|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

This page provides an educational overview of reverse mortgages for homeowners in Baltimore, Maryland, using updated 2026 housing data and federal Home Equity Conversion Mortgage (HECM) guidelines.

Reverse mortgages are a type of home loan available to homeowners age 62 and older that allow access to home equity without requiring monthly mortgage payments. These loans are most commonly used to pay off an existing mortgage, improve retirement cash flow, or establish a line of credit for future needs.

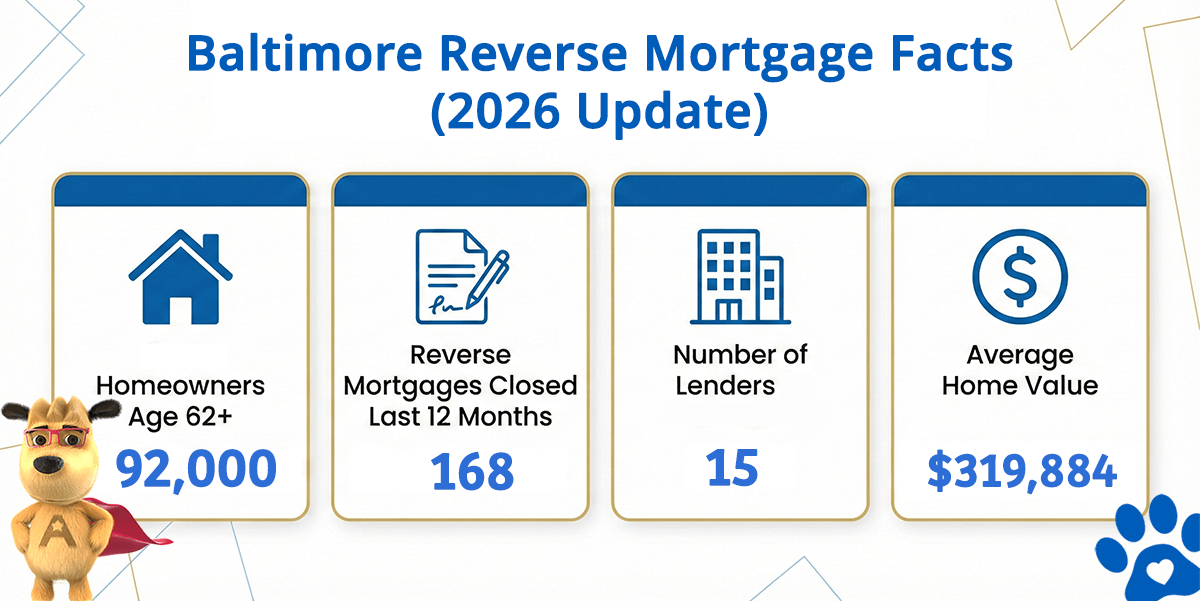

Baltimore Reverse Mortgage Facts (2026 Update)

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Baltimore (est) | Avg. Home Value |

|---|---|---|---|---|

| Baltimore | 92,000 | 168 | 15 | $319,884 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

Understanding the HECM Reverse Mortgage Program

The most common type of reverse mortgage in the United States is the Home Equity Conversion Mortgage (HECM). This program is federally insured and regulated by the U.S. Department of Housing and Urban Development (HUD).

Key characteristics of a HECM include:

-

Available to homeowners age 62 or older

-

No required monthly mortgage payments

-

Borrowers retain ownership of the home

-

Loan balance grows over time as interest accrues

-

Repayment typically occurs when the home is sold, vacated, or after the last borrower passes away

Borrowers must continue to live in the home as their primary residence and remain current on property taxes, homeowners insurance, and basic maintenance.

How Reverse Mortgages Are Commonly Used in Baltimore

Baltimore homeowners who explore reverse mortgages often do so for long-term planning rather than short-term cash needs. Common uses include:

-

Paying off an existing mortgage to eliminate monthly payments

-

Improving monthly retirement cash flow

-

Establishing a standby line of credit for future expenses

-

Funding home repairs, healthcare costs, or aging-in-place modifications

Because reverse mortgages affect home equity over time, they are best evaluated within the context of long-term housing and estate plans.

Baltimore Housing Market Overview (2026)

Baltimore is Maryland’s largest city and one of the oldest major cities in the United States, founded in 1729. The city has a substantial base of long-term homeowners, with approximately 15 to 16 percent of residents being homeowners age 62 or older.

Based on the most recent housing data, Baltimore’s average home value is approximately $319,884, which places many properties well below the 2026 federal HECM lending limit of $1,249,125.

Homes valued below this limit generally fall within standard HECM eligibility guidelines. Higher-value properties may require proprietary or jumbo reverse mortgage programs, which are privately funded and not insured by HUD.

Baltimore Economy and Lifestyle Considerations

Baltimore’s economy is driven largely by healthcare, education, and bioscience, anchored by institutions such as Johns Hopkins Hospital and Johns Hopkins University. The city also has a deep cultural and historical legacy tied to American history, literature, music, and film.

For homeowners planning to remain in their homes long term, housing equity can play a meaningful role in retirement planning, particularly in cities with relatively stable home values.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald