Rating Methodology – How This Comparison Was Conducted

Selecting a reverse mortgage lender is a significant financial decision. To provide readers with a clear, verifiable comparison of major reverse mortgage lenders, the following methodology documents how publicly available third-party data was gathered, reviewed, and summarized.

This page explains the scope, data sources, inclusion criteria, and evaluation factors used in compiling the comparison table below. No proprietary data or internal performance metrics were used.

The purpose of this disclosure is transparency. Readers should be able to understand exactly how the information was assembled and evaluate the data independently if they choose.

Who Provides the Ratings

Advertising and consumer protection laws do not allow lenders to simply declare themselves “the best” or “number one” without clearly disclosing who is making that determination and how it was reached.

For that reason, this page does not assign ratings, rankings, or endorsements of its own.

Instead, all ratings and performance indicators shown here come from independent, third-party sources that collect and publish consumer feedback and regulatory data as part of their normal operations. These organizations are responsible for establishing their own standards, review processes, and scoring systems.

The role of this page is to gather publicly available information and present it in a standardized, easy-to-review format so readers can see how large reverse mortgage lenders compare based on external evaluations.

No lender, including All Reverse Mortgage, Inc., supplied, influenced, or edited the data used in this comparison.

Top 20 Reverse Mortgage Lenders of 2025/2026 (National HECM Rankings & BBB Reviews)

| Lender | BBB Rating | Accredited | Years in Business | Customer Rating (0–5) | % Positive Reviews | Complaints | Source |

|---|---|---|---|---|---|---|---|

| All Reverse Mortgage, Inc. (ARLO) | A+ | YES | 21 | 4.94/5 | 99.0% | 0 | Source |

| American Pacific Mortgage | F | NO | 28 | 1.75/5 | 35.0% | 6 | Source |

| CrossCountry Mortgage, LLC. | F | YES | 22 | 1.43/5 | 29.0% | 303 | Source |

| Fairway Independent Mortgage | A+ | YES | 29 | 4.51/5 | 90.0% | 26 | Source |

| Finance of America Reverse LLC (FAR) | A+ | YES | 22 | 3.71/5 | 74.0% | 36 | Source |

| Goodlife Home Loans | A+ | YES | 13 | N/A (Not enough reviews) | N/A (Not enough reviews) | 1 | Source |

| Guaranteed Rate | A+ | YES | 26 | 2.25/5 | 450% | 45 | Source |

| Guild Mortgage Company LLC | A+ | NO | 65 | 1.55/5 | 31.0% | 73 | Source |

| HighTechLending Inc | A+ | YES | 19 | 4.94/5 | 99.0% | 1 | Source |

| Liberty Home Equity Solutions Inc. | A+ | NO | 22 | 1.00/5 | 20.0% | 1 | Source |

| Longbridge Financial LLC | A+ | YES | 13 | 3.77/5 | 75.0% | 34 | Source |

| Luminate Bank | NR | NO | 84 | NA | NA | NA | Source |

| MCM Holdings | A+ | YES | 27 | NA | NA | NA | Source |

| The Money House | NR | NO | 28 | NA | NA | 0 | Source |

| Movement Mortgage, LLC | A+ | NO | 18 | 4.43/5 | 89.0% | 92 | Source |

| Mutual of Omaha Mortgage | A+ | YES | 12 | 3.31/5 | 66.0% | 65 | Source |

| New American Funding | A+ | YES | 26 | 4.65/5 | 93.0% | 147 | Source |

| Plaza Home Mortgage Inc | A+ | YES | 24 | 2.67/5 | 53.0% | 6 | Source |

| Smartfi Home Loans | A+ | YES | 6 | N/A (Not enough reviews) | N/A (Not enough reviews) | 0 | Source |

| South River Mortgage, LLC | A+ | NO | 6 | 3.79/5 | 76.0% | 14 | Source |

Review Comparison Group

Top 20 Reverse Mortgage Lenders by HECM Endorsements

The initial peer group was defined using RMInsight’s Top 20 HECM Lenders report, published October 1, 2025. RMInsight aggregates FHA endorsement data reported by the U.S. Department of Housing and Urban Development (HUD), making it a commonly cited source for national reverse mortgage lending activity.

Only lenders appearing in the Top 20 by endorsement volume were included to ensure the comparison reflected the largest and most active HECM originators nationally.

Source: RMInsight Top 20 HECM Lenders

(Data period ending September 2025)

Source: https://www.rminsight.net/hecm-lenders-september-2025/

Data Sources Used

All lender data shown was collected from the following public sources:

-

RMInsight.net

-

Better Business Bureau (BBB.org)

No data was supplied by lenders themselves, and no paid placements or sponsorships were involved.

BBB information was reviewed and verified on December 10, 2025.

Data Points Collected From BBB

For each lender in the RMInsight Top 20 group, the following BBB information was recorded when available:

-

BBB letter rating

-

BBB accreditation status

-

Customer review score (1–5 stars)

-

Number of verified customer reviews

-

Complaint counts

-

Length of time in business as reported by BBB

BBB was selected because it applies consistent standards across companies and maintains verified complaint histories and consumer reviews.

Minimum Review Threshold

To avoid drawing conclusions from insufficient data, lenders with fewer than two verified BBB customer reviews were not included in comparative scoring.

BBB notes that very low review counts limit statistical reliability. These lenders remain listed in the table for completeness but were excluded from any relative ranking analysis.

Examples include lenders with no or single-review histories.

Standardization of Customer Feedback

Because lenders vary widely in total review volume, a positive-review percentage was calculated to normalize customer sentiment.

Positive-review percentage reflects the proportion of BBB reviews rated 4 or 5 stars, allowing for more consistent comparison across lenders regardless of review count.

Evaluation Factors Considered

For lenders meeting the review threshold, the following factors were reviewed together:

-

BBB letter rating

-

BBB accreditation status

-

Average BBB customer rating

-

Positive-review percentage

-

Complaint history

-

Years in business (included for context only)

No weighting was applied based on lender size, loan volume, or marketing presence.

Observations From the Data

Based on the criteria above and the data available at the time of review, one lender displayed the highest combination of customer rating, positive-review percentage, and complaint history among lenders meeting the minimum review threshold.

This outcome reflects a snapshot in time and is based solely on publicly available information. BBB ratings, reviews, and complaint records can change, and readers are encouraged to verify current information directly through BBB.org and RMInsight.net.

Transparency and Limitations

This comparison does not evaluate pricing, interest rates, loan terms, underwriting decisions, or borrower outcomes beyond publicly reported complaint and review data.

The information presented is intended to support independent evaluation, not replace personal due diligence. Consumers should review multiple sources and consult trusted advisors when selecting a reverse mortgage lender.

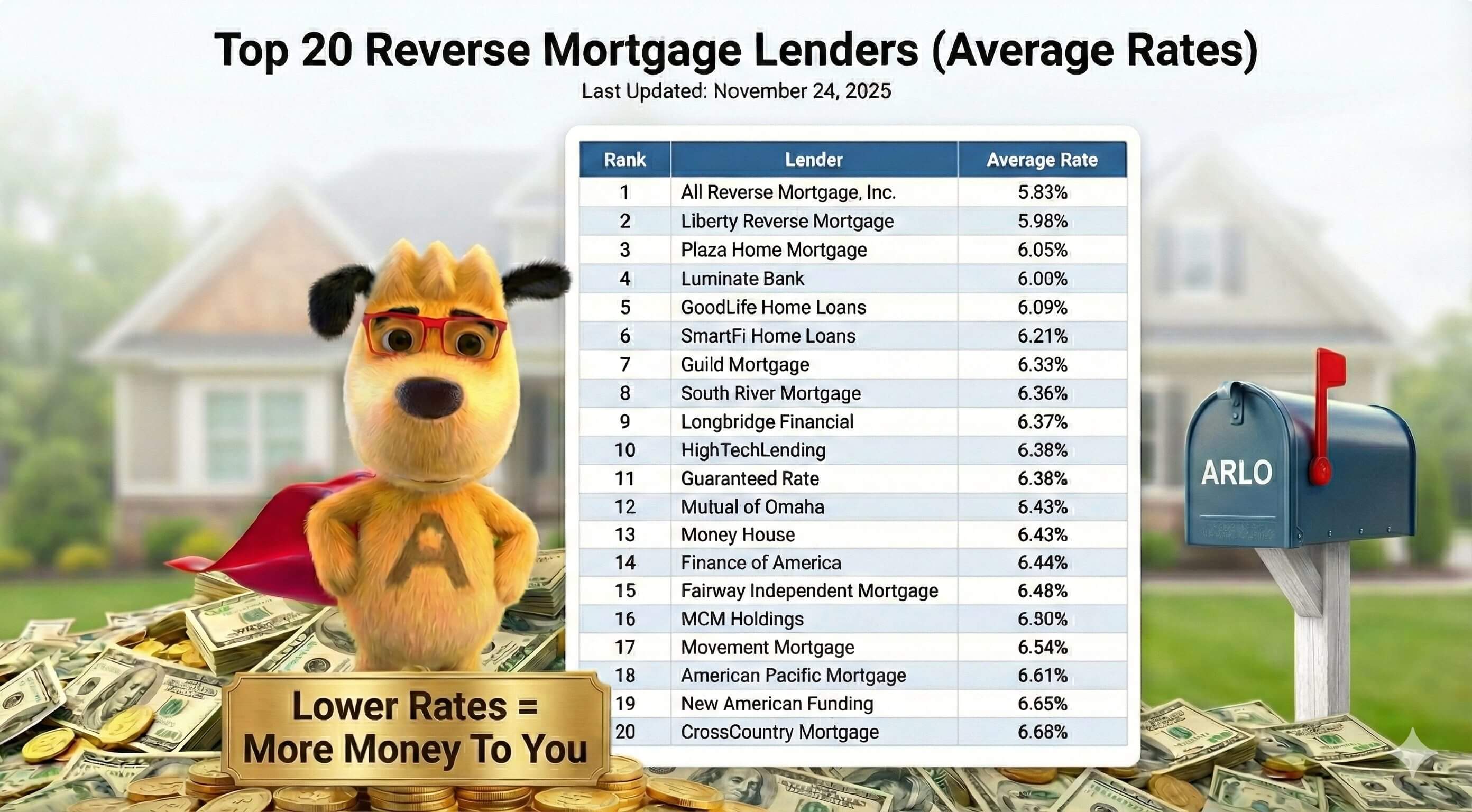

Based on HUD FHA case endorsement data from Sept. 1, 2024 – Aug. 31, 2025. Rates shown reflect average note rate at endorsement, not a rate quote. Actual borrower rates vary and may change without notice. Report compiled Oct. 13, 2025. HUD data source: https://entp.hud.gov/sfnw/public/ Top 20 lender list: https://www.rminsight.net/wp-content/uploads/2025/10/Lenders_202509.pdf (Access this data file here.)

Based on HUD FHA case endorsement data from Sept. 1, 2024 – Aug. 31, 2025. Rates shown reflect average note rate at endorsement, not a rate quote. Actual borrower rates vary and may change without notice. Report compiled Oct. 13, 2025. HUD data source: https://entp.hud.gov/sfnw/public/ Top 20 lender list: https://www.rminsight.net/wp-content/uploads/2025/10/Lenders_202509.pdf (Access this data file here.)

Questions or Verification

Questions about how this information was compiled or requests for data sources can be directed to:

Readers are also encouraged to review the original source material directly through RMInsight and the Better Business Bureau for the most current updates.