|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

Why Homeowners Trust All Reverse Mortgage Calculator

Looking for a reverse mortgage quote you can trust? Our calculator, powered by ARLO™ (All Reverse Loan Optimizer), provides real-time, personalized estimates—no personal information required to start. Unlike generic tools, ARLO™ is designed specifically for homeowners exploring reverse mortgage options with accuracy and transparency.

What Makes Our Calculator Different:

- Real-Time Rates & APR: Updated daily to reflect current market conditions.

- Local Lending Limits: Uses your ZIP code to customize results.

- Personalized Recommendations: Matches you with options based on your home, age, and goals.

- Full Amortization Schedules: See how loan balances and equity change over time.

- Compare Loan Types: Instantly review HECM, jumbo, and proprietary options side-by-side.

How to Use the Reverse Mortgage Calculator

Using ARLO™ is simple, even if you’re just getting started:

- Enter Your ZIP Code: This sets your local HECM lending limits and closing cost estimates.

- Confirm Home Value: ARLO™ provides a default estimate based on current sales data, but you can adjust this for accuracy.

- Provide Age & Mortgage Balance: These details determine your eligibility and payout. If you have a younger spouse, include their age for added protections.

- Get Your Personalized Quote: See your results in seconds.

Compare Reverse Mortgage Options—Side by Side

After you complete your 3-step quote, ARLO™ instantly shows you four personalized loan scenarios based on your needs:

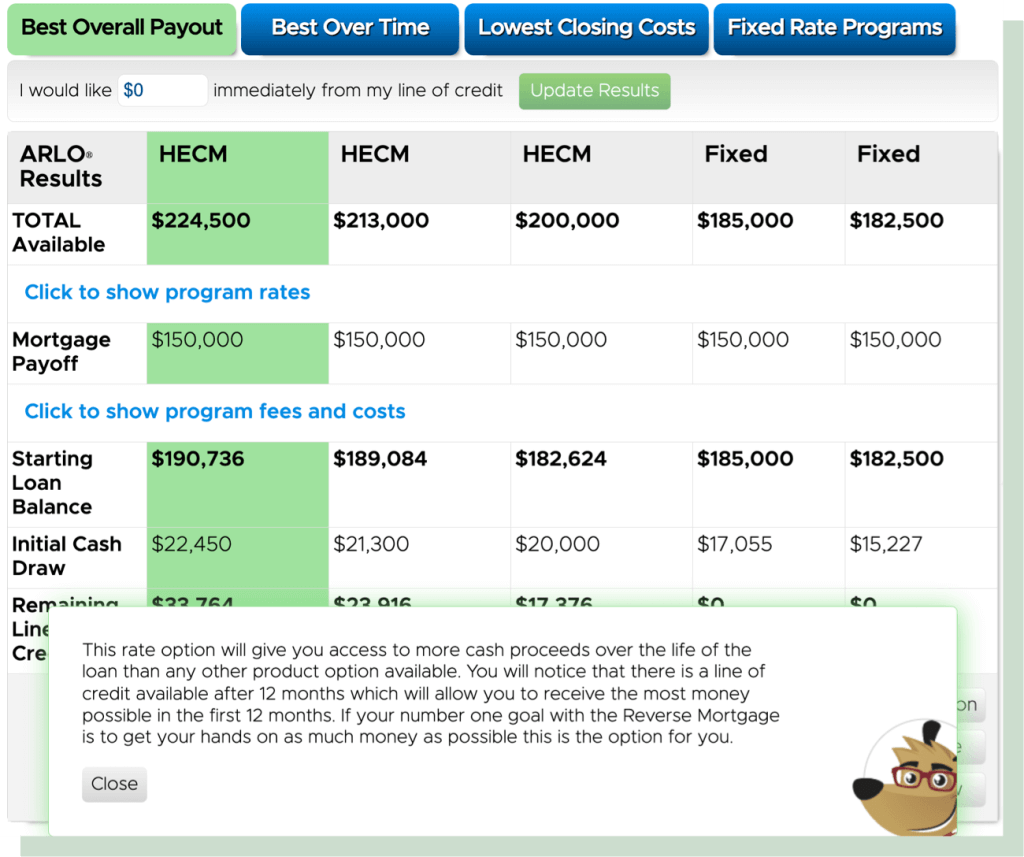

1. Max Cash Out (Best Overall Payout)

Get the highest total proceeds available from your home equity. Best for: Homeowners focused on maximizing cash today.

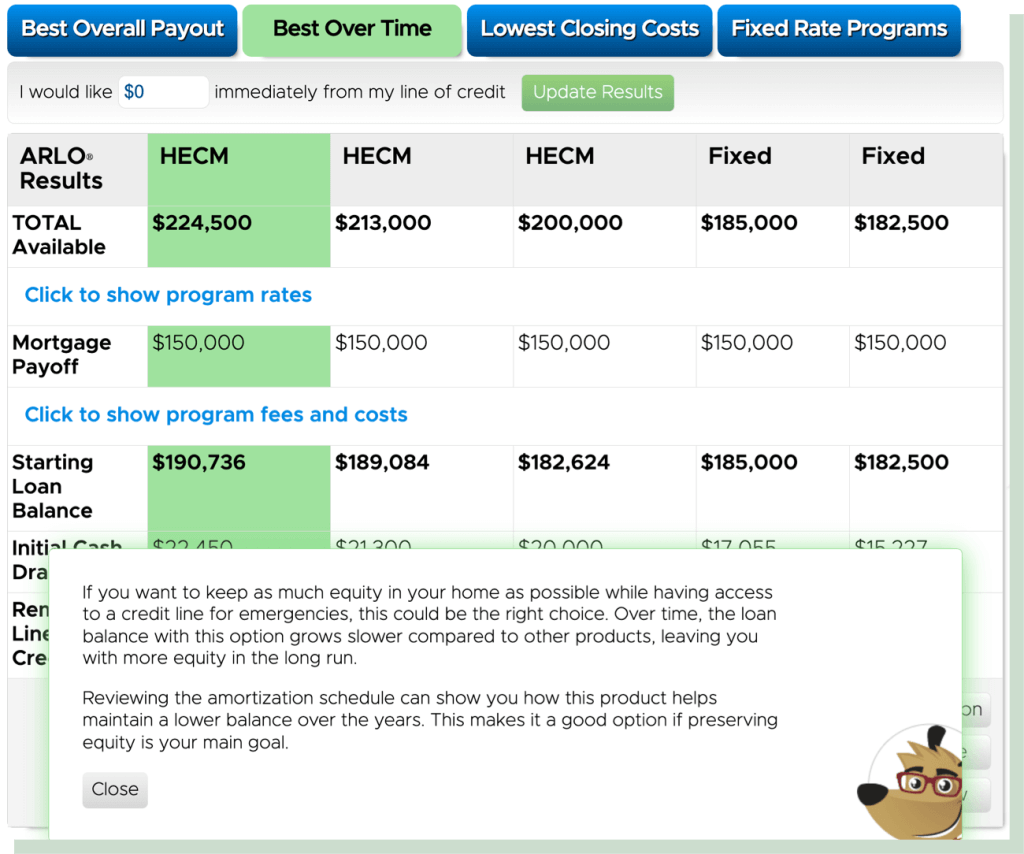

2. Grow Equity Over Time (Best for Long-Term Flexibility)

Choose a lower rate option to preserve more equity and slow loan balance growth.

Best for: Homeowners who want access to funds but value leaving more equity for later.

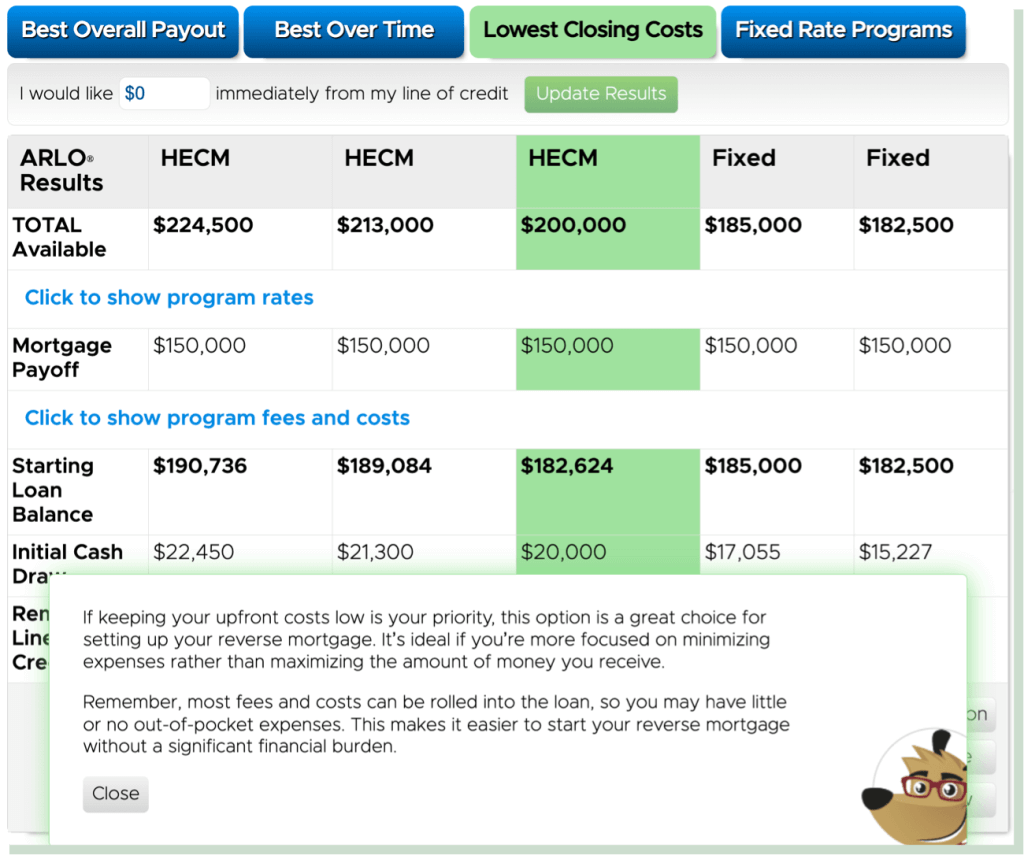

3. Lowest Upfront Costs

Minimize closing costs. Most fees are rolled into the loan, reducing out-of-pocket expenses.

Best for: Homeowners who have a shorter-term outlook to limit upfront costs

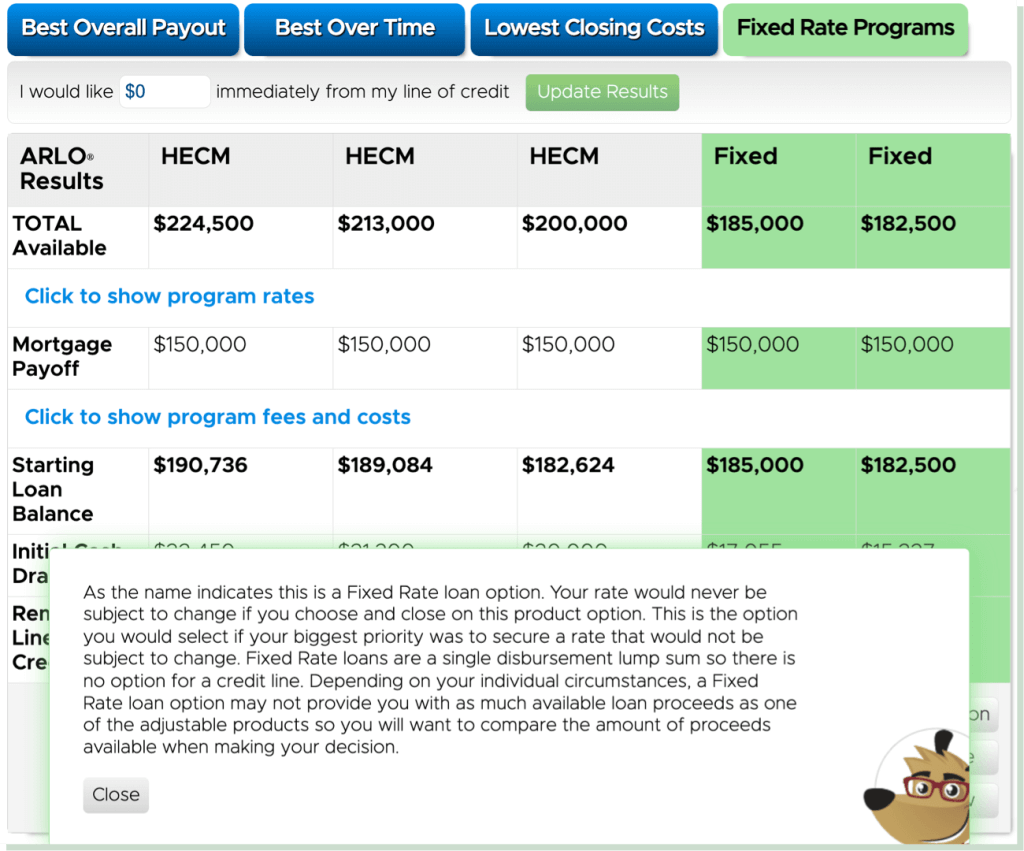

4. Fixed-Rate Lump Sum Option

Receive a one-time payout with a locked interest rate for life.

Best for: Those seeking stability and predictability, although it typically yields lower total proceeds than adjustable options.

Visual Comparison Tools: You can compare these options side-by-side, view projected loan balances over time, and adjust your inputs to see how age, home value, or rate changes may impact your results—all directly inside ARLO™

Visual Comparison Tools: You can compare these options side-by-side, view projected loan balances over time, and adjust your inputs to see how age, home value, or rate changes may impact your results—all directly inside ARLO™

Tips to Maximize Your Reverse Mortgage Payout

Simple steps can help you qualify for more:

-

Include a Younger Spouse’s Age: Even if they’re not on the loan, this can enhance protections and sometimes increase proceeds.

-

Consider Waiting for Your Next Birthday: HUD uses age in whole years. If you’re within six months of your next birthday, waiting may boost your payout.

-

Enter All Current Mortgage Balances: This ensures that your quote accurately reflects what you’ll actually receive after paying off your existing loans.

Why Our Calculator Stands Out in 2025

| Feature | All Reverse Mortgage (ARLO™) | Other Calculators |

|---|---|---|

| Daily Rate & APR Updates | ✅ Yes | ❌ No |

| Closing Cost Estimates | ✅ Local fees included | ❌ Rarely detailed |

| Amortization Schedules | ✅ Full projections | ❌ Often missing |

| AI-Powered Insights | ✅ Custom recommendations | ❌ Generic |

| HECM & Jumbo Results | ✅ All types shown | ❌ Limited options |

What Homeowners Are Saying

Reverse Mortgage Calculator FAQs

How Much Can I Get From a Reverse Mortgage?

Your loan amount depends on:

-

Your age

-

Your home’s value

-

Current interest rates

-

Your existing mortgage balance

ARLO™ uses real-time interest rates and HUD’s official reverse mortgage formulas to estimate your eligibility—instantly and accurately.

Do I Need to Share Personal Info to Get a Quote?

No. Our calculator only asks for your ZIP code, home value, and age to start. You’ll see results right away without needing to provide contact information.

Why Do Interest Rates Matter?

Reverse mortgage proceeds change with current rates. Lower rates = more funds. Higher rates = less.

That’s why our calculator is updated daily.

How Does the HECM Line of Credit Work?

With a HECM credit line, unused funds grow over time at your loan’s interest rate plus 0.5%. This can significantly increase your available funds later.

Is This Calculator Accurate?

Yes. Our tool updates daily with:

-

Current HUD limits

-

Real-time rates & APR

-

Local closing cost estimates

This makes it one of the most accurate online reverse mortgage calculators.

About All Reverse Mortgage, Inc. (ARLO™)

We’re America’s #1 rated reverse mortgage lender with over 20 years of experience and a 4.99/5 customer satisfaction rating.

As a HUD-approved lender (NMLS #14041, FHA #26031-0007), our goal is to provide transparent, expert guidance with no pressure.

Ready to find out how much you qualify for? Use our real-time reverse mortgage calculator now or call (800) 565-1722. All Reverse Mortgage, Inc. is America’s #1 rated reverse mortgage lender with 20+ years of experience and a 4.99/5 customer satisfaction rating.

Explore our full suite of tools designed to help you estimate payments, credit line growth, refinance opportunities, home purchase, and long-term loan projections.

Compare Our Suite of Reverse Mortgage Calculators

| Calculator Type | What It Does | Key Features | Includes Rates/APR |

| All Reverse Calculator | Figures out payments, lump sums, and credit lines | AI-powered: Recommends the best loan for your goals | Yes |

| Free Quick Calculator | Estimates payments, lump sums, and credit lines | No personal info needed—just a fast estimate | No |

| Line of Credit Calculator | Shows HECM credit line and growth over time | Projects how your credit line grows | No |

| Refinance Calculator | Checks if refinancing your HECM pays off | Uses home value, rates, and 5x benefit rule | No |

| Purchase Calculator | Plans buying a home with a reverse mortgage | Estimates down payment and sale proceeds | Yes |

| Amortization Calculator | Tracks loan balance and equity over years | Downloadable Excel file for your records | Yes |

| Note: Explore our suite of 2025 reverse mortgage calculators designed to fit your needs. | |||

|---|---|---|---|

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald