mortgage Counseling Agencies in Connecticut

| Name | Agency ID | Address | Phone | Web Site |

|---|---|---|---|---|

| BRIDGEPORT NEIGHBORHOOD TRUST | 80835 | 570 STATE ST BRIDGEPORT, CT 06604-4500 | (203) 290-4255 | https://www.bntweb.org |

Did you know? Connecticut state does not mandate in-person counseling. Visit our counseling page for a list of phone-based counseling agencies and conduct your required counseling from the comfort of your home.

Additional Resources:

Reversemortgage.org NRMLA Members in Connecticut: https://www.reversemortgage.org/Find-a-Lender/state/CT

HUD.GOV Approved Lenders Search: https://www.hud.gov/program_offices/housing/sfh/lender/lenderlist

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald