|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

This page is a consumer-friendly overview of reverse mortgages in Cincinnati, Ohio, including local HECM activity, estimated older homeowner counts, and home value context.

All Reverse Mortgage, Inc. is a HUD-approved reverse mortgage lender headquartered in California. While we are not licensed to originate reverse mortgages in Ohio, we publish educational guides like this to help homeowners understand how the FHA-insured Home Equity Conversion Mortgage (HECM) works, what the national lending limit means, and how reverse mortgages are commonly used in retirement planning.

Nothing on this page is an offer to lend or a solicitation for business in Ohio. Reverse mortgage availability and terms vary by state and lender, so Cincinnati homeowners should speak with a properly licensed mortgage professional in Ohio for advice or loan quotes.

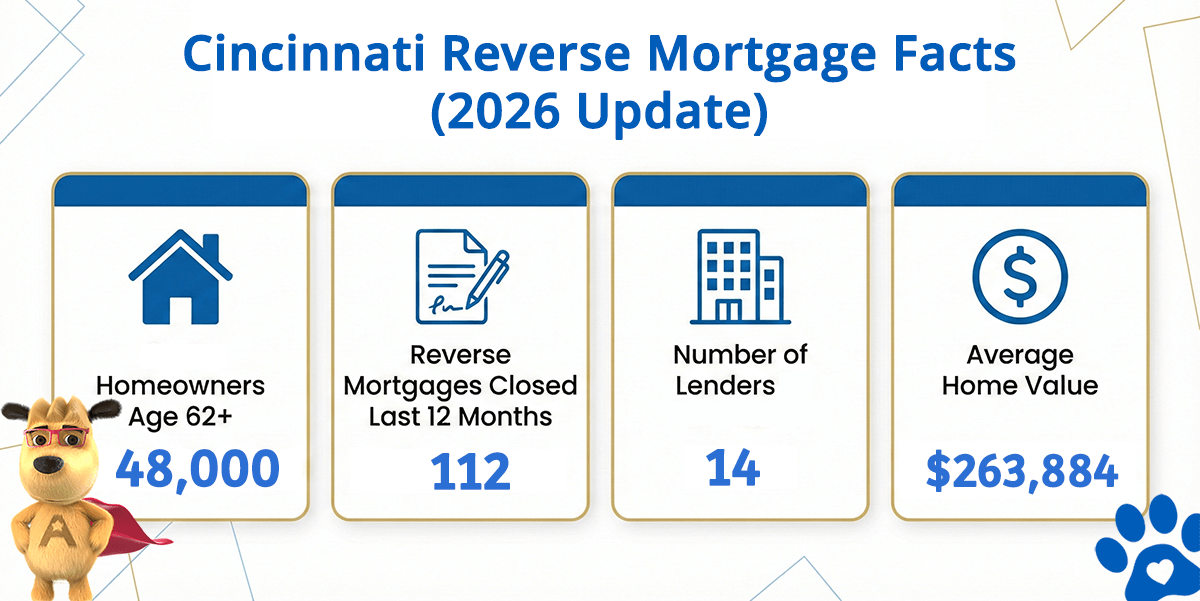

Cincinnati Reverse Mortgage Facts (2026 Update)

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Cincinnati (est) | Avg. Home Value |

|---|---|---|---|---|

| Cincinnati | 48,000 | 112 | 14 | $263,884 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

Understanding Reverse Mortgages in Cincinnati

A reverse mortgage allows eligible homeowners age 62 and older to convert a portion of their home equity into usable funds without making required monthly mortgage payments. The most common program nationwide is the HUD-insured Home Equity Conversion Mortgage (HECM), which includes built-in consumer protections and non-recourse safeguards.

Reverse mortgages are increasingly used as part of retirement planning rather than as a last-resort option. Common uses include paying off an existing mortgage, creating a standby line of credit, or improving monthly cash flow while remaining in the home.

Cincinnati Housing Market and HECM Eligibility

Cincinnati is the third-largest city in Ohio, with a population of approximately 301,000 residents. An estimated 14.7 percent of the population consists of homeowners age 62 and older, representing a meaningful segment of households potentially eligible for a reverse mortgage.

As of 2026, average home values in Cincinnati remain well below the national HECM lending limit of $1,249,125, which means many owner-occupied properties fall within the value range eligible for FHA-insured reverse mortgages. For higher-value homes, proprietary or jumbo reverse mortgage programs may exist, though these are private products and are not FHA-insured.

Local Context and Economic Profile

Founded in 1788 and incorporated in 1819, Cincinnati is one of the oldest major cities in the Midwest. The city is known for its historic architecture, vibrant arts scene, and cultural landmarks such as the Cincinnati Zoo and Botanical Garden, Cincinnati Art Museum, and its riverfront districts.

Cincinnati’s economy is anchored by education, financial services, insurance, healthcare, and manufacturing. These sectors have supported long-term homeownership across multiple generations, contributing to a stable base of older homeowners.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald