|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

Columbia Reverse Mortgage Lenders

This page provides an educational overview of reverse mortgages in Columbia, Maryland, using updated 2026 housing data and federal Home Equity Conversion Mortgage (HECM) program guidelines.

A reverse mortgage is a home loan available to homeowners age 62 or older that allows access to home equity without requiring monthly mortgage payments. These loans are commonly evaluated as part of long-term retirement and housing planning.

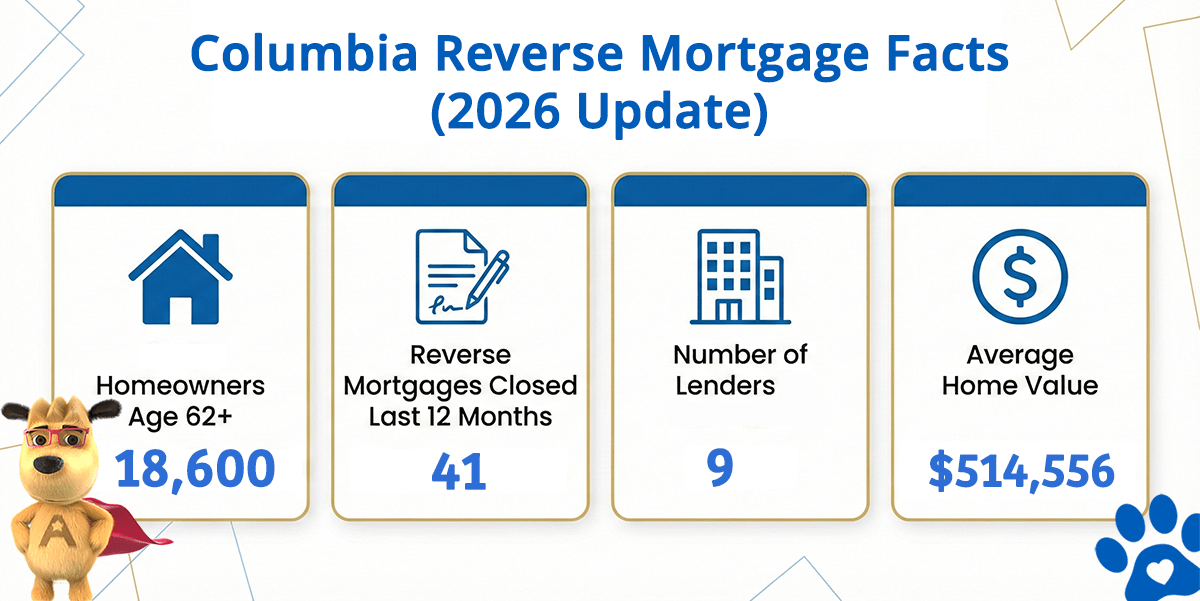

Columbia Reverse Mortgage Facts (2026 Update)

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Columbia (est) | Avg. Home Value |

|---|---|---|---|---|

| Columbia | 18,600 | 41 | 9 | $514,556 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

Understanding the HECM Reverse Mortgage Program

The most common reverse mortgage program nationwide is the Home Equity Conversion Mortgage (HECM). HECMs are federally insured and regulated by the U.S. Department of Housing and Urban Development (HUD).

General HECM features include:

-

Available to homeowners age 62 or older

-

No required monthly mortgage payments

-

Borrowers retain title to the home

-

Loan balance increases over time as interest accrues

-

Repayment typically occurs when the home is sold, vacated, or after the last borrower passes away

Borrowers must continue to occupy the home as their primary residence and remain current on property taxes, homeowners insurance, and required maintenance.

How Reverse Mortgages Are Commonly Used

Homeowners who explore reverse mortgages often do so as part of broader retirement planning. Common considerations include:

-

Paying off an existing mortgage to remove monthly payments

-

Improving monthly cash flow during retirement

-

Establishing a line of credit for future expenses

-

Funding home improvements or aging-in-place modifications

Because reverse mortgages impact home equity over time, they are best evaluated alongside long-term housing and estate plans.

Columbia, Maryland Housing Market Overview

Columbia is the second-largest census-designated place in Maryland and part of the Baltimore–Columbia–Towson metropolitan area. Founded in 1967 by James Rouse as part of the New Town Movement, Columbia was designed to prioritize livability, accessibility, and community planning.

Columbia has an estimated population of just over 100,000 residents, with approximately 16 to 17 percent of residents being homeowners age 62 or older.

Based on recent housing data, the median home value in Columbia is approximately $347,800, placing many properties well below the 2026 federal HECM lending limit of $1,249,125.

Homes valued below this limit typically fall within standard HECM guidelines. Higher-value properties may require proprietary or jumbo reverse mortgage programs, which are privately funded and not insured by HUD.

Local Economy and Lifestyle Factors

Columbia’s economy is driven largely by healthcare, bioscience, education, and professional services. Its proximity to both Baltimore and Washington, D.C. makes it attractive to long-term homeowners seeking suburban stability with access to major employment centers.

For homeowners planning to remain in their homes long term, housing equity can be an important consideration in retirement planning strategies.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald