If you’re thinking about moving, downsizing, or getting closer to family, a reverse mortgage can help you buy your next home without taking on a monthly mortgage payment.

Many homeowners are surprised to learn that you can use a reverse mortgage to purchase a home in one simple transaction. You bring a down payment, the reverse mortgage covers the rest, and you live in the home as your primary residence.

This 2026 guide walks you through how a reverse mortgage purchase works, who qualifies, the typical down payment required, and what recent HUD updates mean for today’s buyers.

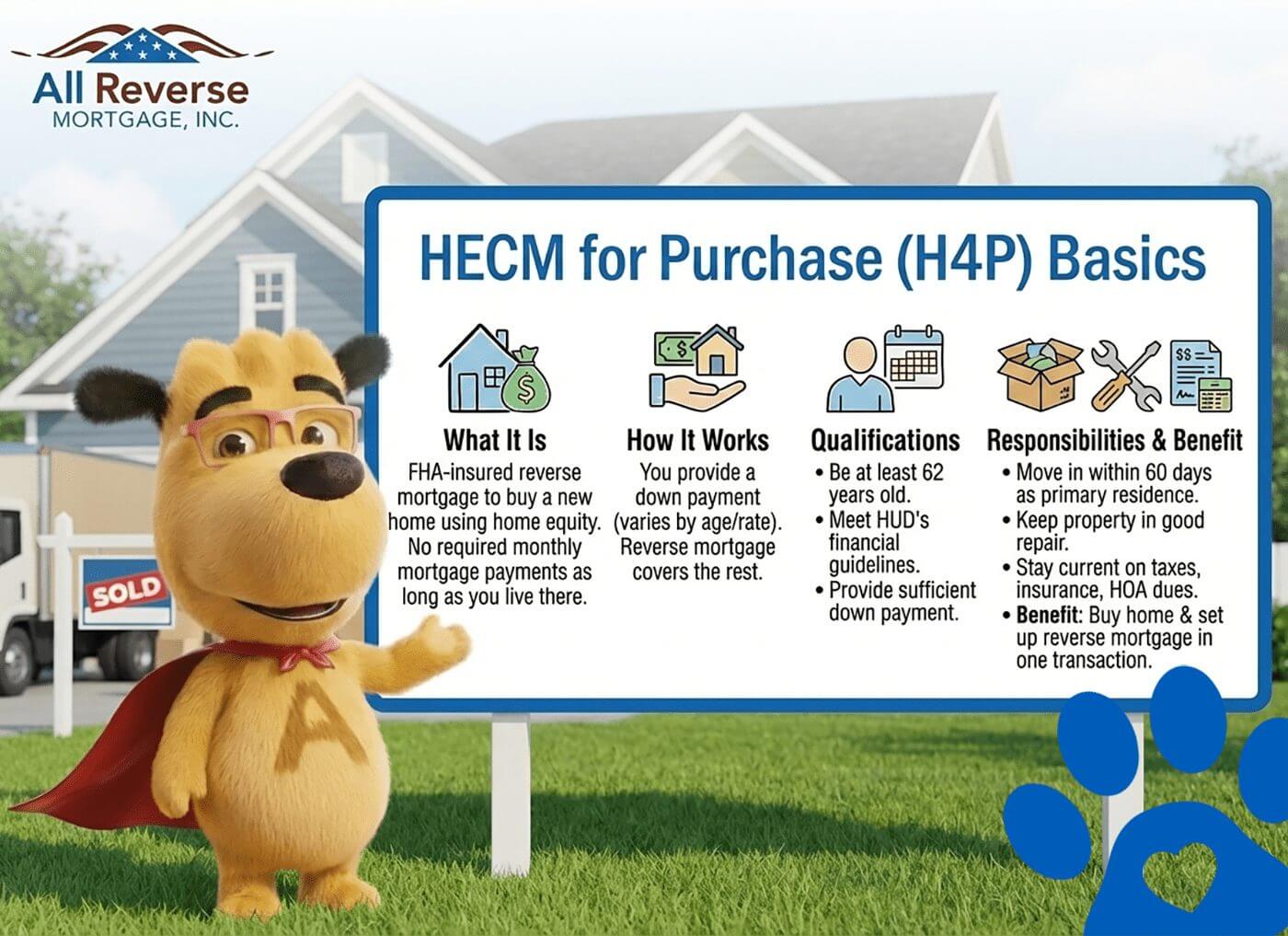

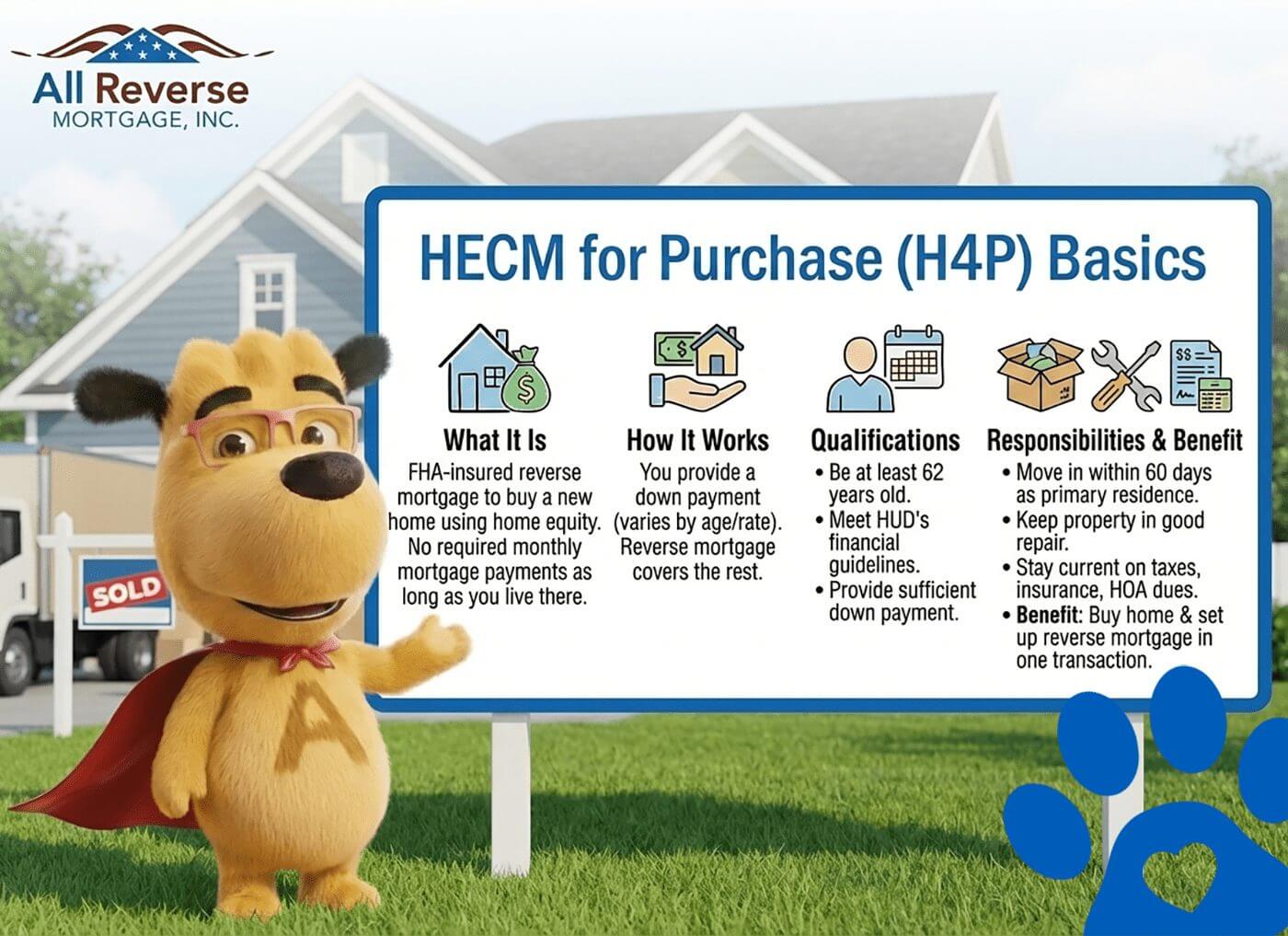

The HECM for Purchase (H4P) is an FHA-insured reverse mortgage that helps you buy a new home while financing part of the purchase with your home’s equity. You’ll use your own funds for a down payment, and the reverse mortgage covers the rest, letting you own your new home without required monthly mortgage payments as long as you live there.

To qualify, you must:

After closing, you must:

The most significant benefit of the H4P program is convenience. You buy your home and set up your reverse mortgage in a single transaction, avoiding the extra costs and delays of taking out a separate reverse mortgage later.

Expert Insight from Michael Branson, CEO: “The HECM for Purchase is ideal if you’re downsizing or moving closer to family, it simplifies the move into one transaction.”

HUD now requires that all HECM borrowers be U.S. citizens or lawful permanent residents. Borrowers with temporary or non-permanent residency status (such as work or visitor visas) are no longer eligible for FHA-insured reverse mortgages, including the HECM for Purchase program.

If you’re a U.S. citizen or hold a green card, you fully qualify under the current residency rules.

The HECM for Purchase program allows a wide range of home types, as long as they meet FHA standards and the property will be your primary residence.

Eligible properties include:

If you’re buying new construction, the final Certificate of Occupancy must be issued before closing.

Did You Know? HUD-approved condos, single-family homes, and 2–4 unit properties qualify. However, co-ops, homes still under construction, and older manufactured homes (built before June 15, 1976) are not eligible for HECM financing.

Not every home type qualifies for a HECM for Purchase. HUD limits eligibility to ensure the property meets safety and long-term habitability standards.

Ineligible property types include:

Important:

Certain manufactured homes may not qualify, particularly those built before 1976 or those that fail to meet HUD manufactured home requirements.

When you buy a home using a HECM for Purchase, you’ll need a larger down payment than with a traditional mortgage, but in exchange, you’ll have no required monthly mortgage payments for as long as you live in the home.

Most borrowers use the equity from the sale of their previous home. Others combine personal savings, retirement funds, or eligible gifts to meet the requirement.

HUD now allows several documented, non-repayable sources to help cover your down payment:

All funds must be fully documented, typically by wire transfer or cleared check before closing. Borrowed funds, unsecured loans, and credit-card advances are not permitted.

Expert Insight from Michael Branson, CEO: “Most borrowers use equity from selling their current home. This lets them buy their next property without taking on a monthly mortgage payment, and without paying all cash.”

The required down payment depends on:

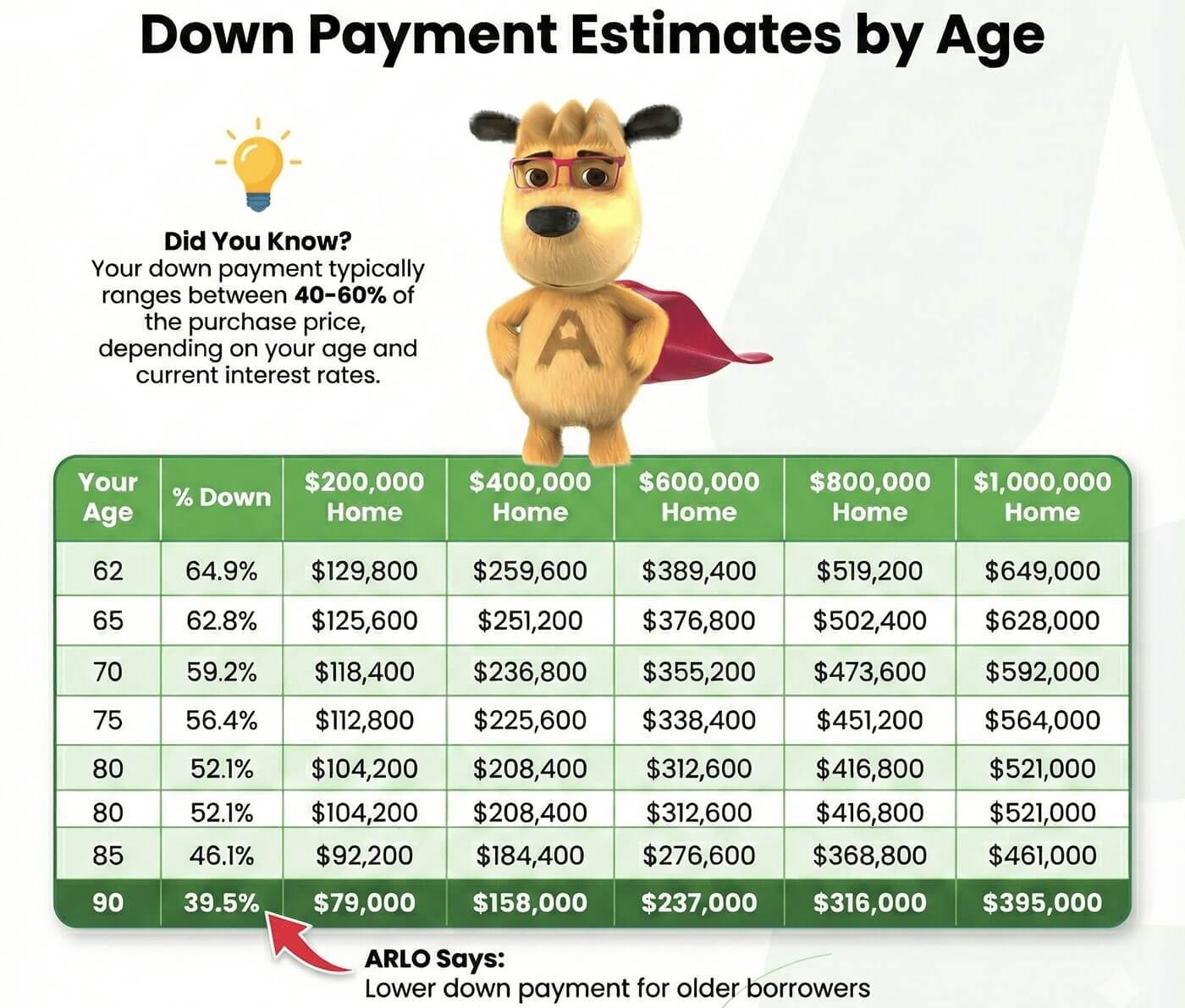

Did You Know? Your down payment typically ranges between 40-60% of the purchase price, depending on your age and current interest rates.

| Your Age | % Down | $200,000 Home | $400,000 Home | $600,000 Home | $800,000 Home | $1,000,000 Home |

|---|---|---|---|---|---|---|

| 62 | 64.9% | $129,800 | $259,600 | $389,400 | $519,200 | $649,000 |

| 65 | 62.8% | $125,600 | $251,200 | $376,800 | $502,400 | $628,000 |

| 70 | 59.2% | $118,400 | $236,800 | $355,200 | $473,600 | $592,000 |

| 75 | 56.4% | $112,800 | $225,600 | $338,400 | $451,200 | $564,000 |

| 80 | 52.1% | $104,200 | $208,400 | $312,600 | $416,800 | $521,000 |

| 85 | 46.1% | $92,200 | $184,400 | $276,600 | $368,800 | $461,000 |

| 90 | 39.5% | $79,000 | $158,000 | $237,000 | $316,000 | $395,000 |

HUD has updated HECM for Purchase rules to match conventional “forward” mortgage standards. Now, sellers, agents, and builders can contribute up to 6% of the home’s sales price or appraised value (whichever is lower) toward the buyer’s allowable closing costs and fees.

These contributions can be used for:

Note:

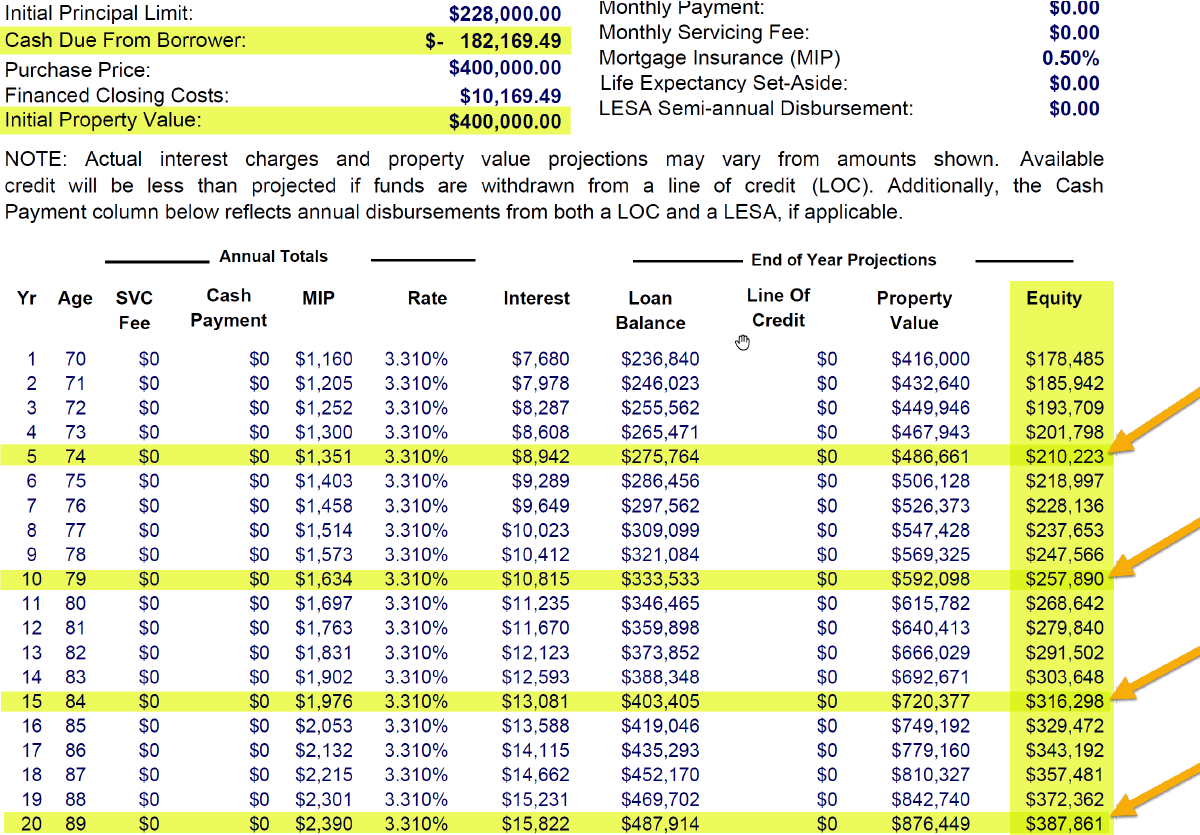

Example: A 70-year-old uses a reverse mortgage to buy a $400,000 home. The required down payment is $182,000 (about 45%). For illustration, assume a 4% annual home appreciation and an “expected rate” based on a 10-year index.

Under these assumptions, equity could be ~$210,000 in five years and ~$257,000 in ten years without making monthly mortgage payments. If the borrower later moves to assisted care, the loan becomes due. The home can be sold; any equity above the loan balance belongs to the borrower or heirs.

When that time comes, you can:

Equity outcomes depend on appreciation, interest rates, timing/amount of draws (purchase funds are disbursed at closing), and any voluntary prepayments.

Also see: Ideal Reverse Mortgage Purchase Example

| Lending Limit | Fixed Rate (APR) | Adjustable Rate |

|---|---|---|

| $1,249,125 (HECM) | 7.56% (8.06% APR) | 6.885% (2.125% Margin) |

| $4,000,000 (Jumbo) | 8.99% (9.25% APR) | 9.52% (5.875% Margin) |

| Note: Fixed APR example: 7.56% + 0.50% MIP =8.06% total interest for a $250,000 loan, including standard closing costs. | ||

| Key Topic | How It Works |

|---|---|

| Who Qualifies? | Homebuyers age 62+ who meet HUD’s financial guidelines |

| Down Payment Needed? | Yes – Typically 40-60% of the purchase price depending on age and rates |

| Monthly Mortgage Payments? | No – Just maintain property taxes, insurance, and upkeep |

| Eligible Property Types | Single-family homes, HUD-approved condos, 2–4 unit homes (owner-occupied) |

| Ineligible Properties | Co-ops, homes under construction, some manufactured homes |

| Best Funding Sources | Proceeds from selling your current home, savings, or eligible family gifts |

| Benefits of the Program | One transaction, no monthly payments, FHA-insured with non-recourse protection |

| Limitations to Consider | Higher down payment than traditional loans, upfront/ongoing MIP applies |

The HECM purchase program can be an excellent option to consider during retirement, allowing you to move without monthly mortgage payments. However, like all loans, there are trade-offs.

Did You Know? FHA insurance guarantees a purchase HECM so that at the time of maturity, you’ll never owe more than your home’s value, no matter how long you live there or what the market does.

Select a real estate agent with experience in reverse-mortgage purchases. Your originator can help, but an agent who is familiar with HUD rules can streamline the process.

Yes. Reverse mortgages have been available for purchases since 2008, allowing buyers to avoid two separate closings.

Loan proceeds are based on the age of the youngest borrower/spouse and interest rates. You bring funds to closing to cover the difference.

It depends on age, rates, and HUD limits. Use the HECM purchase calculator for specifics.

Yes. Funds must be your own or from acceptable sources (e.g., verified savings, sale proceeds, or a bona fide family gift). Borrowed funds like credit card advances are not allowed.

Yes, if you withdraw or sell the policy and document receipt of funds. You cannot borrow against the policy for down payment funds.

No. For a reverse mortgage used to buy a home (HECM for Purchase), HUD uses the lower of the home’s appraised value or the agreed-upon purchase price to calculate the loan.

If the appraisal comes in below the contract price, you can still complete the transaction if you wish but the HUD loan would be based on the appraised value and you would need to bring in the additional difference with your down payment to close the loan if you want to move forward anyway. If the appraisal comes in higher, HUD will still base the loan on the purchase price.

This is the same way valuations are treated for forward or traditional loans. It protects borrowers in that it ensures they have a safeguard against inflated values by giving them a tool to either renegotiate the selling price if the value is not supported, walk away if they need to or close the transaction when the situation warrants and the borrower feels strongly that this is in their best interest.

Yes, if the project is HUD-approved. Some proprietary programs may allow non-FHA condos, but HUD HECM often offers better terms.

Yes. HUD allows up to four units if the property is owner-occupied.

You must occupy the home as a primary residence. Moving out makes the loan due per HECM rules.

Possibly, with re-established credit and a strong letter of explanation. A lender review is required.

In states that allow it, yes — with counseling and required documentation. See non-borrowing spouse rules.

You can sell anytime without prepayment penalties. If HUD incurs a loss from early departure on a prior HECM, you may be ineligible for another reverse mortgage until the loss is repaid.

Yes, but the new purchase can only close after the prior HECM payoff is verified, which can add a brief delay.

Look for agents experienced with HECM purchases. Ask firms if they have HECM-savvy agents familiar with HUD rules.

“All Reverse Mortgage flawlessly handled my reverse mortgage purchase, providing clear explanations and great professionalism. They promptly answered my questions and returned calls quickly. I highly recommend them to friends and family.” — John P. (BBB)

Thinking About Buying a Home with a Reverse Mortgage? We Make It Simple. With the HECM for Purchase program, you can buy your next home without monthly mortgage payments. Call (800) 565-1722 or try our reverse mortgage purchase calculator to see how much home you can afford.

Videos from our YouTube Channel:

ARLO recommends these helpful resources: